Immerse yourself in the fascinating world of foreign exchange (forex), where the ebb and flow of currency values present unparalleled opportunities. As a seasoned trader, I’ve witnessed firsthand the exhilarating rush of navigating the ever-changing forex landscape, particularly when dealing with high volatility pairs.

Image: www.hsb.co.id

Delve into this comprehensive guide as we unravel the secrets of high volatility pairs in forex, empowering you to harness their explosive potential and elevate your trading prowess.

Bracing for High Volatility: The Powerhouse Pairing

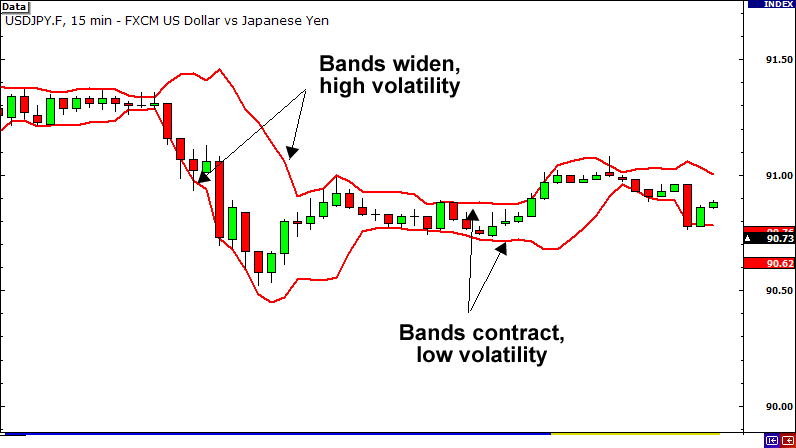

In the realm of forex, high volatility pairs are characterized by their pronounced price fluctuations, offering traders the chance to amplify their profits. These pairs often comprise currencies from countries with contrasting economic circumstances, such as varying interest rates, political stability, and economic growth patterns.

When these economic landscapes diverge, the currency pair’s exchange rate experiences greater volatility, creating opportunities for traders to capitalize on rapid price movements. Understanding the dynamics driving these high volatility pairs is crucial for exploiting their inherent trading advantages.

Unveiling the Volatility Drivers

Several factors contribute to the heightened volatility associated with high volatility pairs in forex. Interest rate differentials, reflecting the contrasting monetary policies of different countries, play a significant role. When interest rates diverge, it can lead to increased currency demand and higher levels of volatility in the associated currency pair.

Furthermore, political instability and economic uncertainties can further magnify volatility. Unexpected events, such as political upheavals or economic crises, can trigger substantial fluctuations in currency values. Traders must remain alert to geopolitical developments and economic indicators to anticipate potential market shifts.

Additionally, news releases and economic data can spark volatility as traders react to the latest developments affecting the underlying currencies. Keeping abreast of economic calendars and analyzing news events can provide valuable insights for gauging upcoming market movements.

Tips for Navigating High Volatility Pairs

Trading high volatility pairs requires a disciplined and strategic approach. Risk management is paramount, as the potential for substantial losses is equally present alongside the high reward opportunities. Employ the following tips to enhance your trading outcomes:

1. Understand the Fundamentals: Delve into the economic and political landscapes of the countries associated with the high volatility pair you intend to trade. Comprehend the factors influencing their currency values and monitor economic indicators and news releases.

2. Practice Risk Management: Implement sound risk management strategies to mitigate losses. Prudently determine your position size and leverage, ensuring they align with your risk tolerance and trading capital. Utilize stop-loss orders to limit potential losses.

Image: www.forex.com

Expert Insights: Mastering Volatility

“Volatility is an inherent aspect of forex trading,” asserts renowned trader Mark Douglas. “Embracing it rather than fearing it is essential. By understanding the drivers of volatility and employing proper risk management techniques, traders can harness its power to their advantage.”

Echoing this sentiment, trading expert Dr. Alexander Elder advises, “High volatility pairs present both challenges and opportunities. Traders must cultivate the discipline to manage risk effectively while remaining敏锐to market opportunities. A clear trading plan and emotional control are crucial for success.”

Frequently Asked Questions

Q: What defines a high volatility pair in forex?

A: High volatility pairs exhibit pronounced fluctuations in their exchange rates, primarily due to contrasting economic circumstances between the underlying countries.

Q: How can I identify high volatility pairs?

A: Analyze economic indicators and news to gauge interest rate differentials, political stability, and overall economic conditions. Technical analysis can also provide insights into the volatility of specific currency pairs.

High Volatility Pairs In Forex

Conclusion

High volatility pairs in forex present both lucrative opportunities and potential risks. By understanding the factors driving volatility, implementing sound risk management practices, and embracing expert advice, traders can navigate these dynamic markets with greater confidence and optimize their trading outcomes.

Are you ready to unlock the hidden potential of high volatility pairs? Embrace the challenge, enhance your trading prowess, and seize the opportunities these volatile markets offer.