In the dynamic world of foreign exchange (forex) trading, volatility stands as a double-edged sword. It can unlock opportunities for savvy traders while simultaneously posing significant risks. Understanding how to trade volatility effectively is paramount to navigating the complexities of this ever-evolving market.

Image: forextradingza1.blogspot.com

Defining Volatility: The Driving Force of Forex Markets

At its core, volatility measures the extent and speed of price fluctuations within a financial asset over a specific period. In forex trading, volatility gauges the rate at which currency pairs move from one price level to another. Periods of high volatility indicate rapid and substantial price swings, while low volatility suggests relatively stable and gradual price changes.

Embracing Volatility’s Potential: Unveiling Trading Opportunities

Embracing market volatility can unlock immense trading opportunities for those who possess the skills to navigate its unpredictable waters. Volatility provides the catalyst for price movements, enabling traders to profit from both upward and downward trends. By capitalizing on large and unexpected fluctuations, traders can potentially generate substantial returns that would not be possible in a low-volatility environment.

Harnessing Volatility: Essential Trading Strategies

Taming the volatility beast requires a combination of robust trading strategies and a keen understanding of market dynamics. Here are some indispensable approaches to consider:

Image: www.earnforex.com

1. Trend Trading: Riding the Momentum

Trend trading seeks to identify and exploit extended price movements by capturing the momentum of rising or falling trends. Volatility acts as a guiding force, signaling the strength and duration of these trends. Seasoned traders employ trend-following indicators, such as moving averages and Bollinger Bands, to determine trade entries and exits, capitalizing on predictable price patterns.

2. Range Trading: Capitalizing on Fluctuations within Boundaries

Range trading involves identifying specific price levels at which an asset oscillates. Traders buy at support levels (where prices historically fall) and sell at resistance levels (where prices historically rise), profiting from the predictable bounces within this range. High volatility, in this scenario, can provide wider ranges, amplifying the potential profits for skilled range traders.

3. Scalping: Capturing Minute Price Changes

Scalping is a high-frequency trading strategy that involves executing numerous trades within a short time frame, targeting small but consistent profits from minor price fluctuations. In high-volatility environments, scalping can yield substantial returns, provided traders have lightning-fast execution capabilities and a razor-sharp understanding of market microstructure.

Understanding Volatility Indicators: Quantifying Market Swings

Measuring volatility objectively is crucial for successful trading. Enter volatility indicators – essential tools that quantify the extent and speed of price fluctuations, providing valuable insights into market behavior. Here are a few commonly used indicators:

1. Bollinger Bands: Visualizing Volatility and Momentum

Bollinger Bands consist of two outer bands (upper and lower) placed a specific number of standard deviations away from a central moving average. Bollinger Bands depict volatility as the width between these bands. Wider bands indicate higher volatility, while narrower bands suggest lower volatility. Additionally, price breakouts beyond the bands can signal potential trend reversals.

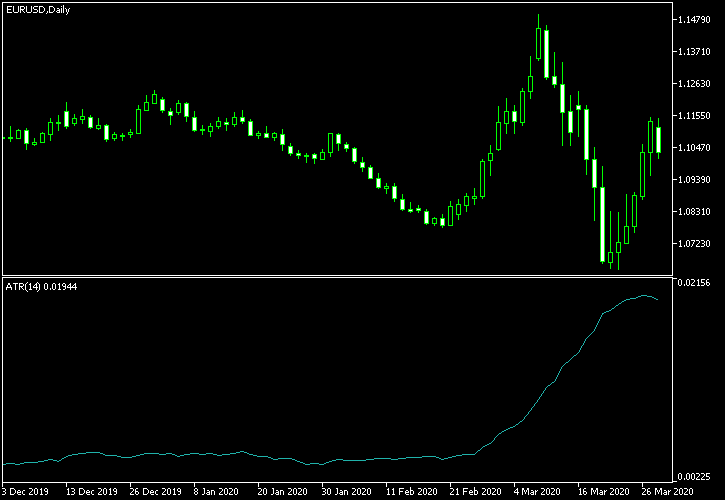

2. Average True Range (ATR): Measuring Market Dynamics

The Average True Range (ATR) quantifies market volatility by measuring the average range of price fluctuations over a specific period. Volatility manifests as a higher ATR value, signifying a highly volatile market, and vice versa. The ATR is a versatile indicator, employed in both trend analysis and determining appropriate stop-loss levels.

3. Stochastic Oscillator: Gauging Market Sentiment and Momentum

The Stochastic Oscillator is a momentum indicator that helps determine whether an asset is overbought or oversold, revealing potential trading opportunities. Volatility influences the speed and amplitude of the oscillator’s movements. Rapid oscillator readings suggest high volatility, providing clues for trend continuations or reversals.

Managing Volatility: Mitigating Risk and Preserving Capital

While volatility presents enticing opportunities, managing risk is imperative to protect capital. Several risk mitigation techniques can be adopted:

1. Position Sizing: Adjusting Risk Exposure

Position sizing involves strategically determining the size of trades based on available capital and risk tolerance. It ensures that potential losses are limited to a tolerable level, safeguarding against excessive drawdowns. In high-volatility periods, traders reduce position size to mitigate risk, while in low-volatility environments, they may increase it to capture potential profits.

2. Stop-Loss Orders: Protecting Against Adverse Swings

Stop-loss orders are essential risk management tools. They automatically close a trade when prices reach a predetermined level, limiting potential losses if market conditions turn adverse. Volatility influences the placement of stop-loss orders, with traders typically setting tighter stops in high-volatility periods to reduce exposure.

3. Correlation: Understanding Intermarket Relationships

Understanding the correlation between different currency pairs is crucial. Correlation measures the extent to which two assets move in tandem. High correlation indicates that assets move in a similar direction, while low correlation suggests they move independently. Considering correlation helps traders diversify their portfolios and hedge against unexpected market movements.

Additional Considerations: Enhancing Volatility Trading Performance

Beyond the fundamental strategies and risk management techniques, several additional considerations can bolster your volatility trading performance:

1. Market News and Sentiment: Staying Informed and Adapting

Volatility is heavily influenced by market news and sentiment. Economic data releases, geopolitical events, and central bank decisions can trigger rapid price swings. Staying informed about market events and analyzing sentiment can provide valuable insights into future volatility.

2. Backtesting and Statistical Validation: Confirming Strategies

Backtesting trading strategies on historical data is essential for validating their effectiveness. By applying your strategies to past market conditions, you can assess their profitability, risk-reward ratio, and robustness under varying volatility conditions.

3. Emotional Discipline: Controlling Fear and Temptation

Volatility can test the emotional resilience of traders. Fear during market downturns and the temptation of FOMO (fear of missing out) during upswings can lead to impulsive and detrimental trading decisions. Maintaining emotional discipline, sticking to the trading plan, and managing stress are fundamental for long-term success.

How To Trade Volatility In Forex

Conclusion: Harnessing Volatility’s Power for Trading Success

Trading volatility in forex demands a fusion of strategic finesse, risk awareness, and emotional control. By understanding the nature of volatility, employing the appropriate strategies, managing risk, and considering additional factors, traders can harness its potential to generate substantial returns while navigating the ever-changing forex market landscape. Remember, a robust knowledge of volatility and a disciplined trading approach are the keys to unlocking the opportunities this dynamic environment has to offer.