Embark on a Lucrative Forex Adventure

Imagine witnessing a world where potential profits unfold at the click of a button. Enter the realm of forex scalping, where adept traders harness the power of precision and swift execution to capture tiny price fluctuations and build substantial gains. Amidst the myriad scalping strategies, one stands apart – the 15 pips forex scalping system. This exceptional approach empowers you to seize consistent returns by exploiting price movements as minute as 15 pips.

Image: www.trendfollowingsystem.com

Mastering the Art of 15 Pip Forex Scalping

The essence of 15 pip forex scalping lies in its ability to identify and execute trades that yield a quick profit of 15 pips. This strategy is ideally suited for intraday traders seeking to capitalize on short-term price fluctuations. The key to success lies in selecting a currency pair with high volatility and liquidity, such as EUR/USD or GBP/USD.

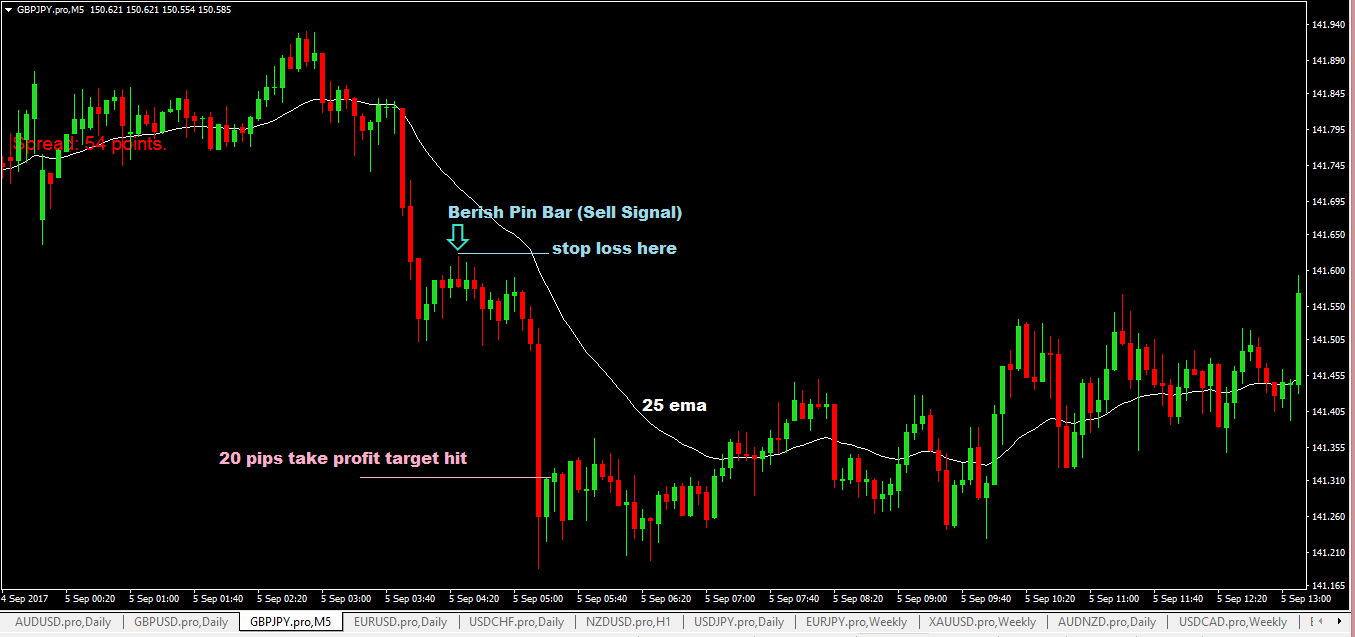

The 15 pip forex scalping system typically employs moving averages to determine the overall trend and identify potential trading opportunities. Traders may also incorporate additional technical indicators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, to enhance the accuracy of their trade setups. When a trade setup meets predefined criteria, scalpers swiftly execute the trade with a predetermined risk-to-reward ratio.

Market Analysis and Technical Insights: Navigating the Forex Landscape

Success in forex scalping hinges on meticulous market analysis and a deep understanding of technical indicators. The 15 pip forex scalping system often utilizes moving averages to identify the prevailing trend and assess the strength of the market momentum. By monitoring the interplay of moving averages, traders can determine the optimal entry and exit points for their trades.

Additional technical indicators provide valuable insights into market sentiment and price dynamics. The Relative Strength Index measures the relative strength or weakness of a currency pair, aiding traders in identifying overbought or oversold conditions. The Stochastic Oscillator further enhances traders’ understanding of market momentum and potential trend reversals. These indicators, when combined with moving averages, equip scalpers with a comprehensive arsenal for making informed trading decisions.

Unveiling the Secrets of the 15 Pip Forex Scalping System

-

Precise Market Entry and Exit Points: Identify optimal trade setups using moving averages and technical indicators, ensuring timely entries and exits for maximum profit potential.

-

Swift Trade Execution: Act quickly once a trade setup meets predefined criteria, capitalizing on the rapidly evolving nature of forex markets.

-

Dynamic Risk Management: Employ strict risk management measures, including stop-loss orders and position sizing, to safeguard profits and minimize losses.

-

Emotional Control and Discipline: Maintain a composed demeanor throughout the trading process, adhering to your trading plan and avoiding impulsive decisions.

-

Continuous Market Analysis: Regularly monitor market news, economic indicators, and technical charts to stay abreast of market developments and identify potential trading opportunities.

Image: www.forexcracked.com

Navigating the World of 15 Pip Forex Scalping: Expert Tips

-

Harness the Power of Discipline: Adherence to your trading plan is paramount. Avoid making impulsive trades or chasing losses, as this can lead to significant financial setbacks.

-

Utilize Market News and Economic Indicators: Stay informed about key market events and economic data releases, as these can have a substantial impact on currency prices.

-

Practice Demanding Risk Management: Implement stringent risk management strategies, including setting appropriate stop-loss levels and limiting trade sizes to avoid excessive losses.

-

Seek Knowledge and Continuing Education: Forex markets are constantly evolving, so continuous learning is essential. Study trading strategies, technical analysis techniques, and market trends to hone your trading skills.

Frequently Asked Questions about the 15 Pip Forex Scalping System

Q: What is the recommended capital required to start 15 pip forex scalping?

A: The initial capital requirement varies depending on your risk tolerance and trading style. However, it’s generally advisable to start with a comfortable amount that allows you to withstand potential losses.

Q: Can 15 pip forex scalping be automated?

A: Yes, it’s possible to automate 15 pip forex scalping using trading algorithms or expert advisors (EAs). However, it’s crucial to note that automated trading comes with its own set of risks and should be approached with caution.

Q: What is the average win rate of the 15 pip forex scalping system?

A: The win rate varies depending on factors such as market volatility, trading strategy, and individual trader skill. It’s generally not recommended to chase high win rates, as this can lead to overtrading and increased risk.

15 Pips Forex Scalping System

Embark on Your Forex Scalping Journey: A Call to Action

The 15 pip forex scalping system presents a lucrative opportunity for forex traders seeking consistent profits. Embrace the principles outlined in this article, immerse yourself in market analysis, and develop the discipline necessary for successful trading. Remember, the road to financial freedom is paved with knowledge, patience, and unwavering determination. Are you ready to seize the potential of 15 pip forex scalping? Embark on this journey today and unlock the path to financial success.