Introduction

In the ever-evolving landscape of financial markets, foreign exchange (forex) trading has emerged as a lucrative arena for both seasoned investors and aspiring enthusiasts. With the potential to generate substantial profits, it’s no wonder that many are eager to dive into the world of currency trading. However, navigating this complex and dynamic market requires a keen understanding of the factors that influence currency values and the ability to identify the right forex to buy at the right time.

In this comprehensive guide, we’ll delve into the intricacies of forex trading, exploring the key factors that shape currency movements and providing expert insights to help you make informed decisions. We’ll equip you with the knowledge and strategies needed to identify the most promising forex opportunities and maximize your trading potential. Whether you’re a novice or an experienced trader, this article will empower you to unlock the secrets of profitable forex trading.

Image: howtotradeonforex.github.io

Understanding Forex Markets

At its core, forex trading involves the exchange of one currency for another. Unlike stocks or bonds, which are traded on centralized exchanges, forex is traded over-the-counter (OTC), making it the largest and most liquid financial market globally. With a daily trading volume exceeding $5 trillion, the forex market offers traders unparalleled opportunities to profit from currency fluctuations.

Currency values are influenced by a multitude of factors, including economic data, political events, central bank policies, and market sentiment. By understanding the forces that drive currency movements, traders can better position themselves to capitalize on market trends and minimize potential losses.

Identifying Promising Forex Pairs

The first step in successful forex trading is identifying currency pairs that have the potential to yield profitable returns. This involves analyzing economic indicators, news events, and technical charts to determine which currency is likely to appreciate or depreciate against another.

One of the most fundamental indicators used in forex trading is gross domestic product (GDP) growth. A country with a strong and growing economy tends to see its currency rise in value, as investors seek out currencies backed by solid economic fundamentals.

Political stability is another important factor to consider. Currencies from countries experiencing political turmoil or uncertainty often depreciate in value, as investors seek safer havens for their capital.

Central bank monetary policy can also have a significant impact on currency values. When a central bank raises interest rates, it makes its currency more attractive to investors, causing it to appreciate in value. Conversely, when a central bank lowers interest rates, its currency tends to depreciate.

Technical Analysis for Profitable Trading

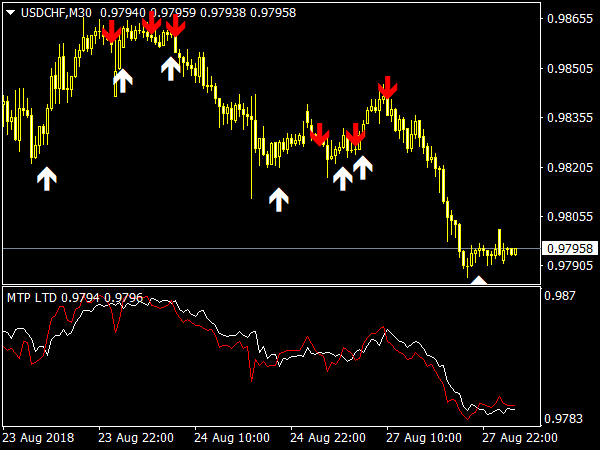

In addition to fundamental analysis, technical analysis is a widely used tool for identifying trading opportunities in the forex market. Technical analysts use historical price charts to identify patterns and trends that can help predict future price movements.

One of the most basic technical indicators is the moving average. A moving average is simply the average price of a currency over a specified period of time. Traders often use moving averages to identify support and resistance levels, which are key price points that can indicate potential trend reversals.

Another popular technical indicator is the Relative Strength Index (RSI). The RSI measures the strength of a currency’s trend by comparing the magnitude of recent gains and losses. Traders use the RSI to identify overbought and oversold conditions, which can signal potential trend reversals.

Image: www.best-metatrader-indicators.com

Expert Insights for Success

To further enhance your forex trading skills, it’s essential to seek guidance from experienced professionals. Renowned economists, financial analysts, and successful traders offer valuable insights that can help you navigate the complexities of the market and make informed decisions.

One of the most important lessons experienced traders emphasize is the importance of risk management. Managing risk effectively is crucial for long-term profitability, as it helps preserve capital and prevent catastrophic losses. Setting stop-loss orders, using appropriate leverage, and diversifying your portfolio are all essential risk management strategies.

Another key insight from experts is the significance of patience and discipline in forex trading. Unlike other markets, forex trading doesn’t offer quick or easy profits. Success requires patience, discipline, and the ability to stick to your trading plan even during volatile market conditions.

What Forex To Buy Now

Conclusion

In the dynamic world of forex trading, success hinges on your ability to identify the right forex to buy at the right time. By understanding the factors that influence currency movements, utilizing technical analysis, and seeking expert guidance, you can significantly increase your chances of profitability. Remember, forex trading involves risk, and it’s essential to manage risk effectively and trade within your limits. With the knowledge and strategies outlined in this article, you’re well-equipped to embark on a successful forex trading journey.