Introduction

In the dynamic and exhilarating world of forex trading, success hinges on the ability to effectively track your trades. Like a skilled navigator charting a course through treacherous waters, tracking your trades ensures you stay on top of market movements, identify opportunities, and manage risk with precision. In this in-depth guide, we’ll embark on a journey to unravel the secrets of forex trade tracking, empowering you with the knowledge and techniques to navigate the complexities of the market with confidence.

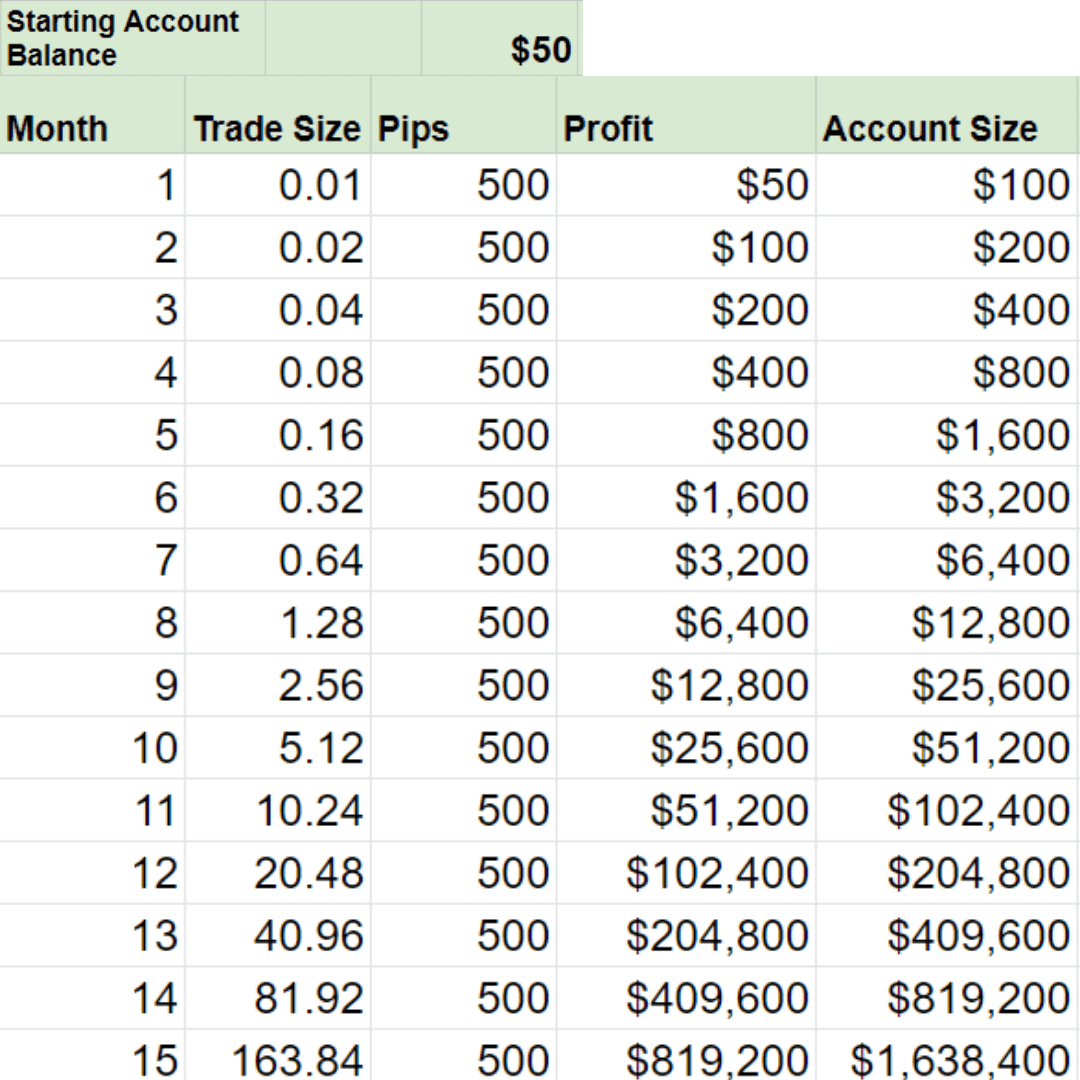

Image: www.pinterest.com.mx

Delving into the Art of Forex Trade Tracking

Forex trade tracking involves meticulously recording and analyzing every trade you execute. It’s a crucial practice that provides invaluable insights into your trading performance, allowing you to identify areas for improvement and optimize your strategies. By keeping a comprehensive record, you gain a clear understanding of your strengths and weaknesses, the factors influencing your trades, and ultimately, the path to consistent profitability.

Step-by-Step Guide to Effective Trade Tracking

1. Choose a Tracking Tool

The first step is to select a tracking tool that aligns with your trading style and needs. Several reliable platforms and apps are available, each offering a range of features to assist you. Whether you prefer spreadsheets, trading journals, or specialized software, find a tool that simplifies the recording and analysis process.

2. Record Every Trade

Meticulously document every trade, capturing essential details such as entry and exit prices, trade direction, currency pair, profit/loss, and any relevant notes. Consistency is key here – don’t skip any trades, no matter how small or insignificant they may seem.

3. Analyze Your Trades

Once you’ve established a solid database of trades, it’s time to analyze your performance. Review your trades objectively, evaluating your entry and exit points, risk management strategies, and market conditions. Identify patterns, both successful and unsuccessful, to gain insights into what’s working and what needs adjusting.

4. Identify Key Metrics

Tracking specific metrics will provide you with a quantitative measure of your trading performance. These may include win rate, profit factor, Sharpe ratio, or any other metric relevant to your strategy. By monitoring these metrics over time, you can assess the effectiveness of your trading approach and make necessary adjustments.

Expert Insights for Successful Tracking

-

Embrace Technology: Utilize automated trade tracking tools to streamline the process and reduce errors.

-

Learn from Others: Seek guidance from experienced traders on effective tracking techniques and strategies.

-

Stay Consistent: Discipline is paramount. Track every trade diligently, regardless of its outcome.

-

Review Regularly: Schedule regular time for in-depth analysis of your trades. Identify patterns, adjust your strategy, and continuously improve.

Image: tradingstrategyguides.com

How To Track Forex Trades

Conclusion

Tracking forex trades is not merely a technical exercise; it’s an art that empowers you with the knowledge and confidence to master the market. By implementing the techniques outlined in this guide, you gain a competitive edge, unlocking the potential for consistent profitability and long-term success. Remember, the journey to trading mastery is an ongoing one. Continuously refine your tracking system, analyze your performance, and adjust your approach as needed. With dedication and perseverance, you’ll navigate the forex markets with the precision of a seasoned navigator, charting a course towards financial success.