Axis Bank Forex Card: Unraveling the Secrets of Currency Conversion

Image: www.ankuraggarwal.in

When embarking on international adventures, anxiety often stems from the daunting task of currency conversion. Fortunately, Axis Bank offers a solution that empowers travelers with peace of mind and financial flexibility – the Axis Bank Forex Card. This comprehensive guide will unveil the intricacies of this remarkable card, empowering you to navigate foreign currencies with ease.

What is an Axis Bank Forex Card?

An Axis Bank Forex Card is a prepaid card that seamlessly converts Indian Rupees into a desired foreign currency, eliminating the need for physical cash exchange. It is widely accepted at millions of retail outlets and ATMs worldwide, ensuring convenience and security during your travels.

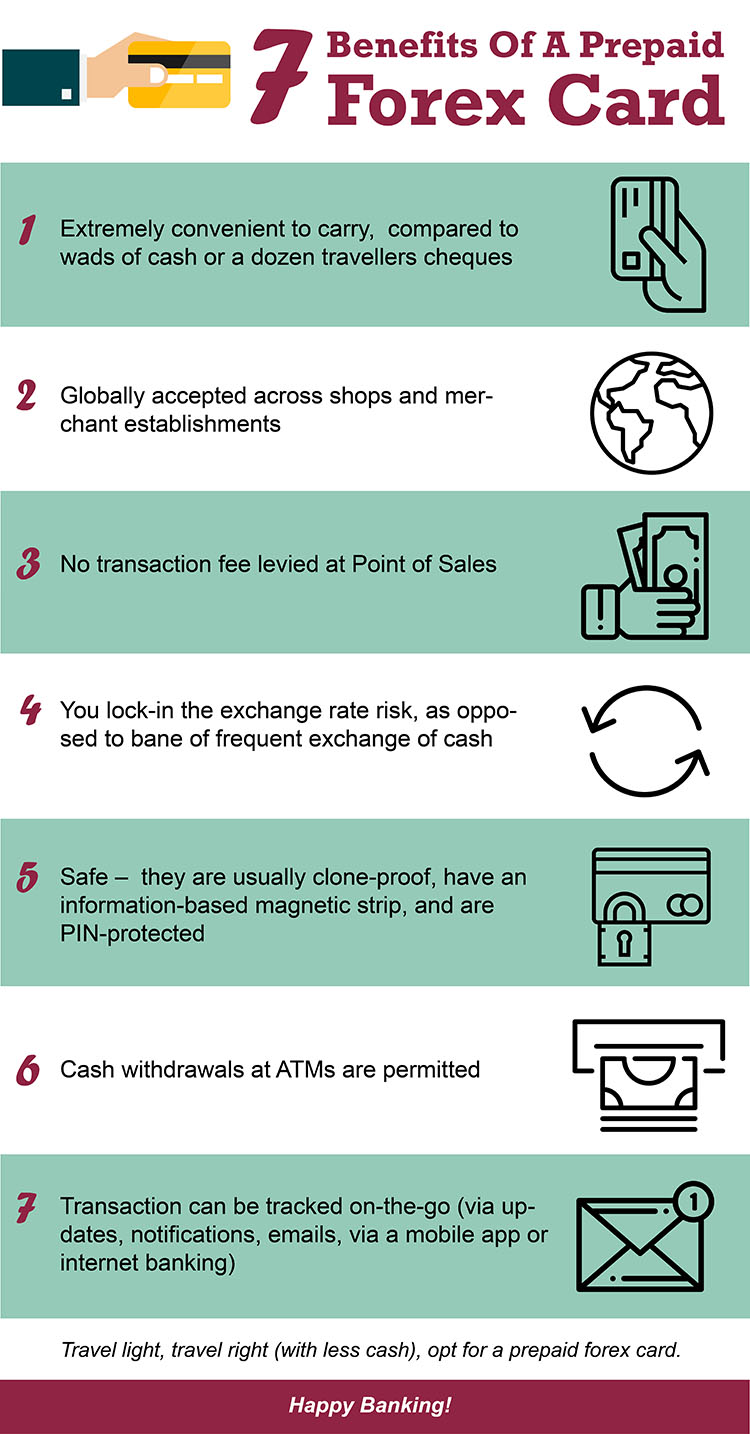

Benefits of Using an Axis Bank Forex Card

-

Secure Transactions: Enjoy enhanced security with chip-enabled technology, minimizing the risk of fraud.

-

Competitive Exchange Rates: Access competitive exchange rates, ensuring you maximize the value of your money.

-

Reduced Transaction Costs: Avoid the hefty charges associated with converting currency at airports or exchange bureaus.

How to Check the Balance of Your Axis Bank Forex Card

Monitoring the balance of your forex card is crucial for responsible spending. Here are several convenient methods to check your balance:

-

Online Banking: Log in to Axis Bank’s net banking portal to view your card balance in real-time.

-

Mobile Banking: Download the Axis Bank mobile app to access your forex card balance on the go.

-

SMS Banking: Send an SMS to “MBAL

Last 4 digits of the Forex Card” to 5676782 to receive your balance. -

Call Center: Contact Axis Bank’s dedicated Forex Card Helpline at 1800 266 8333 or +91 22 3333 8333 for assistance.

Fees and Charges Associated with Axis Bank Forex Card

-

Transaction Fees: A small transaction fee applies to each purchase or withdrawal using your forex card.

-

Reload Fees: There may be a fee associated with reloading funds onto your forex card.

-

Inactivity Charges: If your forex card remains inactive for a specified period, a monthly inactivity fee may be applicable.

Tips for Managing Your Axis Bank Forex Card

-

Set Spending Limits: Establish spending limits to prevent overspending and keep your finances under control.

-

Track Transactions: Regularly check your online account or transaction history to monitor your expenses.

-

Disable the Card: If you misplace your forex card or suspect unauthorized activity, promptly contact Axis Bank to disable it.

Unleashing the Power of Currency Conversion

In today’s interconnected world, currency conversion is a necessary aspect of international travel. With the Axis Bank Forex Card, you can confidently navigate foreign lands, knowing that your money is secure and easily accessible. Embrace the freedom to explore, shop, and experience new cultures without the constraints of traditional currency exchange. Let the Axis Bank Forex Card be your trusted companion, empowering you to make the most of your global adventures.

Image: robotforexkaskus.blogspot.com

Axis Bank Forex Card Check Balance