When it comes to trading financial markets, you’ll encounter a plethora of options, including forex spread betting and CFDs (Contracts for Difference). Both instruments offer unique advantages and cater to different trading styles. Understanding the intricacies of each will help you make an informed decision about which one aligns best with your goals and risk tolerance.

Image: forexstrategiesdownload.blogspot.com

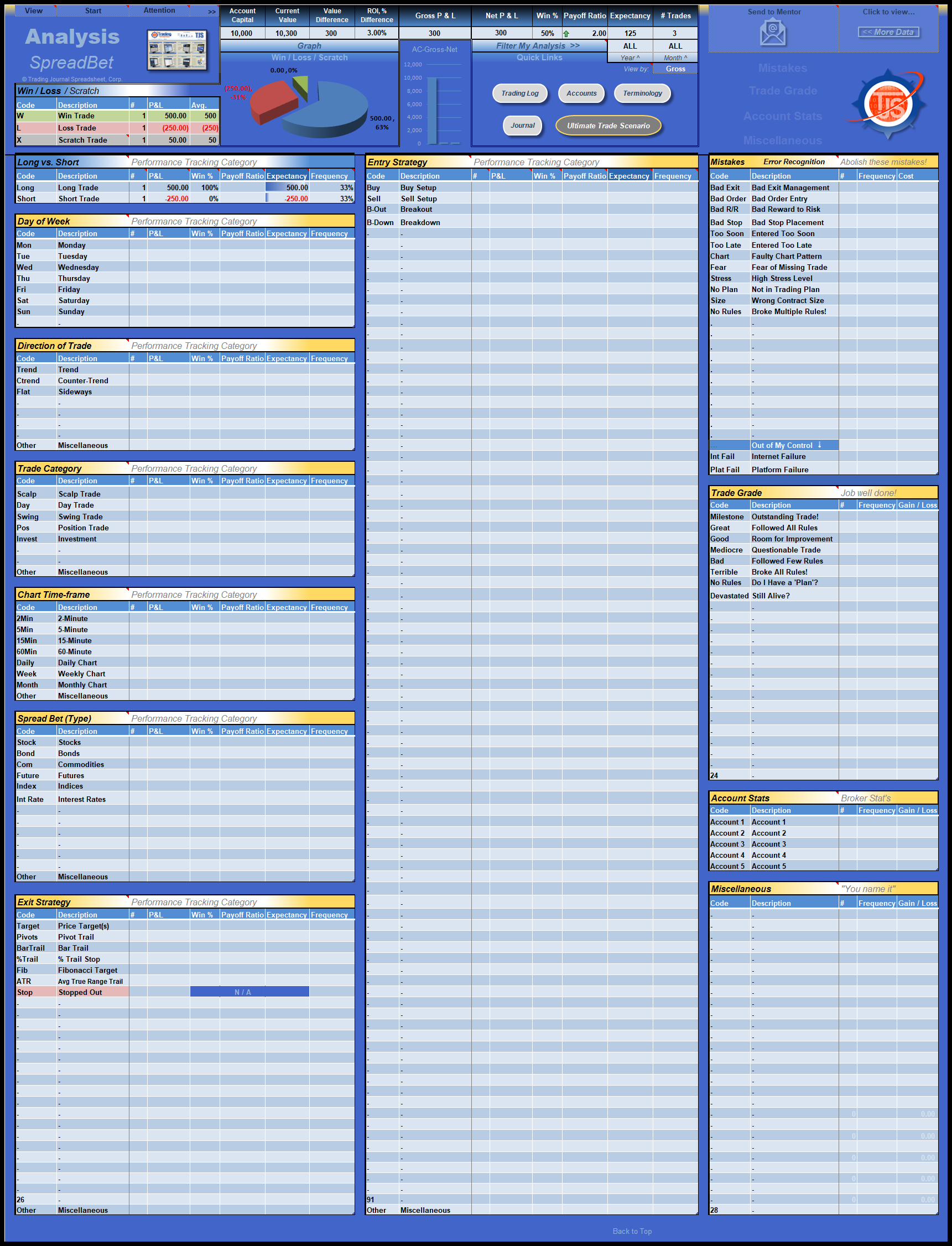

Forex Spread Betting: A Simplified Overview

Forex spread betting involves speculating on the movements of currency pairs without directly owning the underlying assets. Instead, you bet on the spread, the difference between the buy and sell prices offered by your broker. If your prediction aligns with the market’s direction, you profit; otherwise, you incur losses.

One key advantage of forex spread betting is its tax-free status in the United Kingdom. Additionally, leverage is typically higher compared to CFDs, allowing you to amplify your potential profits (and losses). However, you should be mindful of the increased risk that comes with higher leverage.

CFDs: Contracts for Difference

Contracts for Difference (CFDs) are another popular instrument used for speculating on financial markets. Unlike forex spread betting, CFDs represent an agreement between you and your broker to exchange the difference in the value of an underlying asset from the time you open your position to the time you close it.

CFDs provide exposure to a wider range of financial assets, including stocks, indices, commodities, and bonds. They offer flexible trading strategies, such as going long (buying) or short (selling), and can be used for hedging purposes.

Comparative Analysis: Forex Spread Betting vs. CFDs

To help you make a more informed decision, let’s delve into a comparative analysis of forex spread betting and CFDs based on key factors:

Tax Implications: Forex spread betting is tax-free in the UK, while CFDs are subject to Capital Gains Tax (CGT).

Tradable Assets: Forex spread betting is limited to currency pairs, while CFDs offer exposure to a wider range of financial markets.

Leverage: Forex spread betting typically offers higher leverage than CFDs, however, this also increases the risk involved.

Hedging Opportunities: CFDs can be effectively utilized for hedging strategies, whereas forex spread betting is less suitable for this purpose.

Execution Costs: Transaction costs may vary depending on the broker and the type of instrument chosen (spreads for forex spread betting, commissions for CFDs).

Image: pepperstone.com

Expert Insights: Tapping into the Wisdom of Industry Pros

To provide you with valuable insights, we consulted with industry experts who shed light on the nuances of forex spread betting and CFDs:

“Forex spread betting offers a simplified approach to trading currency pairs, appealing to those seeking tax-free returns,” explains financial analyst Emily Carter. “However, traders must navigate the potential pitfalls of leverage.”

“CFDs have gained traction among traders due to their versatility and hedging capabilities,” remarks market strategist Robert Harrison. “They provide access to a vast selection of markets, allowing traders to diversify their portfolios.”

Actionable Tips: Empowering Your Trading Journey

Put these actionable tips into practice to enhance your trading experience:

-

Start with a demo account to familiarize yourself with the nuances of forex spread betting and CFDs.

-

Determine your risk appetite and choose an instrument that aligns with your tolerance level.

-

Seek professional guidance if you are new to the world of trading financial markets.

-

Continuously educate yourself to stay abreast of market dynamics and trading strategies.

Forex Spread Betting Vs Cfd

Conclusion: Making an Informed Decision

Choosing between forex spread betting and CFDs depends on your individual circumstances and trading goals. Forex spread betting offers tax advantages and higher leverage, but it’s limited to currency pairs. CFDs provide exposure to a wider range of assets and hedging opportunities, though they are subject to Capital Gains Tax.

Whether you’re a seasoned trader or just starting your journey, understanding the intricacies of forex spread betting and CFDs will help you navigate financial markets with more confidence and make informed trading decisions. Remember, knowledge is power, and by equipping yourself with the right information, you can maximize your chances of success.