Imagine a bustling financial hub where traders from across the globe converge to exchange currencies in real-time, driving the economic heartbeat of nations. This is the world of forex, the largest and most liquid financial market in the world. However, as a prospective trader, a fundamental question arises: Are these markets accessible during the weekend, when the rest of the world takes a break? This article delves into the intricacies of forex market operations to unravel the mystery of weekend trading, equipping you with crucial information to navigate this dynamic realm successfully.

Image: ykoteky.web.fc2.com

The Rhythms of the Forex Market: A Global Marketplace

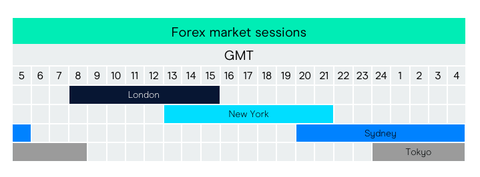

Unlike traditional stock exchanges that adhere to specific trading hours, the forex market operates 24 hours a day, five days a week. This unique feature stems from the global nature of the market, with participants from all time zones engaging in currency exchange. As one region closes for business, another awakens, ensuring continuous liquidity and price discovery. However, this begs the question: What happens during the weekend, when financial institutions typically close their doors?

Weekend Intermission: A Pause in Official Trading

During weekends, the forex market enters a state of “intermission,” as major financial institutions and central banks cease their operations. This temporary halt in official trading means that no new orders can be executed, and the market enters a period of relative inactivity. Currency exchange rates remain frozen at the closing prices of Friday, awaiting the resumption of trading on Monday.

Over-the-Counter Transactions: A Lifeline for Dedicated Traders

While official trading may cease on weekends, the forex market doesn’t completely shut down. A small but dedicated group of retail traders and specialized brokers engage in over-the-counter (OTC) transactions during this period. These trades are executed directly between counterparties, bypassing the central exchanges. However, it’s important to note that OTC weekend trading comes with its own set of challenges.

Image: forexretro.blogspot.com

Challenges of Weekend OTC Trading: Navigating the Ebb and Flow

Weekend OTC trading presents several unique challenges for traders. Firstly, liquidity is significantly reduced compared to weekdays, which can lead to wider spreads and increased volatility. Secondly, the absence of major market participants can result in less reliable price discovery, making it harder to gauge market sentiment accurately. Additionally, weekend trading hours may not align with the availability of all traders, limiting their ability to participate.

Advantages of Weekend OTC Trading: Seizing Opportunities

Despite these challenges, weekend OTC trading offers certain advantages. For dedicated traders who can adapt to the unique market dynamics, it presents opportunities to capitalize on market movements that may occur outside of regular trading hours. Additionally, it allows traders to monitor market conditions and make informed decisions in preparation for the week ahead.

Striking the Balance: Assessing Weekend Trading Suitability

Ultimately, the decision of whether to participate in weekend OTC trading is a personal one that depends on an individual’s risk tolerance, trading style, and availability. Those new to forex trading are generally advised to gain experience during regular trading hours before venturing into weekend trading. Seasoned traders, on the other hand, may find weekend trading a valuable tool to enhance their strategies and capitalize on market inefficiencies.

Are Forex Markets Open On Weekends

Conclusion: Empowering Informed Decisions

Understanding the intricacies of forex market accessibility on weekends is crucial for traders at all levels. This article has explored the dynamics of weekend trading, highlighting its unique challenges and potential advantages. While official trading may pause during weekends, the market remains accessible through over-the-counter transactions. By carefully considering the factors discussed in this article, traders can make informed decisions about whether weekend trading aligns with their trading strategies and risk appetite, empowering them to navigate the forex market with confidence and knowledge.