Introduction

In the dynamic and often turbulent world of forex trading, savvy traders seek every edge to maximize their potential for profit. One invaluable tool that has emerged is forex trading signals. These signals provide traders with timely insights into market movements, allowing them to make informed decisions and capitalize on market opportunities. In this comprehensive guide, we will delve into the intricacies of forex trading signals, exploring their types, benefits, and how to use them effectively to enhance your trading strategies.

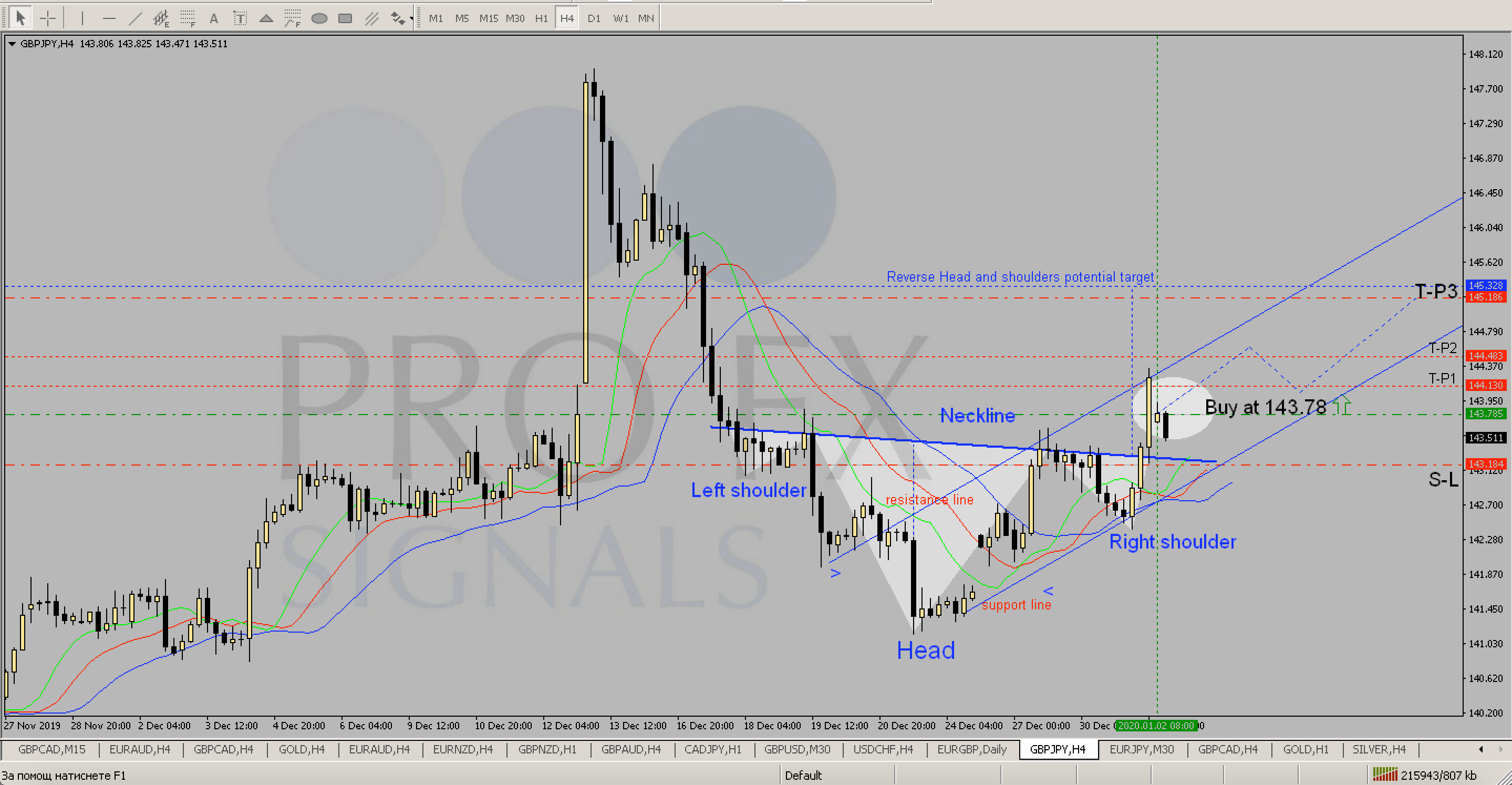

Image: www.pinterest.com

What are Forex Trading Signals?

Forex trading signals are recommendations generated by technical analysis or automated trading algorithms that suggest potential trading opportunities. Traders receive these signals via various platforms, such as websites, mobile apps, or email subscriptions, and utilize them to assess market trends and make informed trades. By leveraging these insights, traders aim to increase their chances of profitability and mitigate risks.

Types of Forex Trading Signals

There are multiple types of forex trading signals, each with its unique characteristics and approach to market analysis. Here are some common categories:

-

Technical Signals: These signals use technical analysis tools, such as moving averages, Bollinger Bands, and support and resistance levels, to identify potential price movements.

-

Fundamental Signals: These signals are derived from economic news, events, and geopolitical developments that influence currency valuations.

-

Sentiment Signals: These signals gauge market sentiment by analyzing social media sentiment, news feeds, and order flow data to determine the prevailing opinion on currency pairs.

-

Automated Signals: These signals are generated by automated trading algorithms that apply quantitative analysis and machine learning techniques to identify profitable trading opportunities.

Benefits of Forex Trading Signals

Incorporating forex trading signals into your trading strategies offers several notable benefits:

-

Time Efficiency: Analyzing market data and identifying trading opportunities can be time-consuming. Signals streamline this process, providing concise and timely recommendations.

-

Increased Accuracy: Signals rely on sophisticated algorithms or experienced traders to analyze market data, minimizing human error and biases.

-

Improved Profit Potential: By leveraging expert insights and following trading recommendations, traders can increase their chances of successful trades and maximize their profits.

-

Risk Mitigation: Signals can identify potential reversal points or overbought/oversold conditions, alerting traders to exit positions before significant losses occur.

Image: fxprofitsignals.com

How to Use Forex Trading Signals Effectively

To derive optimal value from forex trading signals, it is essential to use them prudently:

-

Assess Signal Validity: Evaluate the provider’s reputation, track record, and the methodology used to generate signals.

-

Diversify Signal Sources: Rely on multiple signal providers to mitigate the risks associated with relying solely on a single source.

-

Backtest Signals: Test the reliability of signals with historical data to determine their accuracy and profitability in different market conditions.

-

Manage Risk: Signals should complement your existing trading strategies and risk appetite. Always define position sizes, stop-loss levels, and take-profit targets prudently.

-

Use Signals as a Guide: Consider signals as valuable insights that should be combined with your own analysis and market understanding.

What Are Forex Trading Signals

Conclusion: Unlocking Market Insights

Forex trading signals have become indispensable tools for traders seeking to navigate the complexities of the forex market. By providing timely and actionable recommendations, signals empower traders to make more informed decisions and capitalize on market opportunities. However, it is crucial to approach signals critically, evaluate their validity, and integrate them seamlessly into your trading strategies for optimal results. With a judicious approach, forex trading signals can become an invaluable ally in the pursuit of profitable trades and financial success.