The foreign exchange (forex) market has captivated the imaginations of aspiring investors, promising a world of financial freedom and exponential returns. Yet, beneath this alluring façade lies a complex reality that demands a thorough understanding and cautious approach. Embark on this comprehensive exploration as we delve into the intricate depths of forex trading, exposing its potential rewards and unraveling its inherent risks.

Image: forexrobotnation.com

Forex, in its essence, involves the trading of currencies, where traders speculate on the rise and fall of their values. This global marketplace operates 24 hours a day, 5 days a week, offering potential profits from currency fluctuations. However, it is crucial to acknowledge that forex trading is not a get-rich-quick scheme but rather a legitimate business venture that requires both skill and prudence.

Advantages of Forex Trading: Tapping into Global Markets

The allure of forex trading stems from several advantages that distinguish it from traditional investment options. Firstly, its global reach offers unprecedented liquidity, ensuring that buy and sell orders can be executed almost instantaneously. This high level of liquidity mitigates price volatility, reducing the risk of sudden market movements that can wipe out profits.

Moreover, forex trading grants traders the flexibility to set their own schedules, enabling them to trade at their convenience. This aspect aligns particularly well with individuals seeking to supplement their income or pursue trading as a part-time endeavor.

Delving into the Risks of Forex Trading: Navigating a Volatile Sea

While forex trading presents enticing opportunities, it also carries inherent risks that traders must be cognizant of. The primary risk in forex is undoubtedly market volatility. Currency values can fluctuate rapidly and unpredictably, potentially leading to substantial losses if proper risk management strategies are not employed.

In addition, the use of leverage, a common practice in forex trading, can amplify both profits and losses. While leverage can magnify potential gains, it also magnifies potential losses, potentially exceeding the initial investment. Thus, traders embarking on the forex journey should possess a solid understanding of risk management techniques, such as stop-loss orders and position sizing.

Another significant risk that traders face is the possibility of manipulation by large financial institutions and central banks. These entities possess significant influence over currency markets, and their actions can have profound effects on forex prices. Therefore, staying informed about geopolitical events, economic data releases, and central bank policies is imperative for successful forex trading.

Demystifying Forex Strategies: Navigating a Complex Marketplace

Navigating the complex forex landscape requires a strategic approach that aligns with individual risk tolerance and financial goals. A multitude of forex trading strategies exist, each offering a unique blend of risk and reward. Here are some prevalent strategies employed by seasoned traders:

Image: dailypriceaction.com

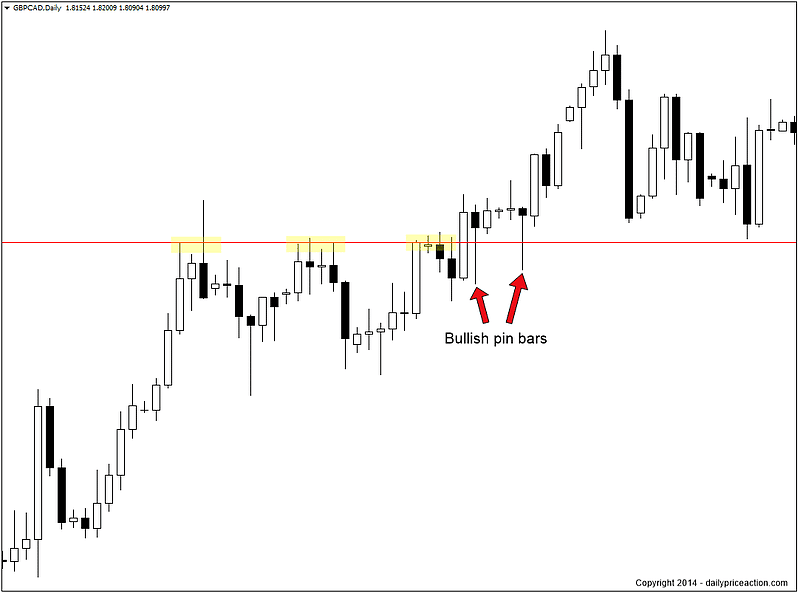

Technical Analysis: Deciphering Price Patterns

Technical analysis relies on historical price data and chart patterns to forecast future price movements. By identifying support and resistance levels, trendlines, and other technical indicators, traders aim to predict price direction and capitalize on market momentum.

Fundamental Analysis: Delving into Economic Indicators

Fundamental analysis focuses on understanding the economic factors that influence currency values, such as interest rates, inflation, gross domestic product (GDP), and political stability. By analyzing these macroeconomic fundamentals, traders seek to determine the intrinsic value of currencies and make informed trading decisions.

Scalping: Quick In, Quick Out

Scalping is a high-frequency trading strategy that involves taking multiple small profits from minor price fluctuations. This strategy suits traders with a nimble approach and the ability to monitor the markets closely.

Day Trading: Seizing Intraday Opportunities

Day trading involves taking positions and closing them within the same trading day. Day traders attempt to profit from short-term price movements and require a high level of market knowledge and technical skills.

Overcoming Common Pitfalls: The Keys to Forex Trading Success

To maximize their chances of success in forex trading, aspiring traders must steer clear of common pitfalls that often hinder profitability. Here are some key mistakes to avoid:

Insufficient Education: Jumping Headfirst into the Abyss

Forex trading, like any other financial endeavor, requires a solid educational foundation. Inexperienced traders who venture into the market without adequate knowledge often fall prey to costly errors.

Overleveraging: A Recipe for Disaster

Excessive use of leverage can lead to severe losses that far exceed the initial investment. Traders must carefully assess their risk tolerance and use leverage judiciously to avoid catastrophic outcomes.

Emotional Trading: Letting Emotions Cloud Judgment

Letting emotions dictate trading decisions can be detrimental in the highly volatile forex market. Traders must strive to maintain objectivity and adhere to their trading plan, even during adverse market conditions.

Chasing Losses: A Slippery Slope

Attempting to recoup losses by making larger or riskier trades is a common pitfall among forex traders. This approach often leads to further losses and should be avoided.

Is Forex A Good Way To Make Money

Conclusion: Weighing the Pros and Cons

Whether forex trading is a suitable path for financial growth depends on individual circumstances, risk tolerance, and commitment to learning. While the allure of high returns and flexible trading hours is undeniable, it is paramount to recognize the inherent risks associated with forex trading. Aspiring traders should embark on this journey with a well-informed understanding of the complexities involved and a prudent approach to risk management.