In the dynamic realm of foreign exchange (forex) trading, the interplay of supply and demand holds the key to unlocking profitable trading opportunities. This comprehensive guide will empower you to understand and identify supply and demand in forex, giving you a competitive edge in the unpredictable markets.

Image: www.vrogue.co

Defining Supply and Demand in Forex

Supply refers to the amount of a particular currency that traders are willing and able to sell at a given price, while demand represents the quantity that traders desire to purchase at that price. The intersection of these two forces determines the equilibrium price of the currency in forex markets.

When supply exceeds demand, the price of the currency tends to fall as sellers compete to unload their inventory. Conversely, when demand outstrips supply, the price rises due to increased competition among buyers. This fundamental relationship is at the core of forex trading.

Identifying Supply and Demand Zones

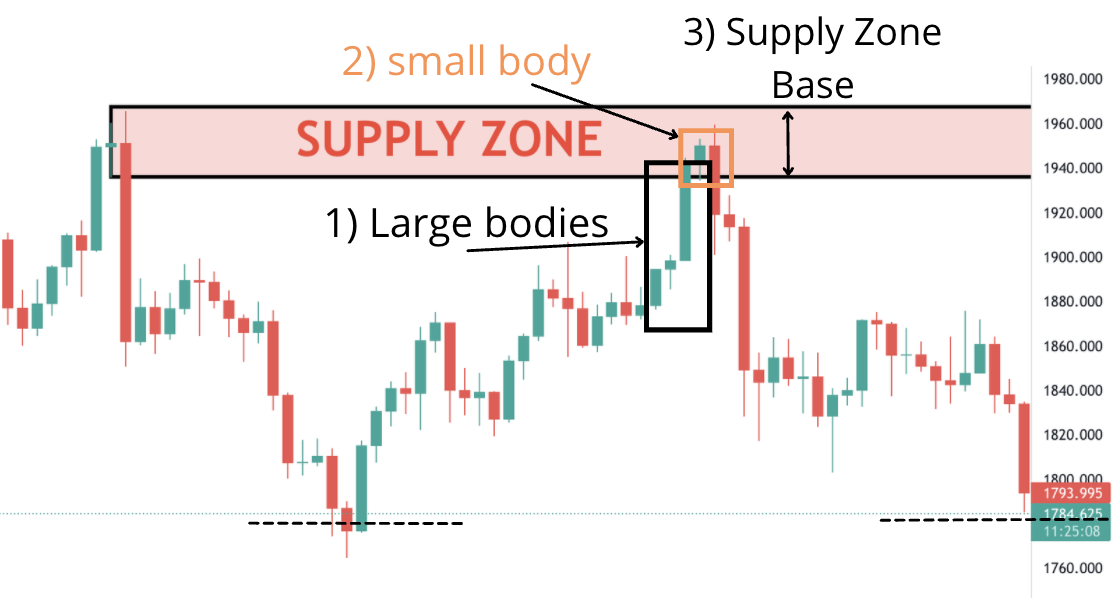

To trade effectively, you need to be able to identify areas of high supply or demand, known as supply and demand zones. These zones indicate potential reversal points in the market. Traders who can anticipate these zones have a significant advantage.

One method for identifying supply zones is to look for areas where prices have risen sharply and then reversed, leaving behind a series of lower highs. This indicates significant resistance from sellers, creating a zone of potential supply.

Demand zones, on the other hand, can be identified by areas where prices have fallen sharply and then reversed, producing a series of higher lows. This suggests strong support from buyers, creating a zone of potential demand.

Leveraging Price Action for Confirmation

Price action refers to the patterns and movements in candlestick charts. By analyzing price action, traders can gain valuable insights into supply and demand.

In supply zones, look for long-legged candlesticks with short bodies, known as pin bars. These candlesticks indicate a strong rejection from higher prices, often signaling a potential reversal.

In demand zones, look for long-legged candlesticks with small upper shadows and long, filled bodies, known as bullish engulfing candlesticks. These candlesticks represent a significant shift in momentum, indicating a potential uptrend.

Image: forexretro.blogspot.com

Technical Indicators for Support

Technical indicators, such as moving averages, support and resistance levels, and oscillators, can provide further confirmation of supply and demand zones.

Moving averages can help identify long-term supply and demand zones, while support and resistance levels can act as potential reversal points. Oscillators, like the Relative Strength Index (RSI), can indicate overbought or oversold conditions, which can help spot potential price reversals in supply and demand zones.

Trading Strategies Based on Supply and Demand

Once you’ve identified supply and demand zones, you can start formulating trading strategies. Two common approaches include:

-

Trend Trading: Trading with the dominant trend, buying in demand zones during an uptrend and selling in supply zones during a downtrend.

-

Counter-Trend Trading: Trading against the short-term trend, entering long positions in supply zones and short positions in demand zones, aiming to capitalize on price reversals.

How To Identify Supply And Demand In Forex

Mastering Supply and Demand in Forex

Unveiling the secrets of supply and demand in forex is not an easy feat, but it’s a journey that empowers traders with knowledge and confidence. By embracing the principles outlined in this guide, you can elevate your trading skills, make informed decisions, and potentially reap the rewards of a lucrative trading career.