Have you ever felt like you’re trading in the dark when it comes to forex? The market can be unpredictable, and it’s easy to lose your way. But what if there was a tool that could help you see the light? The forex support and resistance indicator is a technical analysis tool that can help you identify key levels in the market, so you can make more informed trading decisions.

Image: www.vrogue.co

In this blog post, we’ll take a deep dive into the forex support and resistance indicator. We’ll cover what it is, how it works, and how you can use it to improve your trading. So, buckle up and get ready to take your trading to the next level!

What is the Forex Support and Resistance Indicator?

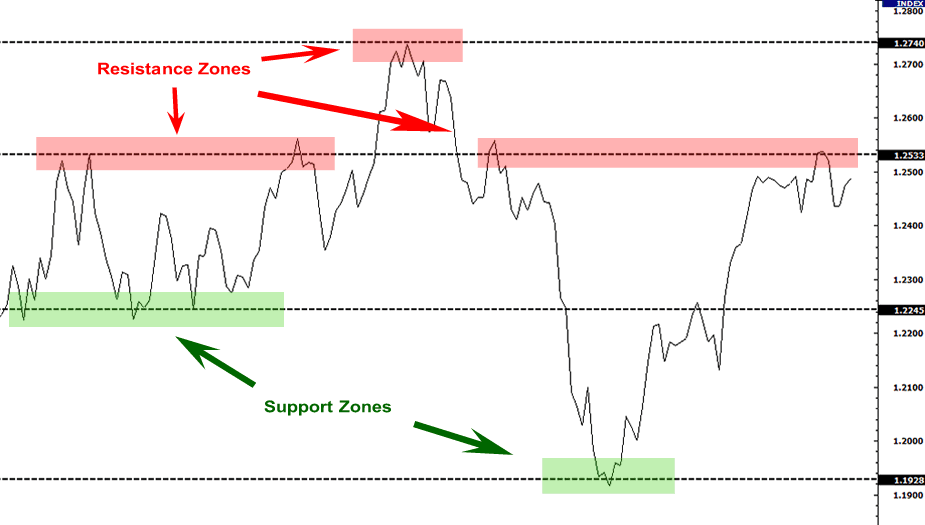

The forex support and resistance indicator is a technical analysis tool that helps traders identify key levels in the market. These levels are crucial because they represent points at which the price of a currency pair has been historically unable to break through. When the price of a currency pair reaches a support level, it may bounce back up. Conversely, when the price of a currency pair reaches a resistance level, it may fall back down.

Support and resistance levels can be created by various factors, including:

- Supply and demand: When the supply of a currency pair exceeds the demand, the price will fall. Conversely, when the demand for a currency pair exceeds the supply, the price will rise.

- Psychological factors: Traders often trade based on technical levels that are psychologically significant, such as round numbers (e.g., 1.0000) or moving averages.

- Historical data: Support and resistance levels can also be identified by looking at historical data and charting price trends.

How to Use the Forex Support and Resistance Indicator

The forex support and resistance indicator is relatively straightforward to use. Here are the steps involved:

- Identify the support and resistance levels.

- Wait for the price of a currency pair to reach a support or resistance level.

- Trade accordingly.

For example, if you identify a support level, you could place a buy order at that level. If the price of the currency pair bounces off the support level, your trade will be profitable.

Tips and Expert Advice for Using the Forex Support and Resistance Indicator

Here are a few tips and expert advice for using the forex support and resistance indicator:

- Use multiple time frames. The most common time frames for trading with support and resistance levels are the daily, 4-hour, and 1-hour charts.

- Confirm your levels. Before trading a support or resistance level, wait for the price of a currency pair to confirm the level by breaking through it.

- Manage your risk. Always use a stop-loss order when trading with support and resistance levels. This will help you limit your losses if the price of a currency pair moves against you.

By following these tips and expert advice, you can improve your chances of success when trading with the forex support and resistance indicator.

Image: omenejomy.web.fc2.com

Frequently Asked Questions (FAQs) about the Forex Support and Resistance Indicator

Q: What is the difference between support and resistance?

A: Support is a level where the price of a currency pair has been historically unable to break below. Resistance is a level where the price of a currency pair has been historically unable to break above.

Q: How do I identify support and resistance levels?

A: Support and resistance levels can be identified by looking at historical data and charting price trends. You can also use technical analysis tools, such as the forex support and resistance indicator, to help you identify these levels.

Q: How do I use the forex support and resistance indicator?

A: Here are the steps involved in using the forex support and resistance indicator:

- Identify the support and resistance levels.

- Wait for the price of a currency pair to reach a support or resistance level.

- Trade accordingly.

Forex Support And Resistance Indicator

Conclusion

The forex support and resistance indicator is a powerful technical analysis tool that can help you identify key levels in the market. By using this indicator, you can improve your chances of success when trading forex. However, trading forex is a complex and risky endeavor. Before you start trading, it is important to understand the risks involved and to develop a sound trading plan. If you are new to forex trading, you can do it for practice with a forex demo account until you build confidence in your trading ability.

Are you interested in learning more about the forex support and resistance indicator? Let me know in the comments below and like and share this blog if you found it helpful.