Headline: Unlocking the Secrets of Bollinger Bands: A Trader’s Guide to Enhanced Forex Profits

Image: fevesa.es

Introduction:

In the ever-dynamic realm of forex trading, the ability to identify and capitalize on market trends is paramount. Enter Bollinger Bands, a versatile technical analysis tool that empowers traders with a profound understanding of market volatility and price movement. This comprehensive guide will delve into the intricacies of using Bollinger Bands in forex trading, providing actionable strategies and insights to maximize your potential returns.

Understanding Bollinger Bands:

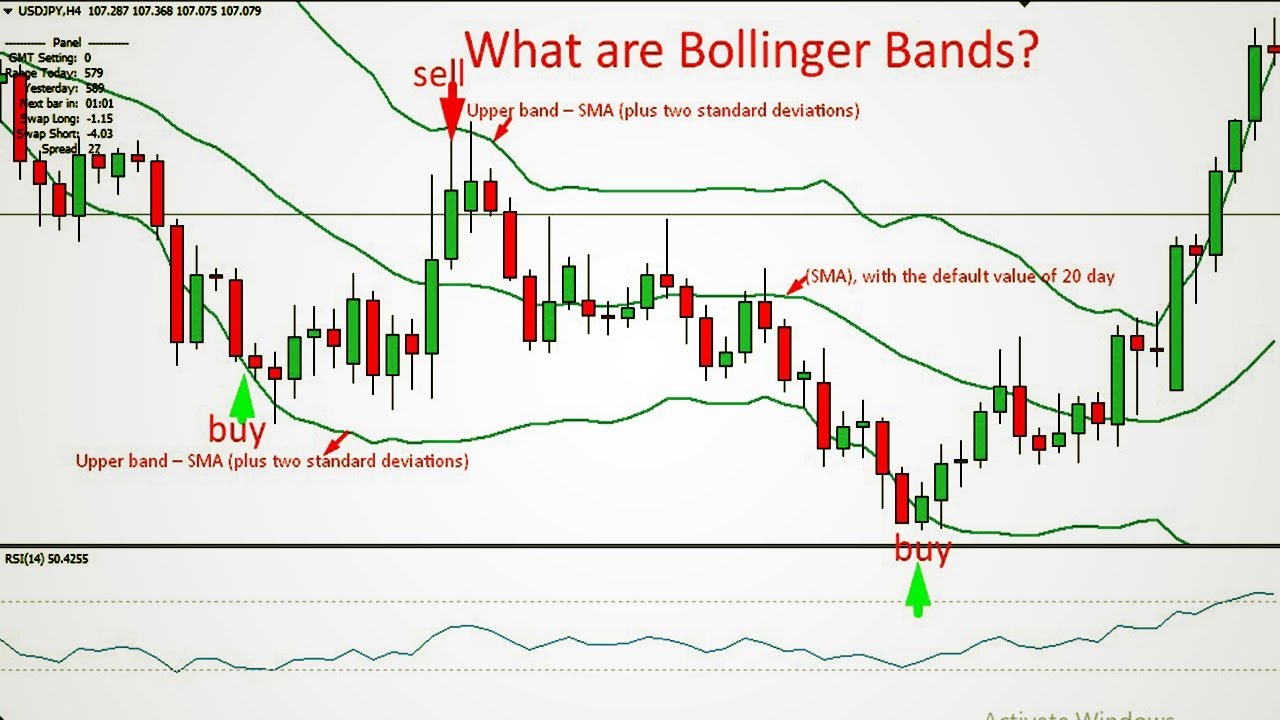

Conceived by John Bollinger in the mid-1980s, Bollinger Bands consist of three lines plotted around a price chart:

- Middle Band: A simple moving average (SMA) of closing prices over a predefined period, typically 20 days.

- Upper Band: Middle Band plus a predetermined number of standard deviations (typically 2).

- Lower Band: Middle Band minus the same number of standard deviations.

These bands create a graphical representation of market volatility, with the distance between the upper and lower bands indicating the degree of price fluctuation.

Trading Strategies Using Bollinger Bands:

Bollinger Bands empower traders with a plethora of trading strategies based on market conditions and price behavior:

1. Bollinger Band Breakout Strategy:

- Identify price breakouts beyond the upper or lower bands, indicating a potential trend reversal.

- Buy when price breaks above the upper band and short when it falls below the lower band.

2. Bollinger Band Squeeze Strategy:

- Watch for periods when the Bollinger Bands contract, narrowing the distance between the upper and lower bands.

- This “squeeze” typically precedes a breakout and increased volatility.

3. Bollinger Band Bounce Strategy:

- Observe price rebounds off the Bollinger Bands, especially when price touches the upper or lower band.

- These “bounces” often signal potential trend continuations.

4. Bollinger Band Envelopes Strategy:

- Create multiple Bollinger Bands with varying standard deviation values (e.g., 1, 2, and 3).

- If price breaks through an inner Bollinger Band and fails to break through the next outer band, it can indicate a potential change in trend.

Tips from the Experts:

- Combine Bollinger Bands with other indicators: Enhance accuracy by combining Bollinger Bands with support/resistance levels or moving averages.

- Consider timeframe and context: Bollinger Band settings may vary depending on the trading timeframe and market conditions.

- Manage risk diligently: Use stop-loss orders to limit potential losses and protect profits.

Conclusion:

Bollinger Bands are an invaluable tool for forex traders seeking to navigate market volatility and identify profitable trading opportunities. By understanding their intricacies and implementing effective strategies, traders can harness the power of Bollinger Bands to enhance their decision-making and maximize their returns. Remember, trading always carries risk, so it’s crucial to have a sound trading plan, thorough research, and proper risk management strategies in place.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-02-f76c639116734ccfb8493dce32ed149a.jpg)

Image: alexgroup.vn

How To Trade With Bollinger Bands Forex

https://youtube.com/watch?v=8z-RvfnnEao