In the fast-paced world of Forex trading, where market movements fluctuate swiftly, analyzing price action across multiple time frames has become an indispensable strategy for successful traders. Multi-Time Frame Analysis (MTFA) provides a comprehensive perspective by blending insights from different time resolutions, empowering traders with a deeper understanding of market trends and enabling them to make more informed trading decisions.

Image: fxssi.com

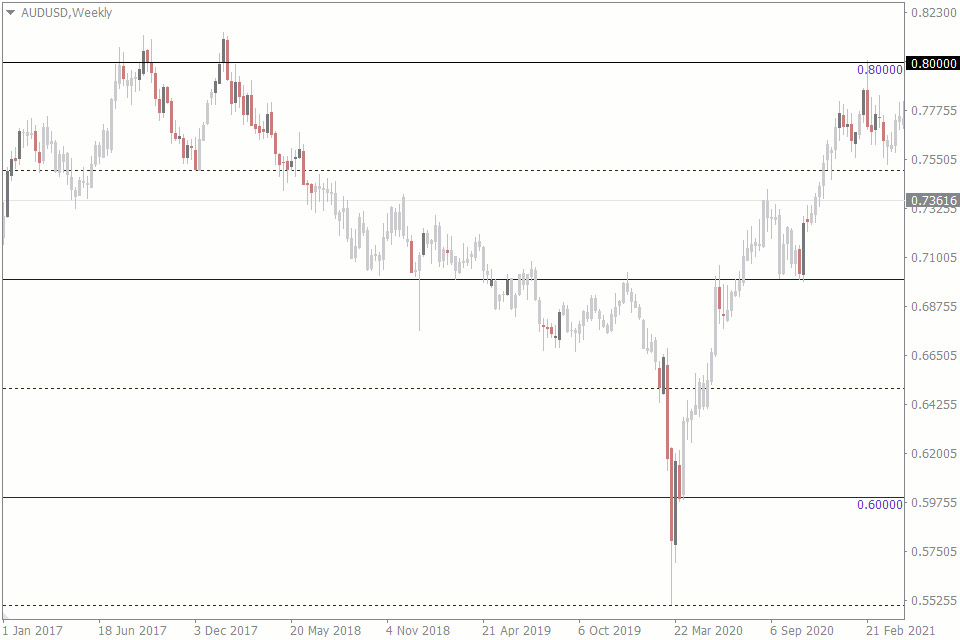

MTFA involves studying a financial asset’s price action across various time frames, ranging from short-term charts (such as 1-minute, 5-minute, or 15-minute charts) to long-term charts (such as daily, weekly, or monthly charts). By examining price patterns and trends on different time scales, traders can gain valuable insights into the interplay between short-term market dynamics and long-term market structure.

Mastering the Basics of Multi-Time Frame Analysis

The cornerstone of MTFA lies in identifying the dominant trend on the higher time frame. This provides the overall market direction, which serves as a filter for identifying potential trading opportunities on lower time frames. For instance, if the daily chart indicates a bullish trend, traders can focus on buying opportunities on smaller time frames within the context of that trend.

Once the primary trend is established, traders can drill down to shorter time frames to pinpoint entries and exits. Short-term price fluctuations can provide valuable information about potential reversals, continuation patterns, and areas of support and resistance. By synchronizing these observations with the prevailing higher time frame trend, traders can increase the probability of successful trades.

Unlocking the Hidden Advantages of Multi-Time Frame Analysis

The benefits of MTFA are multifaceted. It enhances trading accuracy by providing a more complete picture of market dynamics. By analyzing price action across multiple time frames, traders can better anticipate market movements and identify high-probability trading opportunities.

MTFA also promotes risk management by providing a holistic view of the market. Traders can assess the overall market environment and identify potential risks before making trades. It helps them understand the potential impact of short-term fluctuations on their overall trading strategy, enabling them to adjust their risk accordingly.

Furthermore, MTFA reduces emotional decision-making by anchoring trading decisions in a broader market context. By observing price action on multiple time frames, traders can gain a better perspective on the significance of individual price movements, mitigating the influence of emotional impulses and enhancing trading discipline.

Image: www.profitf.com

Multi Time Frame Analysis Forex

Conclusion

Multi-Time Frame Analysis is an invaluable tool for Forex traders seeking to unlock a deeper level of market understanding. By examining price action across multiple time frames, traders can gain insights into market trends, identify trading opportunities, and manage risk more effectively. It’s a powerful technique that empowers traders to make informed decisions, improve their trading accuracy, and navigate the volatile Forex market with greater confidence. Whether you’re a seasoned trader or just starting your journey in the financial markets, incorporating MTFA into your trading arsenal can significantly enhance your chances of success.