Imagine yourself as a global financier, swiftly navigating the turbulent waters of the foreign exchange market, or forex, as it’s commonly known. The forex market is the largest and most liquid financial market in the world, where trillions of dollars worth of currencies are traded daily. It’s a dynamic arena where fortunes are made and lost, but fear not, for you have a secret weapon: the knowledge of how banks trade forex.

Image: www.forex.academy

Banks are the undisputed masters of forex trading, wielding the power and resources to shape the very market they operate in. They possess insider knowledge, sophisticated algorithms, and vast capital that give them an edge over individual traders. However, with the right strategy, you can level the playing field and trade forex like the banks, reaping the rewards of this lucrative market.

Deciphering the Forex Landscape

Before diving into the intricacies of bank-style forex trading, let’s first establish a solid understanding of the market. Forex trading involves the buying and selling of currencies against each other. Each currency pair represents the exchange rate between two currencies, such as the euro and the U.S. dollar (EUR/USD).

The forex market is decentralized, meaning there’s no central exchange like in stock markets. Instead, currencies are traded through a global network of banks and financial institutions. This decentralized nature provides ample opportunities for traders to profit from currency fluctuations.

The Bank’s Trading Arsenal: Unveiling the Secrets

Now, let’s peek behind the curtains and uncover the secrets of how banks trade forex. Banks employ a combination of strategies, including:

-

Fundamental analysis: Banks scrutinize economic data, political events, and central bank decisions to forecast currency movements. This in-depth analysis allows them to make informed decisions based on real-world factors.

-

Technical analysis: Banks also rely on technical indicators, which analyze historical price data to identify patterns and trends. This helps them determine potential entry and exit points for trades.

-

High-frequency trading (HFT): Banks execute a staggering number of trades in milliseconds, leveraging algorithms and supercomputers to exploit even the slightest price movements. This lightning-fast approach generates significant profits over time.

Unlocking the Knowledge: A Guide for Individual Traders

While banks have a distinct advantage in forex trading, individual traders can still succeed by adopting similar principles:

-

Master Fundamental Analysis: Stay abreast of economic and political developments that may influence currency values. Follow financial news and expert analysis to develop informed opinions.

-

Leverage Technical Indicators: Familiarize yourself with technical indicators like moving averages, Bollinger Bands, and relative strength index (RSI). These tools can provide valuable insights into market trends and potential trading opportunities.

-

Consider HFT Strategies: While individual traders may not have access to the same high-powered technology as banks, they can employ similar strategies by using automated trading platforms and expert advisors (EAs).

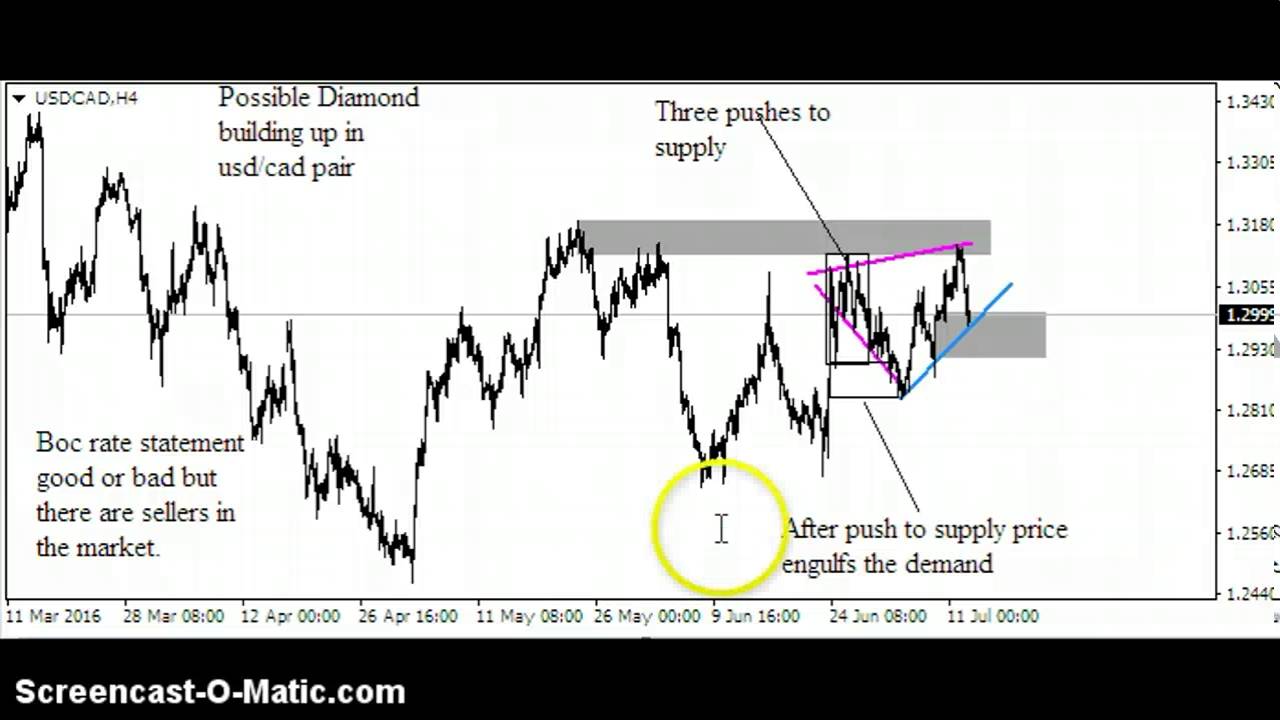

Image: www.youtube.com

The Power of Patience and Discipline

Forex trading, like any form of investment, requires patience and discipline. The allure of quick profits can be tempting, but successful traders know that patience and a well-defined trading plan are key to long-term success.

-

Set Realistic Expectations: Don’t expect to become an overnight millionaire. Forex trading involves risk, and it’s essential to set realistic goals that align with your risk tolerance and financial situation.

-

Stick to Your Trading Plan: Once you’ve established a trading plan, stick to it. Emotional decision-making can lead to impulsive trades and potential losses. Trust in your analysis and follow your strategy diligently.

Trade Forex Like The Banks

Conclusion: Join the Forex Elite

By embracing the strategies employed by banks and combining them with patience and discipline, you can unlock the potential of forex trading and join the ranks of successful traders. Remember, the forex market is a vast and dynamic arena, but with the right knowledge and strategies, you can navigate its complexities with confidence and reap the rewards.