A Personal Journey into the World of Forex Hedging

As a seasoned currency trader, I have navigated the tumultuous waters of the forex market for years. Along the way, I’ve discovered the invaluable power of hedging strategies to mitigate risk and maximize profits. In this blog post, I’ll share my firsthand insights into the surefire forex hedging strategy that has transformed my trading experience.

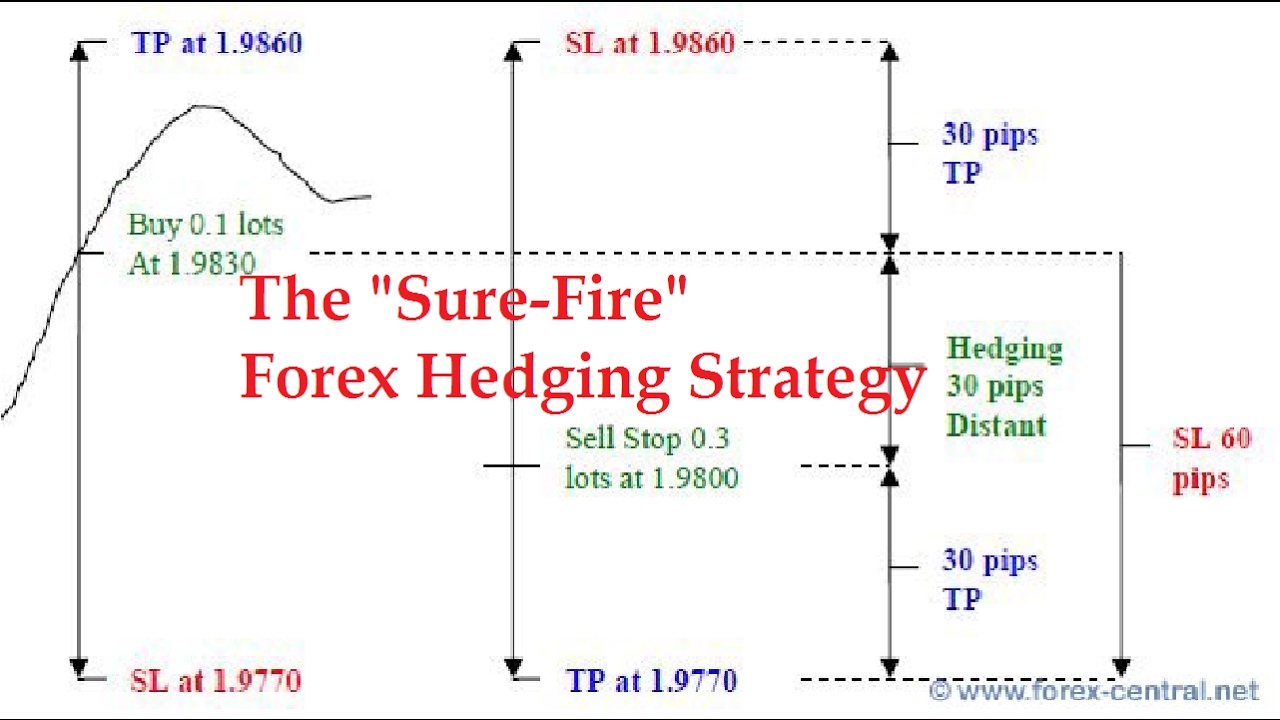

Image: forexcasinosystem1.blogspot.com

Understanding Forex Hedging: A Vital Tool for Risk Management

Forex hedging is a technique that allows traders to offset or reduce the risk associated with potential adverse market movements. By pairing a long position with a short position or vice versa, traders can effectively limit their losses and protect their portfolio value.

Key Benefits of Hedging

- Risk Mitigation: Hedging strategies serve as a safety net, minimizing the impact of unexpected market fluctuations.

- Portfolio Stabilization: By diversifying their currency exposure, traders can enhance portfolio stability and maintain a balanced investment approach.

- Profit Enhancement: Hedging positions can provide additional income streams, potentially boosting overall trading returns.

A Comprehensive Guide to the Surefire Hedging Strategy

The following steps outline my proven hedging strategy, designed to provide maximum protection while generating consistent profits:

- Identify Correlated Currency Pairs: Research currency pairs that exhibit a high correlation, meaning they tend to move in the same direction.

- Take Equal and Opposite Positions: Once correlated pairs are identified, open a long position in one currency and a short position in the other, with the same underlying asset size.

- Monitor Market Trends: Closely observe market conditions and adjust positions as needed to maintain the desired hedge ratio.

- Manage Risk-Reward: Determine the optimal balance between risk exposure and potential rewards based on market volatility and trading goals.

- Exit Strategy: Establish a clear exit strategy to close hedging positions at the appropriate time to realize profits or mitigate losses.

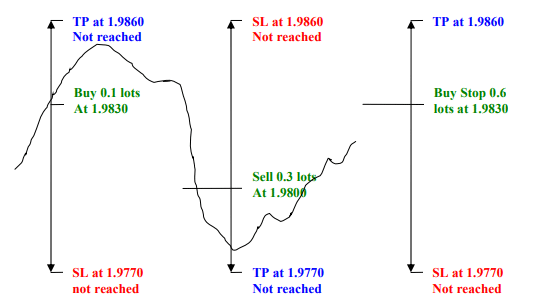

Image: forextraders.guide

Latest Trends and Developments in Forex Hedging

The realm of forex hedging continues to evolve. Here are some pertinent updates and observations:

- Artificial Intelligence (AI) Integration: AI-powered algorithms are gaining traction in hedge analysis, providing real-time data analysis and position optimization.

- Cross-Asset Hedging: Innovative strategies now incorporate correlations between various asset classes, such as stocks, bonds, and commodities, for risk management.

- Social Trading Platforms: These platforms connect traders with professional hedgers, enabling them to copy and follow expert trading strategies.

Expert Tips and Advice for Forex Hedging

Based on my experience, here are some essential tips and expert advice for effective forex hedging:

- Practice Hedging on a Demo Account: Hone your hedging skills in a risk-free environment before committing real funds.

- Use Historical Data for Analysis: Backtest hedging strategies using past market data to evaluate their performance under different market conditions.

- Stay Informed and Adapt: Continuously monitor the currency markets and adjust hedging positions as required.

- Consult with a Financial Advisor: Seek guidance from an experienced financial advisor to tailor hedging strategies to individual risk tolerance and financial goals.

Frequently Asked Questions about Forex Hedging

Q: When is it appropriate to use hedging strategies?

A: Hedging is most effective when markets exhibit volatility or uncertainty, particularly during periods of economic or political instability.

Q: Does hedging guarantee profit?

A: While hedging reduces risk, it does not guarantee profits. Traders must still engage in sound market analysis and consider market conditions before making trading decisions.

Q: What are the risks associated with hedging?

A: Hedging itself carries minimal risk, but the underlying currency positions can still suffer losses if the correlation between the pairs weakens or reverses.

The Sure Fire Forex Hedging Strategy

Conclusion: Embrace Forex Hedging for Enhanced Profits and Risk Management

Forex hedging strategies offer traders an indispensable tool for mitigating risk and enhancing trading outcomes. By following the surefire strategy outlined in this article, you can protect your capital, stabilize your portfolio, and unlock the full potential of the forex market.

Are you interested in mastering the art of forex hedging and unlocking the path to financial success? Share your thoughts and questions in the comments below.