Have you ever dreamed of conquering the tumultuous waters of Forex trading and emerging victorious? If so, you’ve come to the right place. This comprehensive guide will unveil the secrets to mastering Forex trading and achieving consistent success. While it’s impossible to guarantee complete immunity from losses, understanding the strategies and techniques outlined here will significantly tilt the odds in your favor.

Image: www.youtube.com

Understanding Forex Trading

Forex trading, short for foreign exchange trading, involves exchanging currencies for profit. Currencies are traded in pairs, with the value of one currency determined relative to another. For instance, the EUR/USD pair indicates the value of the Euro relative to the US Dollar.

The beauty of Forex trading lies in its 24-hour global market, providing ample opportunities for profit. However, the vast sums of money involved and unpredictable market fluctuations make it a high-risk, high-reward endeavor.

Strategies for Success

-

Technical Analysis: Unveiling Market Trends

Technical analysis is the cornerstone of successful Forex trading. It involves studying historical price data to identify patterns and predict future market movements. By interpreting charts, candlestick patterns, and technical indicators, you can gain insights into potential entry and exit points for trades.

-

Image: howtotradeonforex.github.ioFundamental Analysis: Assessing Economic Factors

While technical analysis focuses on price movements, fundamental analysis delves into the underlying economic factors that influence currency values. Analyzing economic news, interest rate changes, inflation reports, and political events can provide valuable insights into future market trends.

-

Risk Management: The Art of Limiting Losses

Effective risk management is paramount in Forex trading. Determining your risk tolerance, using stop-loss orders, and diversifying your portfolio can help minimize potential losses. Remember, every trade carries inherent risk, and it’s wise to never risk more than you’re willing to lose.

-

Money Management: Allocating Capital Wisely

Sound money management practices are crucial for long-term success. Determine your trading capital, establish a specific amount you’re willing to allocate per trade, and stick to it. Avoid overleveraging, as it can amplify both profits and losses.

-

Psychology: Mastering the Emotional Game

Forex trading can be an emotional roller coaster. FOMO (fear of missing out) and greed can lead to reckless trading decisions. Developing emotional discipline and a clear trading plan can help you stay focused and avoid impulsive trades.

The Path to Mastery

-

Education: Arm Yourself with Knowledge

Continuous learning is the lifeblood of successful Forex traders. Explore books, articles, webinars, and courses to expand your knowledge base. Join online forums and engage with experienced traders to gain insights and perspectives.

-

Demo Trading: Practice Without the Risk

Practice makes perfect. Most Forex brokers offer demo accounts that allow you to trade with virtual money. Use these to test your strategies and hone your skills without risking real capital.

-

Backtesting: Evaluating Strategy Performance

Backtesting involves analyzing historical data to assess the performance of a trading strategy. By applying your strategy to past market conditions, you can refine it before implementing it with real money.

-

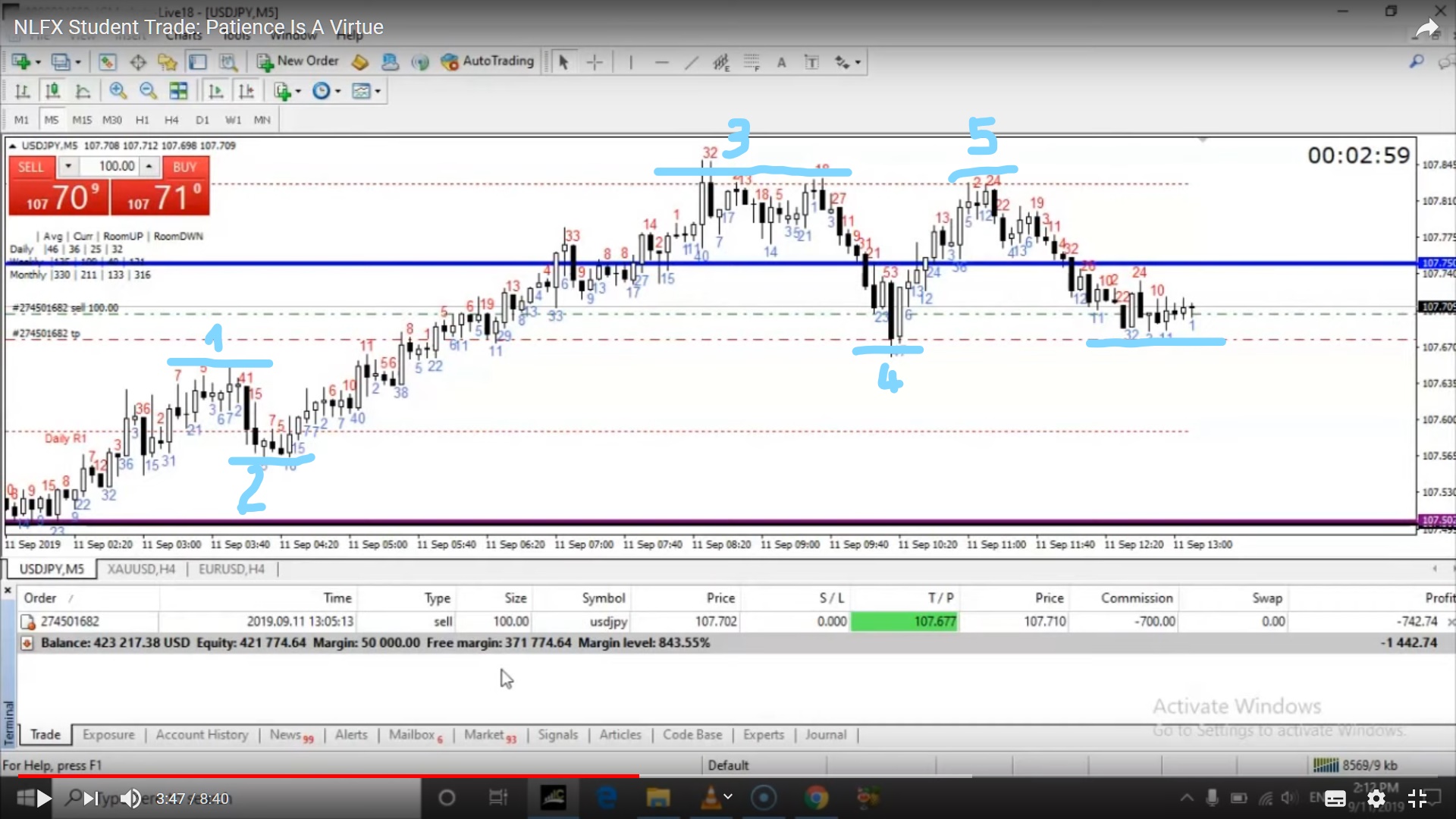

Patience: The Mark of a True Trader

Successful Forex trading requires patience. Don’t expect to become a millionaire overnight. Set realistic profit targets, and be willing to wait for the right trading opportunities.

-

Continuous Improvement: A Journey, Not a Destination

The Forex market is constantly evolving. Adapt your strategies, stay updated on market news, and continuously seek ways to improve your trading skills. Remember, success in Forex is an ongoing journey, not a fixed endpoint.

How To Never Lose In Forex

Conclusion

Conquering Forex trading is a challenging but achievable endeavor. By embracing the strategies outlined in this guide, practicing diligently, and maintaining a commitment to continuous learning, you can equip yourself with the knowledge and skills to navigate the markets and potentially achieve consistent success. Remember, while losses are an unavoidable part of Forex trading, by adopting these proven techniques, you can minimize their impact and maximize your potential for profit.