In today’s dynamic financial landscape, forex trading has gained immense popularity among investors seeking opportunities to profit from currency fluctuations. With its high leverage and potential for substantial gains, forex trading has become a lucrative venture for those willing to navigate its complexities. However, choosing the best forex broker that aligns with your trading needs is paramount, especially for US clients navigating the regulatory landscape. This article delves into the intricacies of forex trading, providing valuable insights into the key factors to consider when selecting a suitable broker. By empowering you with this knowledge, we aim to guide you towards making informed decisions and maximizing your trading potential.

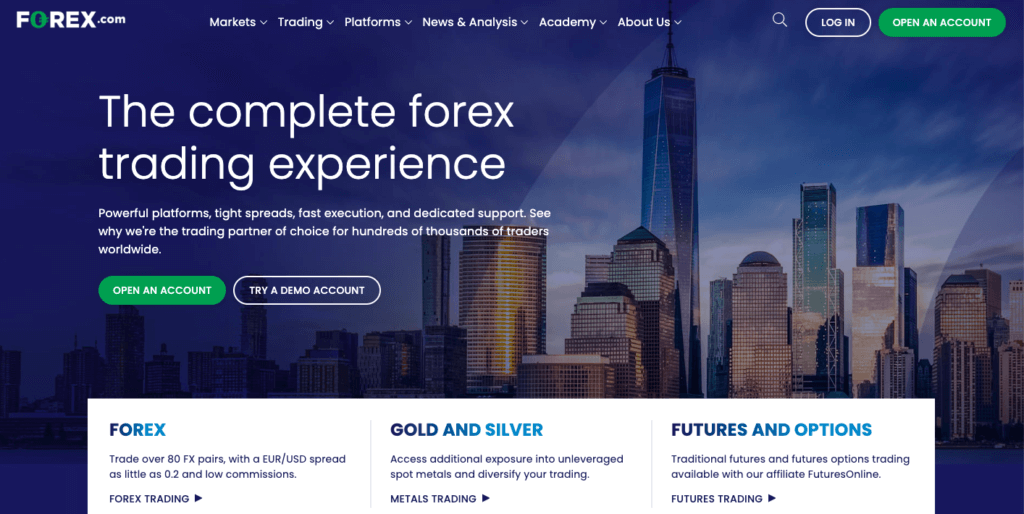

Image: www.compareforexbrokers.com

Essentials of Forex Trading for US Clients

Forex trading involves buying and selling currencies, speculating on their price movements to reap profits. The over-the-counter (OTC) nature of forex trading allows for transactions around the clock, creating a vibrant and dynamic market. However, for US clients, choosing a broker compliant with the strict regulations enforced by the Commodity Futures Trading Commission (CFTC) is essential. These regulations aim to protect traders by ensuring brokers operate ethically and transparently.

Navigating the forex market as a US client requires selecting a broker that adheres to these regulations while offering competitive trading conditions. Whether you’re a seasoned trader or just starting, understanding the broker’s regulatory status is a cornerstone of prudent decision-making.

Choosing the Right Forex Broker for US Clients

When selecting a forex broker as a US client, meticulous research and due diligence are crucial. Considering the following factors can help you make an informed choice:

Regulation and Licensing: Ensure the broker holds a license from a reputable regulatory body, such as the CFTC or the National Futures Association (NFA), to guarantee compliance with industry standards and client protection.

Account Types: Seek a broker that offers various account types tailored to different trading styles and capital levels. This flexibility allows you to choose an account that suits your needs, from standard accounts to those with advanced features or tailored leverage options.

Trading Platform: The trading platform is your gateway to the markets, so selecting one that is user-friendly, reliable, and packed with essential trading tools is vital. Consider platforms that provide real-time quotes, advanced charting capabilities, and flexible order execution options.

Fees and Commissions: Be mindful of the broker’s fee structure, including spreads (the difference between bid and ask prices), commissions, and overnight financing rates. Competitive fees can significantly impact your overall trading profitability.

Customer Support: Responsive and knowledgeable customer support is invaluable when navigating the forex market. Look for brokers offering 24/7 support through various channels, such as live chat, email, or phone, to ensure prompt assistance whenever needed.

Educational Resources: Forex trading can be complex, and access to educational resources is invaluable in enhancing your knowledge and trading skills. Brokers that provide comprehensive educational content, such as webinars, tutorials, and market analysis, can empower you to make informed trading decisions.

Leading Forex Brokers Accepting US Clients

Based on the criteria outlined above, here’s a handpicked selection of reputable forex brokers that cater to US clients:

XM: XM, regulated by the CFTC and FCA, offers a wide range of account types, a user-friendly trading platform, competitive fees, and extensive educational resources, making it a popular choice among US traders.

IG: IG, regulated by the CFTC and FCA, is another well-established broker that provides a robust trading platform with advanced features, multiple account options, and a wealth of educational materials, catering to traders of all levels.

Pepperstone: Pepperstone, authorized by the CFTC, offers lightning-fast execution speeds, low spreads, and tailored account types to cater to both retail and professional traders. Its proprietary cTrader platform is renowned for its advanced trading tools and customization options.

IC Markets: IC Markets, regulated by the ASIC, is another broker excelling in low spreads, deep liquidity, and a vast selection of tradable instruments. Its MT4 and MT5 platforms are equipped with sophisticated tools for technical analysis and automated trading.

eToro: eToro, regulated by the CFTC and FCA, stands out with its user-friendly social trading platform, where traders can copy and learn from experienced traders. Its CopyTrader feature allows beginners to mirror the trades of successful traders, potentially simplifying their trading journey.

Image: mdfinancialskills.org

Best Forex Brokers Accepting Us Clients

Conclusion

Choosing the right forex broker is an integral part of successful forex trading for US clients. By considering factors such as regulation, trading platform, fees, and customer support, you can make an informed decision that aligns with your trading style and goals. Remember, reputable brokers will maintain transparency, safeguard your funds, and provide a supportive environment for your trading endeavors. By following these guidelines, you’re well-positioned to navigate the forex market with confidence and potentially maximize your profits.