In the ever-evolving realm of finance, foreign exchange (forex) trading stands as a captivating arena where opportunities abound. As aspiring traders navigate this intricate landscape, comprehending one fundamental concept is imperative: the elusive spread. This enigmatic entity holds immense power to shape your trading experience, influencing both your potential profits and the safeguarding of your hard-earned capital.

Image: www.babypips.com

Deciphering the Essence of Spread in Forex

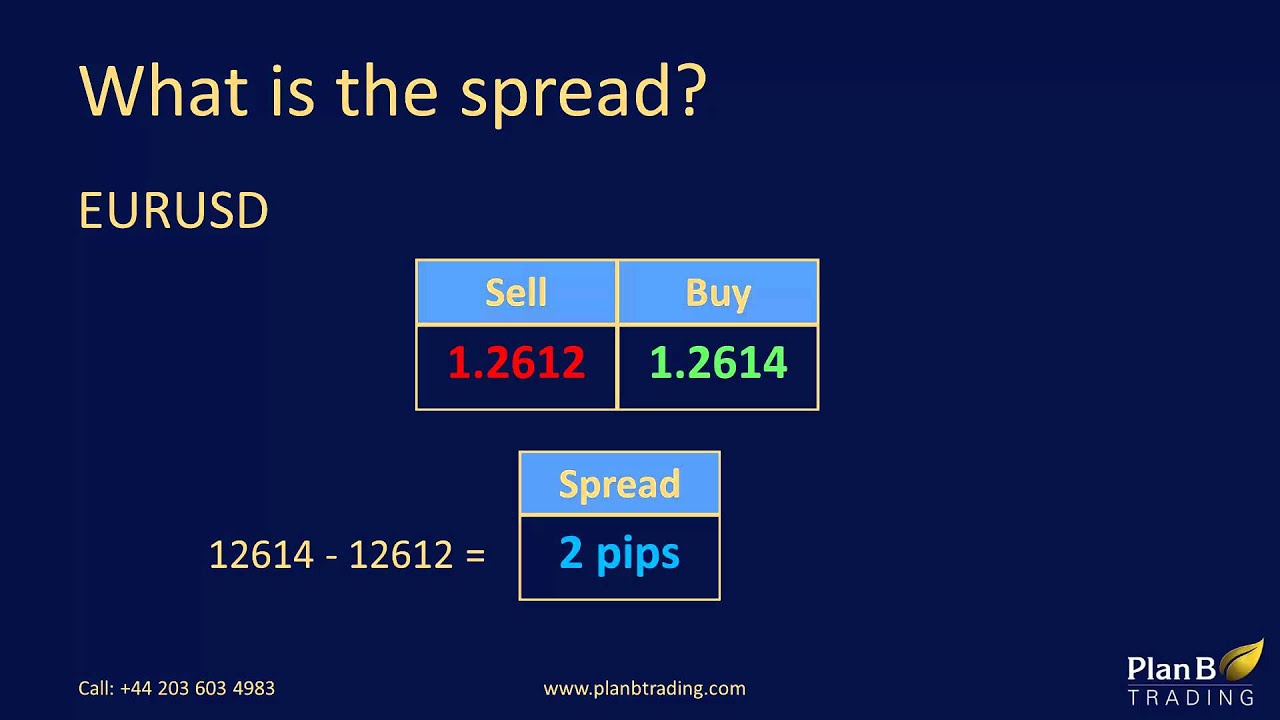

Simply put, spread refers to the difference between the bid and ask prices of a currency pair. This pivotal concept represents the invisible commission levied by brokers on every trade, serving as their compensation for facilitating the exchange. Understanding the mechanics of spread is akin to holding a crucial key, unlocking the door to informed decision-making and potentially profitable ventures.

Dissecting the Bid-Ask Price Dynamics

Visualize the vibrant forex market as a bustling auction hall, where myriad bids (offers to purchase) and asks (offers to sell) collide, each vying for the attention of potential counterparties. The bid price represents the price at which you can sell your currency pair, while the ask price signifies the price at which you can purchase it. The spread, therefore, corresponds to the gap between these two prices.

Practical Implications of Spread in Trading

Grasping the significance of spread extends beyond mere comprehension; it empowers you to make judicious trading decisions. Here’s why:

-

Impact on Profitability: A wider spread inevitably eats into your potential profits. Imagine purchasing a currency pair with a 10-pip spread: to achieve profitability, the market must move in your favor by 11 pips. Conversely, a tighter spread, such as 2 pips, requires a mere 3-pip market movement to yield gains.

-

Risk Management: Spread plays a vital role in risk management. A large spread can amplify your potential losses, particularly in volatile market conditions. Traders must carefully consider the spread in relation to their risk tolerance and overall trading strategy.

Image: www.youtube.com

Navigating the Forex Spread Landscape

Seasoned traders employ various strategies to combat the impact of spread and maximize their trading prowess:

-

Choosing Low-Spread Brokers: Opting for brokers with consistently low spreads can significantly enhance your trading experience. Diligent research and comparative analysis are crucial in identifying reputable brokers that align with your trading needs.

-

Trading High-Volume Pairs: Currency pairs with high trading volumes typically exhibit tighter spreads. Pairs like EUR/USD, GBP/USD, and USD/JPY often boast spreads as low as 1 pip, offering favorable conditions for traders.

-

Adopting Scalping Strategies: Scalping, a trading style involving frequent trades with small profit targets, can be advantageous in low-spread environments. By capitalizing on minor market fluctuations, scalpers can potentially mitigate the impact of spread.

-

Monitoring Market Conditions: Staying abreast of market conditions is paramount. During periods of high volatility, spreads tend to widen, demanding cautious trading approaches. Conversely, periods of low volatility may present opportunities for traders to execute trades with tighter spreads.

What Is The Meaning Of Spread In Forex

Conclusion: Embracing the Power of Spread

As you embark on your forex trading journey, the enigmatic spread will forever remain a ubiquitous presence. However, by deciphering its intricacies and employing strategic approaches, you can transform this unavoidable cost into an ally, empowering you to navigate the turbulent waters of forex trading with increased confidence and potential profitability. Remember, the spread is not an insurmountable obstacle but rather an integral aspect of forex trading that, when harnessed wisely, can unlock avenues to financial success.