Welcome to the fascinating world of forex trading! In this guide, we’ll embark on a journey to empower you with the knowledge and strategies you need to navigate the dynamic forex market using the powerful MetaTrader 5 (MT5) platform.

Image: www.youtube.com

MT5: The Swiss Army Knife for Forex Traders

MT5, the successor to the popular MetaTrader 4, is a cutting-edge platform that provides traders with an arsenal of advanced features and technical analysis tools. With customizable dashboards, multiple chart windows, and sophisticated order management capabilities, MT5 gives you an unparalleled advantage in making informed trading decisions.

Getting Started with MT5

To get started, download the MT5 platform from a reputable broker. Once installed, you’ll need to create a trading account and fund it with the necessary capital for your trading activities.

Understanding the Forex Market

The forex market is the largest and most liquid financial market in the world, where currencies are traded 24 hours a day, 5 days a week. Each currency pair represents the exchange rate between two different currencies. For example, EUR/USD represents the exchange rate between the Euro and US dollar.

Image: insightraders.com

Technical Analysis: Unraveling the Market’s Secrets

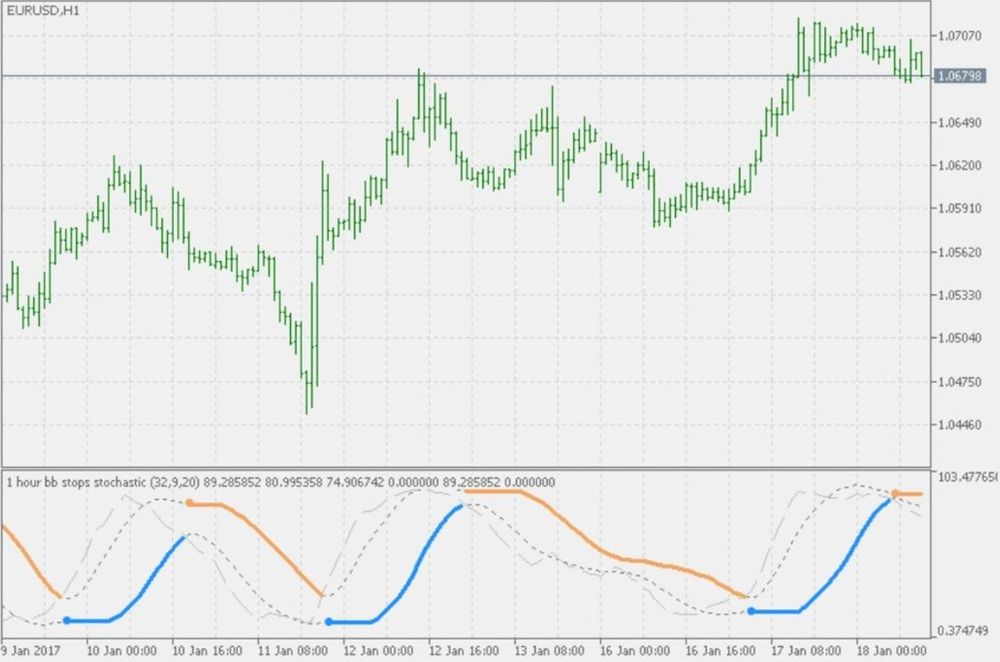

Technical analysis plays a crucial role in forex trading. It involves studying historical price data to identify patterns, trends, and support and resistance levels that can help you predict future price movements. MT5 offers a vast array of technical indicators, such as moving averages, Bollinger Bands, and Fibonacci retracements, to assist you in your analysis.

Trading Strategies for Success

There are numerous trading strategies that traders employ in the forex market. Some popular ones include:

- Trend following: Identifying the overall market direction and trading in line with it.

- Scalping: Making small, short-term trades throughout the trading day.

- Swing trading: Holding positions for a few days to weeks, capturing price fluctuations.

Risk Management: The Cornerstone of Success

Effective risk management is paramount in forex trading. It involves setting stop-loss orders to limit potential losses and using proper leverage to avoid overexposing your account to risk. MT5 allows you to set stop-loss and take-profit orders directly on the chart, ensuring you maintain control over your trades.

FAQ: Your Questions Answered

- Q: Is forex trading suitable for beginners?

A: While forex trading can be accessible for beginners, understanding market principles, technical analysis, and risk management is essential before venturing into live trading.

- Q: How much capital do I need to start trading?

A: The amount of capital required depends on the leverage you use and your risk tolerance. It’s generally recommended to start with a small trading account and gradually increase your capital as you gain experience and confidence.

- Q: What is the best trading strategy for me?

A: The best trading strategy varies depending on your trading style, risk tolerance, and market conditions. Experiment with different strategies and find the one that suits you best.

How To Trade Forex Using Mt5

Conclusion

Forex trading, aided by the powerful MT5 platform, presents both opportunities and risks. By mastering the art of technical analysis, implementing effective trading strategies, and prioritizing risk management, you can navigate the dynamic forex market with confidence and strive for success. Remember, a journey of a thousand trades begins with a single step. Are you ready to embrace the exciting world of forex trading?