The ever-evolving financial landscape demands seamless and efficient foreign exchange transactions. Form A2, a crucial document in forex remittances, plays a vital role in streamlining this process. Understanding its intricacies can empower individuals and businesses to navigate the complexities of global currency transfers.

Image: www.pdffiller.com

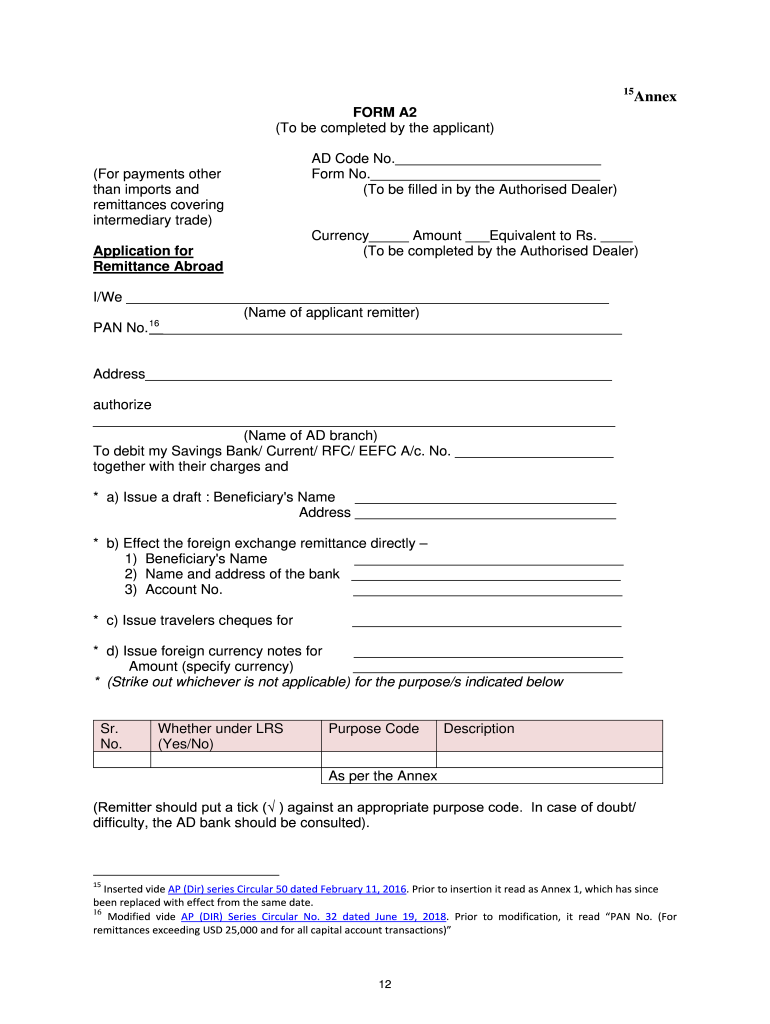

Introduction to Form A2: A Definition

Form A2 is an official document authorized by the Reserve Bank of India and submitted to commercial banks for forex remittances exceeding $50,000 or its equivalent. It serves as a declaration of the intended purpose and authenticity of the transaction, ensuring compliance with foreign exchange regulations.

Form A2 is mandatory for high-value transactions involving a wide range of business activities, including imports, exports, foreign direct investments, and educational payments. Its primary purpose is to prevent illicit financial flows and maintain transparency in cross-border transactions.

Significance of Form A2: Facilitating Compliance and Currency Transfer

Form A2 plays a crucial role in facilitating forex remittances by providing the following advantages:

- Compliance with Regulations: The form ensures adherence to the Foreign Exchange Management Act (FEMA) and Reserve Bank of India guidelines, protecting individuals and businesses from potential legal implications.

- Avoidance of Delays: Incomplete or inaccurate documentation can lead to delays in processing forex remittances. Form A2 streamlines the process and ensures swift and hassle-free transactions.

- Confidentiality: Authorized banks maintain strict confidentiality regarding the information provided on Form A2, safeguarding the privacy of individuals and businesses engaged in forex transactions.

Understanding the Sections of Form A2: A Detailed Guide

Form A2 consists of several sections, each requiring specific information and documents. A clear understanding of these sections is essential for error-free submission.

Section I: General Information

This section captures basic details about the applicant, including name, address, purpose of remittance, and transaction amount.

Section II: Foreign Currency Payments for Import Transactions

This section is relevant for payments related to imports of goods and services. It requires information such as import license details, invoice value, and mode of shipment.

Section III: Foreign Currency Payments for Export Transactions

This section is used for export transactions and seeks details about export invoices, purchase orders, and freight and insurance documents.

Section IV: Foreign Currency Payments for Foreign Direct Investment

This section is applicable for remittances related to direct investments in foreign companies. It requires details about the investment amount, purpose, and the underlying agreement.

Section V: Foreign Currency Payments for Educational Payments

This section captures expenses related to educational pursuits abroad, including tuition fees, living expenses, and other associated costs.

