In the realm of financial trading, the allure of Forex (foreign exchange market) draws countless individuals seeking financial freedom. Amidst the hype and promises, a critical question lingers: what is the percentage of profitable Forex traders? Delving into the complexities of Forex, this comprehensive guide unravels the truth behind this enigmatic statistic and empowers traders with insights to navigate this dynamic market.

Image: learnpriceaction.com

Unveiling the Friction: Challenges of Forex Profitability

The elusive nature of profit in Forex stems from inherent market characteristics and psychological hurdles traders must overcome. Unpredictable market movements, macroeconomic factors, and the volatility of global events pose significant challenges. Compounding these extrinsic difficulties are the cognitive and emotional biases that often sabotage traders’ decision-making. Impatience, fear of loss, and greed can cloud judgment and lead to impulsive trades that erode capital.

Striving for Success: A Comprehensive Guide to Forex Proficiency

While the path to Forex profitability is arduous, it is far from insurmountable. With dedication, knowledge, and a well-rounded approach, traders can tilt the odds in their favor:

1. Master the Discipline of Risk Management

A cornerstone of successful trading, risk management involves setting clear entry and exit points, utilizing stop-loss orders, and calculating position size relative to account balance. Prudent risk management mitigates potential losses and preserves capital for sustained growth.

2. Harness the Power of Technical and Fundamental Analysis

Technical analysis studies price charts to identify patterns and trends, while fundamental analysis examines economic data and news events to gauge market sentiment. Combining these analytical techniques provides a holistic view of market dynamics, enabling traders to make informed decisions.

3. Control Emotional Biases

Emotional trading often leads to irrational decision-making. Cultivating self-discipline and sticking to a trading plan helps manage emotions and prevents impulsivity that can erode profits. Mindfulness and emotional awareness enhance traders’ ability to stay focused and execute trades with clarity.

4. Seek Continuous Education and Experience

Forex is an ever-evolving market, demanding continuous learning and adaptation. Reading industry publications, participating in webinars, and practicing in demo accounts provide valuable insights and hone trading skills. Additionally, mentorship from experienced traders can accelerate learning and bridge the knowledge gap.

FAQ: Addressing Common Forex Trading Concerns

Q: Can anyone become a successful Forex trader?

While Forex trading offers opportunities for financial success, it is not a guaranteed path for everyone. Success requires dedication, knowledge, and a realistic understanding of the risks involved.

Q: How much capital do I need to start Forex trading?

The minimum capital required depends on the trader’s risk tolerance and trading strategy. It is advisable to start with a small amount and gradually increase it as experience and profitability grow.

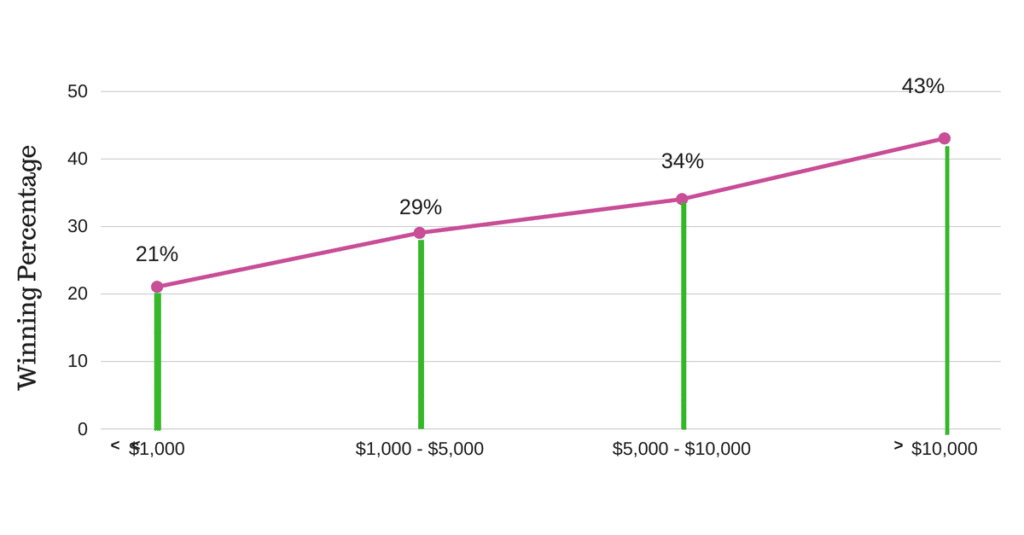

Image: www.quora.com

Percentage Of Profitable Forex Traders

Conclusion

The percentage of profitable Forex traders hovers around 5-10%, a reflection of the challenges inherent in this fast-paced market. However, with a disciplined approach, risk management, and continuous education, it is possible to navigate the complexities of Forex and reap its potential rewards. Embrace this article’s insights and strategies to enhance your trading journey and increase your chances of joining the ranks of successful Forex traders.

Are you ready to delve into the world of Forex trading and pursue financial success? Let this comprehensive guide be your beacon, guiding you towards a profitable future in the dynamic realm of currencies.