Introduction: Trading Resumption and Holiday Impact

The festive season brings a brief pause to the fast-paced world of forex trading, with the markets closing for the Christmas holiday. However, as the holiday cheer fades and the new year approaches, traders eagerly anticipate the market’s reopening, wondering when they can resume their pursuit of financial success. This article delves into the intricacies of the forex market’s post-Christmas schedule, providing a comprehensive guide for traders looking to maximize their opportunities in the new trading year.

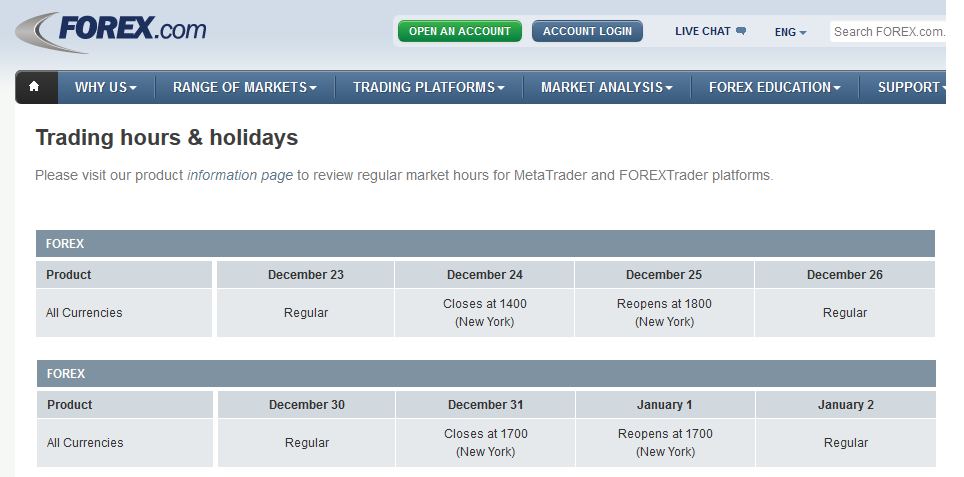

Image: fnforex1.com

Understanding the Forex Market’s Unique Nature

The foreign exchange (forex) market stands out as the most actively traded financial market globally, facilitating the exchange of currencies 24 hours a day, five days a week. However, this continuous trading cycle is disrupted during certain holidays, including Christmas, when most financial institutions and brokerages close for business. This temporary suspension provides traders with a much-needed break but also raises questions about the market’s resumption.

Navigating Post-Christmas Forex Market Hours

The forex market’s reopening time after Christmas varies depending on the individual brokerage firm. Generally, most brokers resume operations on the morning of December 27th or 28th, following the market’s closure on December 24th. It is crucial for traders to check with their respective brokers to confirm the exact reopening time to avoid missing out on potential trading opportunities.

Market Dynamics and Post-Holiday Trading Strategies

The post-Christmas period often presents unique market dynamics that traders should be aware of. Holiday-related events, such as reduced liquidity and volatility, can impact price movements and trading strategies. Some traders choose to adopt a cautious approach during this time, while others see it as an opportunity to capitalize on potential price fluctuations.

Holiday Market Impact: Factors to Consider

Several factors can influence the forex market’s behavior after the Christmas holiday:

- Reduced Liquidity: Holiday closures result in lower market participation, leading to reduced liquidity. This can result in wider spreads and increased slippage, which can affect trading execution.

- Market Sentiment: The holiday season typically fosters a bullish sentiment, with traders expecting higher prices due to increased consumer spending. However, this sentiment can reverse after the holidays, leading to potential price corrections.

- Volatility: Market volatility tends to be lower during the post-holiday period as participants return to work and readjust to the trading rhythm. Nevertheless, unexpected economic or geopolitical events can trigger increased volatility, creating trading opportunities.

Image: sotoyege.web.fc2.com

Tips for Post-Christmas Forex Trading

To navigate the post-Christmas forex market effectively, traders should consider the following tips:

- Monitor Market News: Stay informed about economic events, central bank announcements, and other factors that could influence market sentiment.

- Adapt Trading Strategies: Adjust trading strategies to account for reduced liquidity and potentially lower volatility. Consider risk management and position sizing accordingly.

- Watch for Technical Levels: Observe key technical levels such as support and resistance zones to guide trade entries and exits.

- Use Caution: Exercise prudence during the initial post-holiday trading sessions, as liquidity may be lower and market behavior may be unpredictable.

When Does The Forex Market Open After Christmas

Conclusion: Embracing the Post-Christmas Trading Landscape

The post-Christmas forex market offers both challenges and opportunities for traders. By understanding the holiday-related market dynamics and implementing appropriate trading strategies, traders can position themselves to make the most of this unique trading period. With careful planning and execution, traders can resume their forex pursuits after Christmas, unlocking the potential for profitable returns in the new trading year.