In today’s dynamic global economy, where cross-border transactions are commonplace, understanding the significance of forex gain and loss capitalisation is paramount for businesses seeking to optimise profitability and manage currency risks effectively. This article delves into the intricacies of forex gain/loss capitalisation, explaining its impact on asset transactions, exploring strategies for leveraging gains and mitigating losses, and providing practical insights into how businesses can navigate the complexities of currency fluctuations to their advantage.

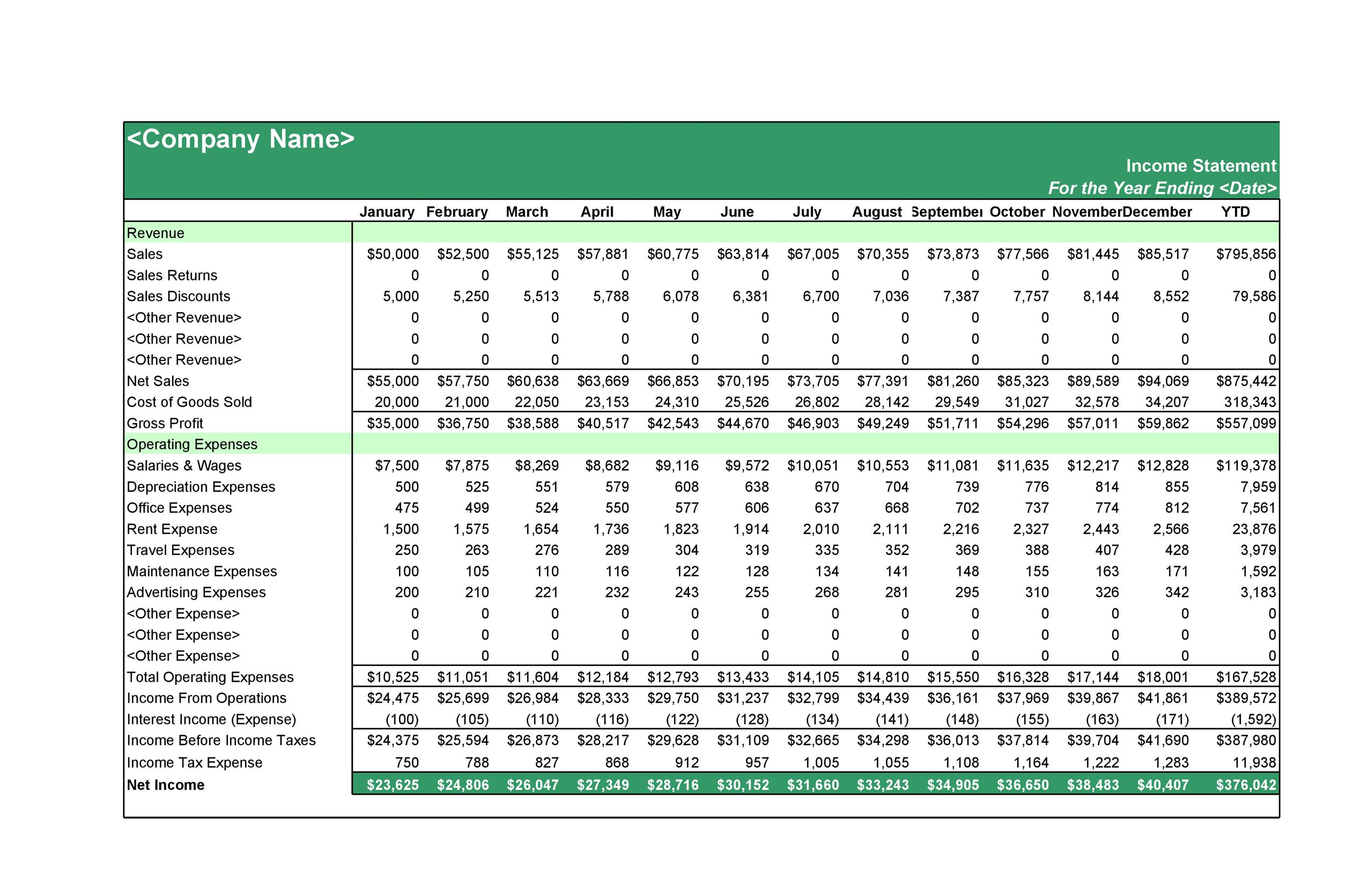

Image: binaariasetuksettilisuomi.logdown.com

Forex Gain/Loss Capitalisation: An Overview

Foreign exchange (forex) gain or loss arises when the value of a currency fluctuates relative to another currency. When a business holds an asset or liability denominated in a foreign currency, changes in the exchange rate can result in a gain or loss. Capitalisation of forex gain/loss refers to the accounting treatment of these gains and losses, determining whether they are recognised immediately or deferred.

Under the immediate recognition approach, forex gains and losses are recorded in the income statement as they occur. This method provides a transparent view of the impact of currency fluctuations on the business’s profitability and can be beneficial for businesses seeking to capitalise on favourable exchange rate movements.

On the other hand, the deferred recognition approach defers the recognition of forex gains and losses until the underlying asset or liability is realised. This method matches foreign exchange gains and losses with the related transaction, providing a more accurate reflection of the economic impact of currency fluctuations. However, it can also result in the deferral of substantial gains or losses until a later period.

Strategic Implications of Capitalisation

The choice between immediate and deferred capitalisation of forex gain/loss has significant implications for businesses. The immediate recognition approach enhances earnings visibility, allowing businesses to report gains and losses in the period in which they occur. This can be particularly beneficial for businesses seeking short-term profitability, such as those operating in highly competitive sectors.

Alternatively, the deferred recognition approach provides a more conservative view of earnings, matching gains and losses with the related transaction and avoiding the volatility associated with immediate recognition. This method is often preferred by businesses with long-term horizons, as it reduces the impact of short-term currency fluctuations on earnings.

Maximising Gains and Mitigating Losses

Businesses can adopt a range of strategies to maximise forex gains and mitigate potential losses. These include:

- Currency hedging: Utilising financial instruments such as forwards, futures, and options to lock in exchange rates and reduce the risk of adverse currency movements.

- Cross-border invoicing: Negotiating the terms of international transactions in favourable currencies to minimise foreign exchange exposure.

- Diversifying revenue streams: Operating in multiple geographic regions, generating revenue in different currencies, and mitigating the impact of currency fluctuations on overall profitability.

- Efficient cash flow management: Monitoring foreign exchange rates in real-time and opportunistically converting currencies when exchange rates are favourable.

Image: forexsystemsresearchcompany.blogspot.com

Practical Implementation

Implementing effective capitalisation of forex gain/loss policies requires proper accounting procedures and a clear understanding of applicable accounting standards. Businesses should consult with their accountants and financial advisors to establish appropriate capitalisation policies that align with their financial objectives and risk tolerance.

Regular monitoring of foreign exchange rates and continuous review of capitalisation policies are essential for businesses to adapt to ever-changing market conditions and maximise profitability. By understanding the implications of capitalisation methodologies and implementing sound risk management strategies, businesses can navigate the complexities of foreign exchange markets and enhance their financial performance.

Capitalisation Of Forex Gain Loss For Asset

Conclusion

Capitalisation of forex gain/loss is a crucial aspect of financial management for businesses engaged in international transactions. Understanding the different capitalisation methodologies, their implications, and available strategies for managing currency risk is essential for maximising profitability and mitigating potential losses. By embracing a proactive approach to capitalisation and implementing best practices, businesses can navigate the challenges of currency fluctuations, enhance their financial resilience, and unlock the full potential of their assets and operations in the global marketplace.