Section VI: Declaration

This section involves a solemn declaration by the applicant, подтверждает точность и полноту предоставленной информации.

Image: management.ind.in

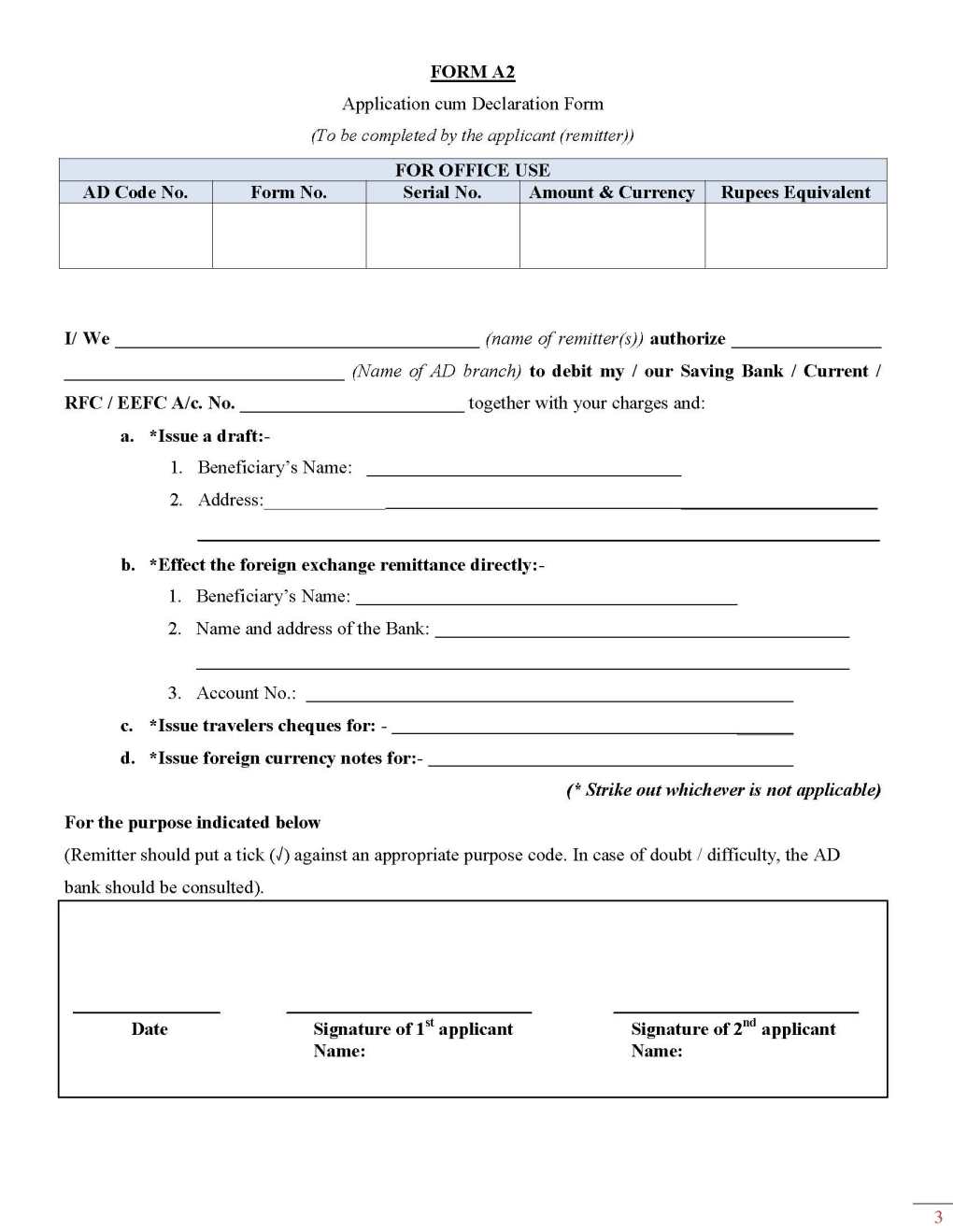

Submission Process and Timelines: Ensuring a Smooth Transaction

To submit Form A2, follow these steps:

- Obtain Form A2 from your authorized commercial bank.

- Complete the form accurately and provide supporting documentation.

- Submit the form along with the necessary attachments to your bank.

Processing timelines for Form A2 may vary depending on the complexity of the transaction and the bank’s internal procedures. While routine remittances may be processed within a few days, complex transactions requiring additional documentation or scrutiny may take longer.

Form A2 For Forex Remittance

https://youtube.com/watch?v=mVpkePK2Fpo

Conclusion: Harnessing Form A2 for Efficient Currency Transfers

Form A2 is an essential document that plays a crucial role in the smooth execution of large-value forex remittances. By understanding its purpose, contents, and submission process, individuals and businesses can navigate global currency transfers with confidence.

Form A2 safeguards the integrity of the financial system, ensures compliance with regulations, and facilitates swift and efficient remittances. Embrace the power of Form A2 and unlock the potential of seamless cross-border financial transactions.