In the tumultuous world of foreign exchange, where currencies dance in an intricate ballet, certain pairs exhibit a remarkable synchrony, gliding in harmony like graceful partners. These “correlated” forex pairs present unique opportunities and challenges for traders, and understanding their intricacies is paramount for navigating the forex market with confidence. Join us as we embark on a journey to uncover the fascinating world of forex pairs that move the same, exploring their behavior, implications, and strategies to harness their potential.

Image: fxssi.com

The Intriguing Correlation Between Forex Pairs

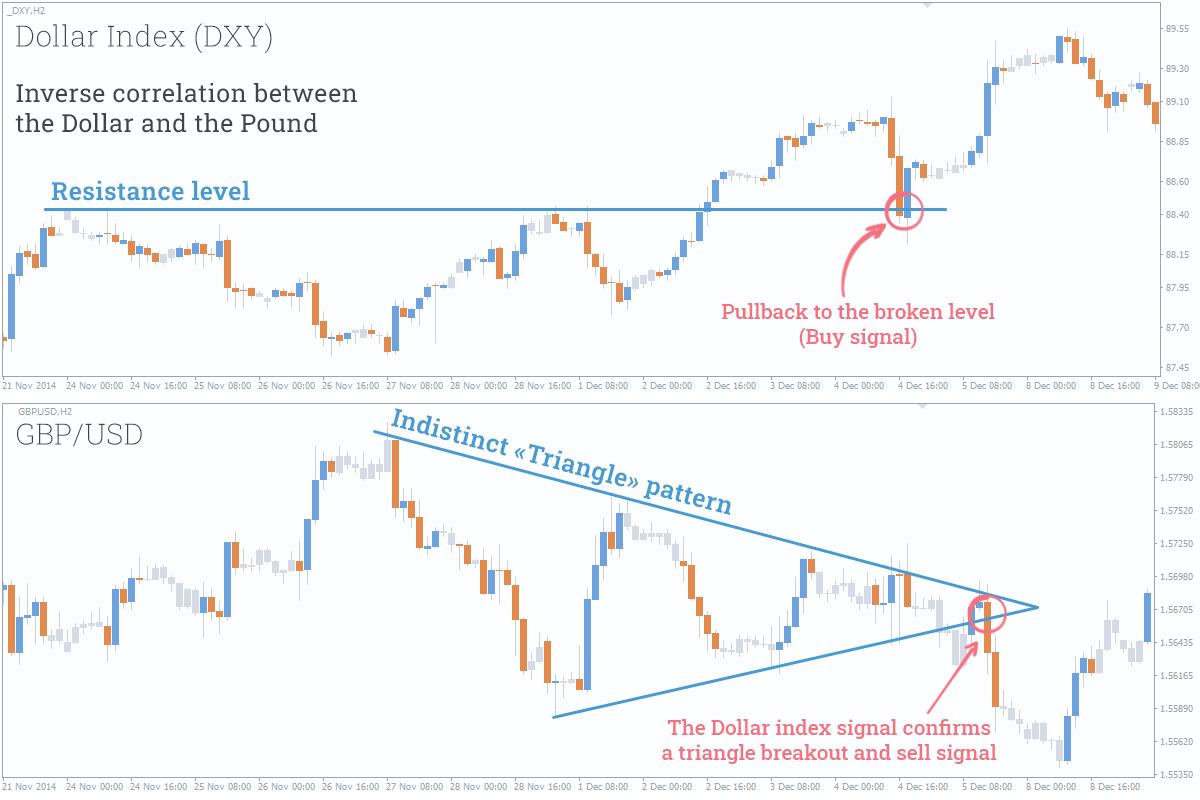

The movement of forex pairs is influenced by a myriad of economic, political, and psychological factors. However, there’s a remarkable phenomenon where some pairs tend to exhibit a positive or negative correlation in their price movements. This correlation is measured on a scale from -1 to 1, with -1 representing a perfect negative correlation, 1 indicating a perfect positive correlation, and 0 denoting no correlation.

For instance, the EUR/USD (Euro/US Dollar) and USD/CHF (US Dollar/Swiss Franc) pairs have historically demonstrated a strong positive correlation. As the EUR/USD increases in value, the USD/CHF often rises in tandem. This can be attributed to both pairs sharing a common currency, the US Dollar. Moreover, the economic fortunes of the underlying economies often move in sync, influencing the demand for these currencies.

Implications for Traders

Understanding the correlation between forex pairs holds immense significance for traders. Positive correlation implies that if one pair rises, the other is likely to follow suit. This presents opportunities for traders to capitalize on the synchronicity by opening trades in the same direction with both pairs. On the other hand, negative correlation suggests that when one pair strengthens, the other may weaken. Traders can potentially profit by taking offsetting positions in such pairs, benefiting from the price movements’ opposing nature.

Exploring Correlated Forex Pairs

Numerous forex pairs exhibit notable correlations, offering traders a diverse range of opportunities. Here are some pairs to consider:

-

Positive Correlation:

- EUR/USD and USD/CHF

- GBP/USD and EUR/GBP

- AUD/USD and NZD/USD

-

Negative Correlation:

- GBP/USD and USD/JPY

- EUR/USD and USD/CAD

- AUD/USD and USD/CHF

It’s important to note that correlations can fluctuate over time, influenced by changing market dynamics. Traders should stay abreast of market news and economic developments to adjust their trading strategies accordingly.

Image: www.hotelgurupokhara.com

Strategies for Harnessing Correlation

Savvy traders can employ various strategies to leverage the correlation between forex pairs, including:

-

Pairs Trading: This strategy involves simultaneously buying one currency pair while selling another correlated pair. The aim is to profit from the spread between the two pairs, irrespective of the overall market direction.

-

Correlation-Based Arbitrage: This sophisticated strategy capitalizes on momentary imbalances in the prices of correlated pairs. Traders exploit these discrepancies to make quick profits, though it requires a high level of market understanding and execution speed.

-

Trend Following: Identifying the underlying trend of correlated pairs can guide trading decisions. Traders can ride the trend by following the dominant price direction in both pairs.

Forex Pairs That Move The Same

Conclusion

Understanding the correlation between forex pairs is a valuable tool for traders, enabling them to navigate the complexities of the foreign exchange market with greater precision. By carefully analyzing correlations, traders can enhance their strategies, identify potential opportunities, and mitigate risks. As the forex market continues to evolve, staying informed about the latest economic developments and market trends remains essential for maximizing the potential of this dynamic and ever-changing arena.