In the treacherous waters of forex trading, where every decision can sway your financial fate, the ability to read candlestick charts accurately is an indispensable skill. Like a seasoned mariner navigating turbulent seas, armed with the knowledge of candlestick patterns, you can decipher the whispers of the market and steer your trades towards profitable shores. Join me on this enlightening journey as we unravel the secrets of candlestick charts, empowering you to harness their power and emerge as a confident chart-reading virtuoso.

Image: elearningensup.gifafrique.com

Candlesticks: The Pillars of Technical Analysis

Candlesticks, the veritable building blocks of technical analysis, are a graphical representation of price movements over a specific time frame, reflecting the battleground between buyers and sellers. Imagine them as mini-narratives etched into the canvas of the financial world, each candle a poignant vignette of the market’s ebbs and flows. The intricate interplay of candlestick patterns reveals market trends, momentum shifts, and potential trading opportunities.

The Anatomy of a Candlestick

Before we embark on our chart-reading adventure, let’s dissect the anatomy of a candlestick. Each candlestick comprises of:

- Body: The central rectangular portion represents the price difference between the opening and closing prices.

- Wick: The vertical lines extending above and below the body depict the highest and lowest prices reached during the time period.

- Open: The top of the body signifies the opening price for that time frame.

- Close: The bottom of the body indicates the closing price for that time frame.

Types of Candlestick Patterns

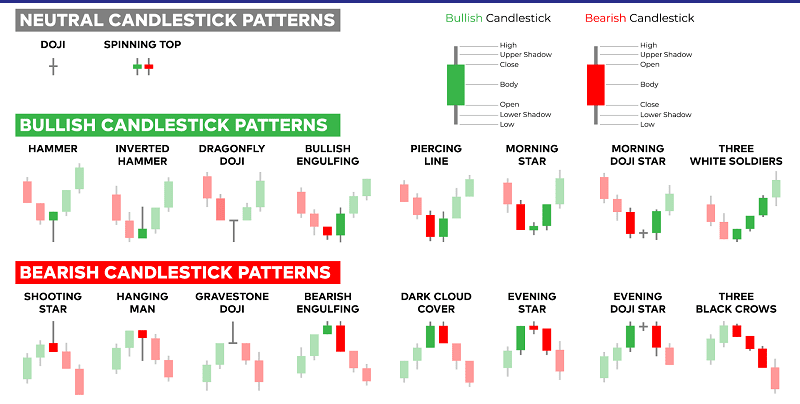

Candlesticks come in a myriad of shapes and sizes, each with its own story to tell. Some common patterns include:

- Bullish Patterns: These patterns signal a potential upward trend, such as the hammer, engulfing pattern, or morning star.

- Bearish Patterns: Indicating a potential downward trend, bearish patterns include the hanging man, evening star, or piercing line.

- Neutral Patterns: These patterns neither strongly favor bulls nor bears, but provide valuable signals of consolidation or reversal, such as the doji or three inside up/down.

Image: deepstash.com

Reading Candlestick Charts: A Step-by-Step Guide

- Identify the Trend: Examine the overall direction of the market by connecting the highs and lows of candlesticks. An upward trend indicates higher highs and higher lows, while a downward trend signifies lower highs and lower lows.

- Examine Individual Candlesticks: Study the body, wicks, and location of each candlestick in relation to the trend. Look for patterns that match the types described earlier, as they provide valuable clues about market behavior.

- Confirm with Volume: Volume data can corroborate candlestick patterns. High volume during bullish patterns strengthens the potential for an uptrend, while high volume during bearish patterns reinforces the likelihood of a downtrend.

- Set Your Trading Strategy: Based on your analysis of candlestick patterns and other market indicators, determine your entry and exit points for trades. Use stop-loss and take-profit orders to manage risk and lock in profits.

How To Read The Candlestick Chart In Forex Trading

Conclusion

Mastering the art of candlestick chart reading is a transformative skill that unlocks the power of technical analysis in forex trading. By deciphering these visual representations of price movements, you gain an invaluable tool to navigate market trends, predict price movements, and seize trading opportunities with greater precision. Armed with this newfound knowledge, you are empowered to conquer the waves of the forex market and forge your path to financial success.