In the realm of global finance, the foreign exchange market, or forex market, stands as a behemoth, facilitating a staggering daily turnover of over $6 trillion. Its importance is undeniable, impacting economies worldwide and offering vast opportunities and complexities for savvy investors.

Image: www.axi.group

Understanding the Forex Market: A Currency Crossroads

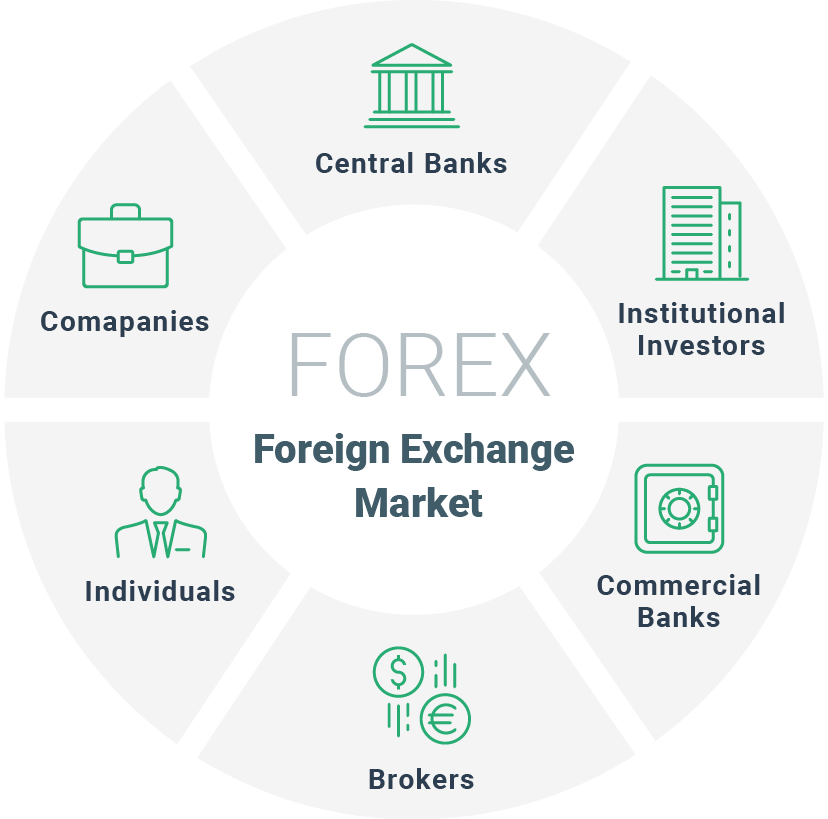

The forex market serves as a 24/7 hub where currencies are bought, sold, and exchanged. Unlike traditional stock markets, it has no centralized location but operates electronically through a vast network of banks, brokers, and institutions. At its core, the forex market is driven by the fundamental principle of supply and demand, where each currency’s value fluctuates based on global economic factors, political events, and market sentiment.

The Role of Forex in International Trade

Forex trading is the backbone of international commerce. When businesses engage in cross-border transactions, they need to exchange their home currency for the currency of the country they are trading with. The forex market provides the platform for this seamless exchange, ensuring the smooth flow of goods and services across borders.

Currencies’ Dance: Major and Minor Pairs

The forex market comprises numerous currency pairs, each representing the exchange rate between two different currencies. The most traded currency pairs are known as “majors,” including EUR/USD, USD/JPY, and GBP/USD. These pairs are highly liquid and accessible, offering tight spreads and substantial volume. Minor currency pairs, on the other hand, involve less liquid currencies and typically exhibit wider spreads.

Image: www.xtb.com

Fundamental Drivers: Shaping Currency Values

A multitude of factors influence currency valuations in the forex market. Economic growth, interest rates, inflation, and political stability play pivotal roles. Positive economic indicators, such as robust GDP growth or low unemployment rates, tend to strengthen a currency, while negative events can lead to depreciation. Central bank policy decisions, including interest rate adjustments, can also have a significant impact on currency values.

Technical Analysis: Charting the Market’s Path

Technical analysis is a widely employed technique used to predict currency price movements. It involves studying historical price data and chart patterns to identify potential trading opportunities. Technical analysts use various indicators, such as moving averages, support and resistance levels, and candlestick patterns, to forecast future price movements.

Risk and Reward: Navigating the Forex Maze

Like any investment endeavor, forex trading involves inherent risks. Currency fluctuations can lead to both profits and losses, and it is crucial to understand these risks before venturing into the market. Proper risk management strategies, such as setting stop-loss orders and hedging, are essential to mitigate potential losses.

How Is Forex Market Today

Conclusion: The Forex Market’s Enduring Legacy

The forex market is a dynamic and ever-evolving arena that offers both opportunities and challenges for investors. Its significance extends far beyond currency trading, as it plays a vital role in international commerce, macroeconomic stability, and global economic growth. Staying abreast of market trends, understanding fundamental and technical factors, and implementing prudent risk management practices are key to unlocking the potential of the forex market. As the world’s financial landscape continues to evolve, the forex market will undoubtedly remain a pivotal force, shaping the flow of capital and connecting economies across the globe.