In the pulsating world of foreign exchange trading, timing is everything. Understanding the best time to trade forex can significantly amplify your chances of maximizing profits and minimizing losses. This comprehensive guide delves into the intricacies of the forex market, unraveling the optimal trading times that align with market volatility, liquidity, and global economic events. Dive in and discover the golden hours where the forex arena truly comes alive.

Image: www.cashbackforex.com

The Anatomy of the Forex Market: A Timeless Dance

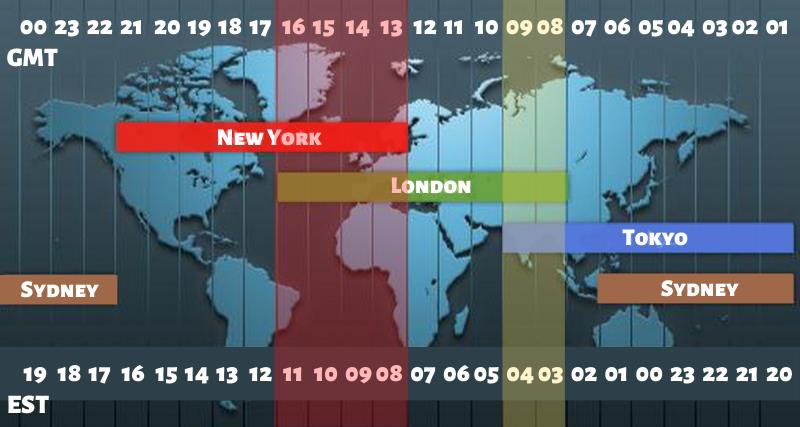

The foreign exchange market stands as the world’s largest and most liquid financial marketplace, with trillions of dollars exchanged daily. This global ecosystem operates 24/7, spanning different time zones and financial centers. However, amidst this ceaseless activity, specific periods emerge as golden opportunities for forex traders.

Unveiling the Peak Performance Window: When Volatility Takes Center Stage

Market volatility, a measure of price fluctuations, drives the lifeblood of forex trading. Higher volatility translates into wider price swings, creating lucrative trading chances. The prime hours for volatility often coincide with the overlap of trading sessions in major financial hubs.

-

The London-New York Overlap (7 AM – 12 PM EST): When the London and New York markets overlap, liquidity and volatility surge, making this period a prime target for forex traders.

-

The Sydney-Tokyo Overlap (12 AM – 5 AM EST): As the Asian trading day draws to a close and the Tokyo session kicks off, a fresh wave of liquidity and volatility washes over the market, creating another optimal trading window.

Navigating the Economic Calendar: Timing Your Trades with Precision

The forex market is intricately linked to global economic events, news announcements, and central bank decisions. These events can trigger significant market movements, making it imperative for traders to stay abreast of the economic calendar.

-

High-Impact News Releases: Central bank interest rate decisions, GDP reports, and inflation data releases often come with high volatility and market impact. Traders should monitor these events closely and adjust their trading strategies accordingly.

-

Scheduled Time Zones: Economic data releases are typically scheduled during specific time zones. By understanding the time differences, traders can plan their trades to capitalize on the immediate market reactions.

Image: la-rescousse.com

Tailoring Your Strategy to the Time of Day: A Symphony of Trading Styles

The best time to trade forex also depends on your individual trading style and risk tolerance. Different trading strategies thrive at different market conditions.

-

Scalping: Scalping involves taking small, quick profits within a short time frame. The high volatility during the London-New York overlap is ideal for scalpers seeking rapid-fire trades.

-

Day Trading: Day traders enter and exit positions within a single trading day, relying on intraday price movements. The Sydney-Tokyo overlap offers ample volatility and liquidity for day trading strategies.

-

Swing Trading: Swing traders hold positions for several days or weeks, exploiting medium-term market trends. The less volatile periods, such as the Asian session, may be more suitable for swing trading strategies.

Best Time To Do Forex Trading

Embracing the Rhythms of the Market: A Harmonious Approach

Timing forex trades effectively requires a holistic approach, considering market conditions, economic events, and individual trading styles. By understanding the pulse of the forex market, traders can synchronize their actions with the optimal trading hours, maximizing their potential profits.