In the ever-evolving global economic landscape, foreign exchange (forex) rates play a pivotal role in facilitating trade and investments. As the central bank of India, the Reserve Bank of India (RBI) assumes the crucial responsibility of managing forex exchange rates to maintain economic stability and foster growth.

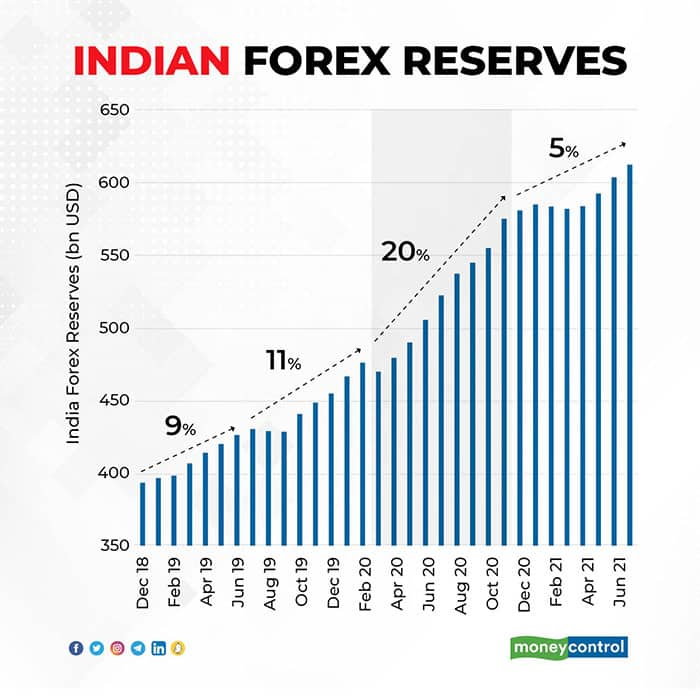

Image: www.moneycontrol.com

The RBI’s mandate in managing forex rates primarily revolves around three objectives: facilitating international trade, fostering capital flows, and maintaining the country’s external value. By closely monitoring global economic conditions, assessing domestic monetary policy objectives, and analyzing international capital flows, the RBI designs and implements policies to ensure the stability and competitiveness of the Indian rupee.

Decoding Forex Exchange Rates

Forex exchange rates essentially represent the value of one currency relative to another. These rates fluctuate constantly, influenced by a multitude of factors such as:

- Economic growth: Positive economic indicators, such as high GDP growth and low unemployment rates, tend to strengthen a currency.

- Interest rates: Countries with higher interest rates generally attract foreign investments, which can boost their currency value.

- Political stability: Political turbulence and uncertainty often lead to currency depreciation, as investors shy away from risk.

- Supply and demand: Changes in the demand for a particular currency, driven by international trade or tourism, can significantly impact its value.

RBI’s Role in Managing Forex Rates

The RBI employs various mechanisms to manage forex exchange rates, including:

- Intervention in the Forex Market: The RBI directly intervenes in the forex market by buying or selling foreign currencies to influence the supply and demand balance, thereby stabilizing the rupee.

- Open Market Operations: The RBI buys or sells treasury bills and government bonds in the open market to alter the liquidity of the economy, influencing interest rates and the value of the rupee.

- Foreign Currency Market Intervention: The RBI actively participates in the foreign currency market to manage the rupee’s value against major currencies like the US dollar and euro.

Benefits of Effective Forex Management

The RBI’s proficient management of forex exchange rates provides numerous benefits to the Indian economy:

- Propelled Trade and Investments: Stable and competitive forex rates enhance the ease of conducting international trade, bolstering exports and attracting foreign investments.

- Controlled Inflation: By managing forex exchange rates, the RBI can influence the inflow and outflow of capital, helping to stabilize inflation levels.

- Economic Stability: Effective forex management promotes overall economic stability by reducing exchange rate fluctuations and maintaining the external value of the rupee.

Image: www.zeebiz.com

Reserve Bank Of India Forex Exchange Rates

Future Outlook on Forex Exchange Rates

In the years to come, the global economic landscape is expected to present both challenges and opportunities for forex exchange rate management. Factors such as the continuing rise of emerging markets, shifting global trade patterns, and technological advancements will influence forex rates and the RBI’s approach to managing them.

Continued research and data analysis will be crucial for the RBI to adapt its forex management strategies to a dynamic and uncertain global environment. By staying abreast of economic trends and leveraging its policy tools effectively, the RBI will continue to play a significant role in ensuring the stability and competitiveness of the Indian rupee.