The Nasdaq, a global technology hub, offers a wealth of opportunities for traders in South Africa. However, timing is everything in the financial markets. In this comprehensive guide, we’ll delve into the optimal trading times for the Nasdaq in South Africa, empowering you to maximize your potential profits.

Image: www.straitstimes.com

When the Nasdaq Sings in South African Time

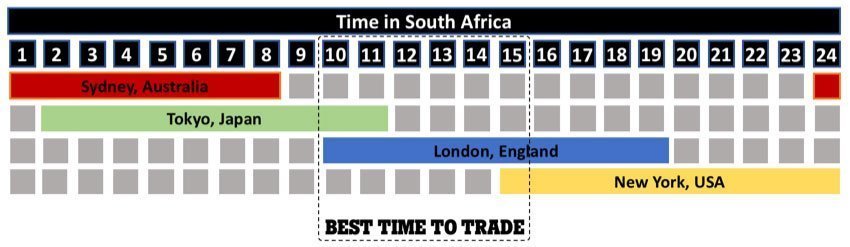

The Nasdaq’s operating hours for South Africa align with the local time zone. From Monday to Friday, the market opens at 2:30 AM and closes at 9:00 PM. However, these timings only represent the official trading hours. To pinpoint the best trading times, we’ll analyze the market’s behavior and expert insights.

Dawn’s Embrace: The Morning Surge

The Nasdaq typically experiences a surge in activity upon opening, as traders in Asia and Europe join the fray. From 2:30 AM to 6:30 AM, market movements tend to be amplified, providing opportunities for scalpers and day traders. News announcements and economic releases during this window can trigger significant volatility.

Midday Lull: A Moment of Respite

Between 6:30 AM and 4:00 PM, the Nasdaq generally enters a period of relative calm. Market activity slows down, and price fluctuations diminish. This lull presents a potential respite for traders looking to close positions or evaluate market trends.

Image: 24forex.co.za

Evening Surge: The American Awakening

As the afternoon transitions into evening in South Africa, the Nasdaq marketplace roars back to life. From 4:00 PM to 9:00 PM, trading volume surges anew as traders in the Americas become active. This period often coincides with the release of important economic data and corporate earnings reports, offering opportunities for swing traders and long-term investors.

Trading Strategies for the Nasdaq in South Africa

Armed with knowledge of the optimal trading times, let’s explore effective strategies:

1. Scalping for Intraday Profits

Scalping involves exploiting small price fluctuations during the morning surge. Traders enter and exit positions within minutes, aiming for quick profits. This strategy requires a keen eye for market movements and a rapid execution capability.

2. Day Trading for Short-Term Gains

Day traders hold positions for a few hours or the entire trading day. During the midday lull, they may identify potential trading opportunities by analyzing price patterns and market sentiment. They aim to profit from short-term price movements.

3. Swing Trading for Medium-Term Profits

Swing traders focus on capturing larger price fluctuations over several days or weeks. They typically enter the market during the evening surge and hold positions overnight. Swing traders rely on technical analysis and market fundamentals to identify trading opportunities.

4. Long-Term Investing for Capital Growth

Long-term investors hold Nasdaq stocks or ETFs for extended periods, aiming to profit from capital growth and dividends. They focus on fundamental analysis and favor blue-chip technology companies with strong financial performance.

Best Time To Trade Nasdaq In South Africa

Conclusion

Harnessing the optimal trading times for the Nasdaq in South Africa empowers traders to maximize their profitability. By understanding the market’s rhythms and employing appropriate trading strategies, investors can unlock the full potential of this dynamic marketplace. Remember, knowledge is power, and timing is key. As you delve deeper into the intricacies of the Nasdaq, you’ll continue to refine your understanding and grow as a successful trader.

So, embrace these insights, time your trades wisely, and conquer the Nasdaq from the heart of South Africa. Let the markets sing their symphony of wealth, and seize the opportunities that await.