In the dynamic world of forex trading, where market fluctuations present ample opportunities, understanding how to calculate profit is paramount. Magnifying your earning potential through leverage is a technique that can significantly enhance your returns, but it’s crucial to grasp its intricacies to navigate the markets effectively. This comprehensive guide will illuminate the ins and outs of calculating forex profit with leverage, empowering you to make informed decisions and maximize your trading endeavors.

Image: marketnerd.com

Leverage: Unveiling the Forex Powerhouse

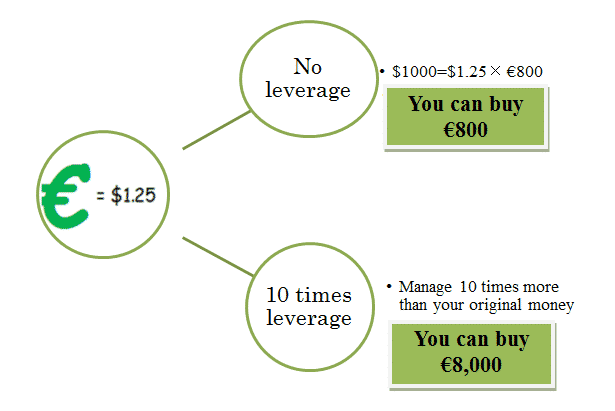

Leverage, in the context of forex trading, empowers traders to control a larger position than their initial capital would allow. Brokers provide traders with a leverage ratio, which determines the maximum allowable leverage. For instance, a leverage ratio of 1:100 implies that for every $1 of your trading capital, you can control $100 worth of currency pairs. This magnifies your potential earnings but also amplifies the potential losses, which must be considered judiciously.

Calculating Forex Profit with Leverage: A Step-by-Step Breakdown

Calculating forex profit with leverage involves a simple yet essential formula:

Profit or Loss = (Pips Gained or Lost) x (Contract Size) x (Leverage)

Let’s illustrate this formula with a practical example:

- Assume you trade the EUR/USD currency pair with a position size of 10,000 units (mini lot).

- The leverage provided by your broker is 1:100.

- The EUR/USD exchange rate moves in your favor by 50 pips (0.0050).

Plugging the values into the formula:

Profit = (50 pips) x (10,000 units) x (1:100) = $50

In this scenario, you would realize a profit of $50, which is a direct result of the leverage employed. Without leverage, your profit would have been limited to $2.50 (pips gained x contract size).

Leverage: A Double-Edged Sword – Understanding the Risks

While leverage offers traders immense profit potential, its inherent risks cannot be overstated. Amplifying your earnings also amplifies the potential losses you could encounter. Without proper risk management strategies, leverage can turn against you, potentially wiping out your trading capital.

Leverage-related losses can occur when the market moves against your predicted position. In our previous example, if the EUR/USD exchange rate had moved by 50 pips against your position, you would have incurred a loss of $50. However, with a leverage ratio of 1:100, this loss could have been significantly greater if the market had continued its adverse movement.

Image: topfxmanagers.com

Calculate Forex Profit With Leverage

Leverage in Forex: A Tool for Success with Caution

Understanding the mechanics of calculating forex profit with leverage is not sufficient; responsible trading demands a profound understanding of leverage’s risks and rewards. Novice traders should consider lower leverage ratios to minimize potential losses while they develop their trading acumen. As traders gain experience and confidence, they may explore higher leverage ratios, always with prudent risk management.

In the forex markets, where fluctuations are constant, timing is everything. Calculating your potential profit and managing your leverage effectively can help you seize opportunities when they arise. With disciplined trading strategies and a comprehensive understanding of the risks involved, leverage can be your ally on the path to forex trading success.