In today’s interconnected world, international travel and business are commonplace. To navigate these transactions seamlessly, discerning individuals seek reliable and efficient financial solutions. HDFC Forex Card emerges as a trusted companion, offering a suite of exceptional benefits and unparalleled convenience. Join us as we embark on an in-depth exploration of the HDFC Forex Card, empowering you with the knowledge to harness its true potential.

Image: www.moneycontrol.com

Understanding HDFC Forex Card: A Gateway to Global Finance

HDFC Forex Card is a prepaid travel card designed to simplify and secure international financial transactions. It provides a convenient alternative to cash or traveler’s checks, safeguarding your funds while enabling seamless purchases and withdrawals worldwide. HDFC Forex Card bridges the gap between domestic and international transactions, allowing you to embrace global experiences without monetary worries.

Benefits that Elevate Your Travel Experience

1. Global Acceptance: HDFC Forex Card is accepted at millions of merchants and ATMs across the globe, ensuring hassle-free access to your funds whenever and wherever you need them.

2. Competitive Exchange Rates: HDFC Forex Card offers competitive exchange rates, ensuring you get the most value for your money.

3. Travel-Friendly Features: The card comes packed with travel-friendly features, including emergency assistance, lost card reporting, and PIN change facilities.

4. Reload Convenience: Replenishing your HDFC Forex Card is effortless. You can reload it online, through HDFC Bank branches, or HDFC Bank ATMs.

5. Security and Reliability: HDFC Forex Card upholds stringent security measures, providing peace of mind while safeguarding your transactions.

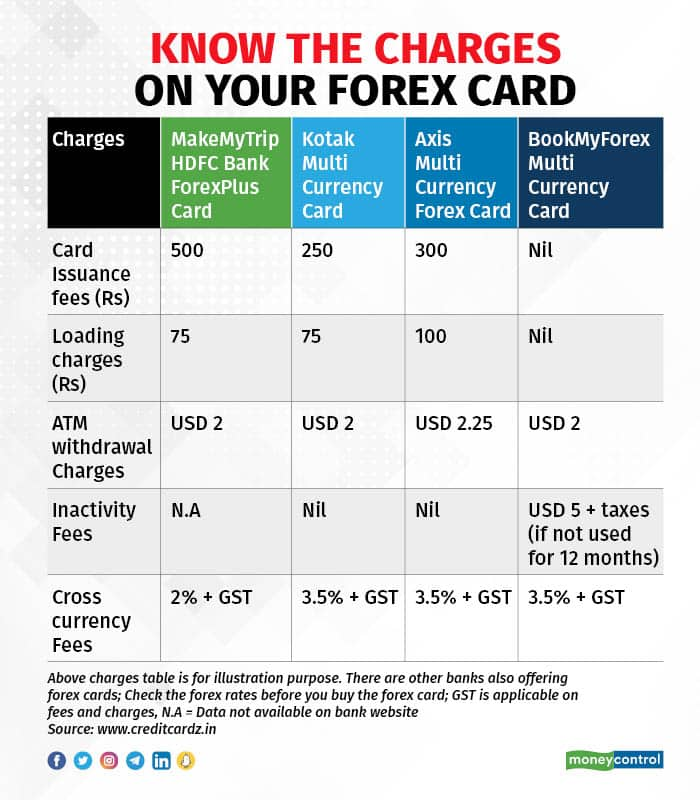

Navigating the World of HDFC Forex Card Charges

While HDFC Forex Card offers a world of convenience, it’s crucial to be aware of the associated charges. Transparency and informed decision-making empower you to optimize the usage of your HDFC Forex Card.

1. Card Issuance Fee: HDFC Bank charges a one-time card issuance fee for obtaining an HDFC Forex Card.

2. Currency Conversion Fee: Whenever you make a transaction in a currency other than the one loaded on your card, a currency conversion fee applies.

3. Transaction Fee: Every time you use your HDFC Forex Card to make a purchase or withdraw cash, you incur a transaction fee.

4. ATM Withdrawal Fee: If you withdraw cash from an ATM using your HDFC Forex Card, an ATM withdrawal fee is levied.

5. Missed Payment Fee: If you fail to make a timely payment on your HDFC Forex Card, you may be charged a missed payment fee.

Expert Insights: Maximizing Card Value

1. Choose the Right Currency: Opt for the currency of your primary destination to minimize currency conversion fees.

2. Load Wisely: Avoid frequent reloading by carefully planning your expenses and loading your card accordingly.

3. Utilize ATMs Wisely: Reduce ATM withdrawal fees by making larger withdrawals less frequently.

4. Track Expenses Closely: Monitor your transactions regularly to stay updated on your balance and avoid overspending.

Unlocking the True Potential: Conclusion

HDFC Forex Card empowers you to navigate the world with financial confidence, convenience, and security. Embrace the benefits it offers, while judiciously considering the associated charges. Enhance your global experiences, knowing that your financial transactions are handled seamlessly. Remember, informed decision-making leads to optimal value from your HDFC Forex Card. Leverage the knowledge gained from this comprehensive guide and embark on your global journeys with a trusted financial companion by your side.

Image: www.forex.academy

Charges Of Hdfc Forex Card