Introduction

In the fast-paced and ever-evolving world of forex trading, staying abreast of the intricacies that drive market movements is paramount to success. Among the key metrics that traders monitor closely is the TT rate. Understanding the TT rate and its impact on forex transactions empowers traders to make informed decisions and maximize their trading potential. This comprehensive guide delves into the world of TT rates, explaining their intricacies, historical significance, and practical implications in the realm of forex trading.

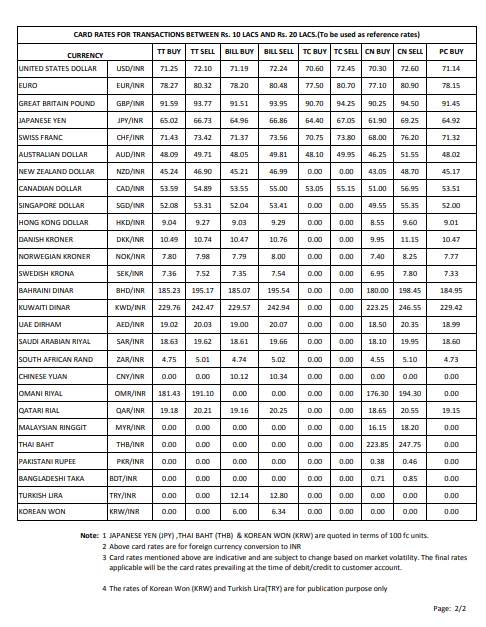

Image: bestmt4ea.com

Definition and Importance of TT Rates

TT stands for “tom-next.” The TT rate, also known as the tom-next rate or the overnight interbank rate, refers to the interest rate differential between the spot rate and the one-day forward rate for a currency pair. It essentially represents the cost of borrowing a currency for one day. The TT rate plays a crucial role in determining the overall direction of exchange rates, influencing the profitability of carry trades, and setting the baseline for future interest rate expectations.

Historical Perspective

The concept of TT rates emerged from the early days of international trade, when merchants and traders needed to exchange currencies for cross-border transactions. To facilitate these transactions, banks developed the concept of forward contracts, which allowed parties to lock in an exchange rate for future delivery. Over time, the TT rate evolved as the benchmark for determining the interest rate differential between the spot and forward markets.

How TT Rates Impact Forex Transactions

TT rates directly impact forex transactions in several ways:

Image: management.ind.in

Carry Trades:

Traders employ carry trades by borrowing a currency with a lower interest rate (such as the Japanese yen) and simultaneously purchasing a currency with a higher interest rate (such as the Australian dollar). The profit potential in carry trades lies in the difference between the interest earned on the purchased currency and the interest paid on the borrowed currency. Favorable TT rates can enhance the profitability of carry trades by reducing the cost of financing and widening the interest rate differential.

Spot Trading:

Traders involved in spot trading speculate on the short-term fluctuations in exchange rates. TT rates play a significant role in determining the attractiveness of currency pairs for spot trading. A high TT rate can, for instance, make it more appealing to sell a currency with a low interest rate and buy one with a higher rate.

Speculation on Interest Rate Expectations:

TT rates serve as a leading indicator of future interest rate expectations. When the TT rate rises, it may signal market participants’ anticipation of higher future interest rates. Conversely, a decline in the TT rate can indicate expectations of lower interest rates. Forex traders can incorporate TT rates into their analysis to forecast the potential direction of interest rates and make informed trading decisions.

Factors Influencing TT Rates

Multiple factors influence TT rates, including:

Central Bank Policy:

Central bank decisions regarding interest rates directly impact TT rates. When a central bank raises interest rates, it typically leads to an increase in the TT rate as investors seek higher returns.

Economic Fundamentals:

Data related to inflation, unemployment, and economic growth can impact TT rates. Strong economic data usually boosts the currency’s value and can result in higher TT rates.

Global Economic Outlook:

Global economic conditions and events greatly influence TT rates. For instance, geopolitical uncertainties or global economic downturns can lead to fluctuations in TT rates.

Market Sentiment and Speculation:

Market sentiment and speculation also influence TT rates. Positive sentiment toward a particular currency can increase its TT rate, while negative sentiment can drive it down.

What Is Tt Rate In Forex

Conclusion

The TT rate is an indispensable metric in the world of forex trading, offering insights into market movements and interest rate expectations. By comprehending the TT rate’s historical significance, its impact on forex transactions, and the factors influencing it, traders can make well-informed decisions and enhance their trading strategies. This comprehensive guide provides a solid foundation for forex traders to navigate the complexities of TT rates, empowering them to capitalize on opportunities and mitigate risks in the ever-evolving forex market.