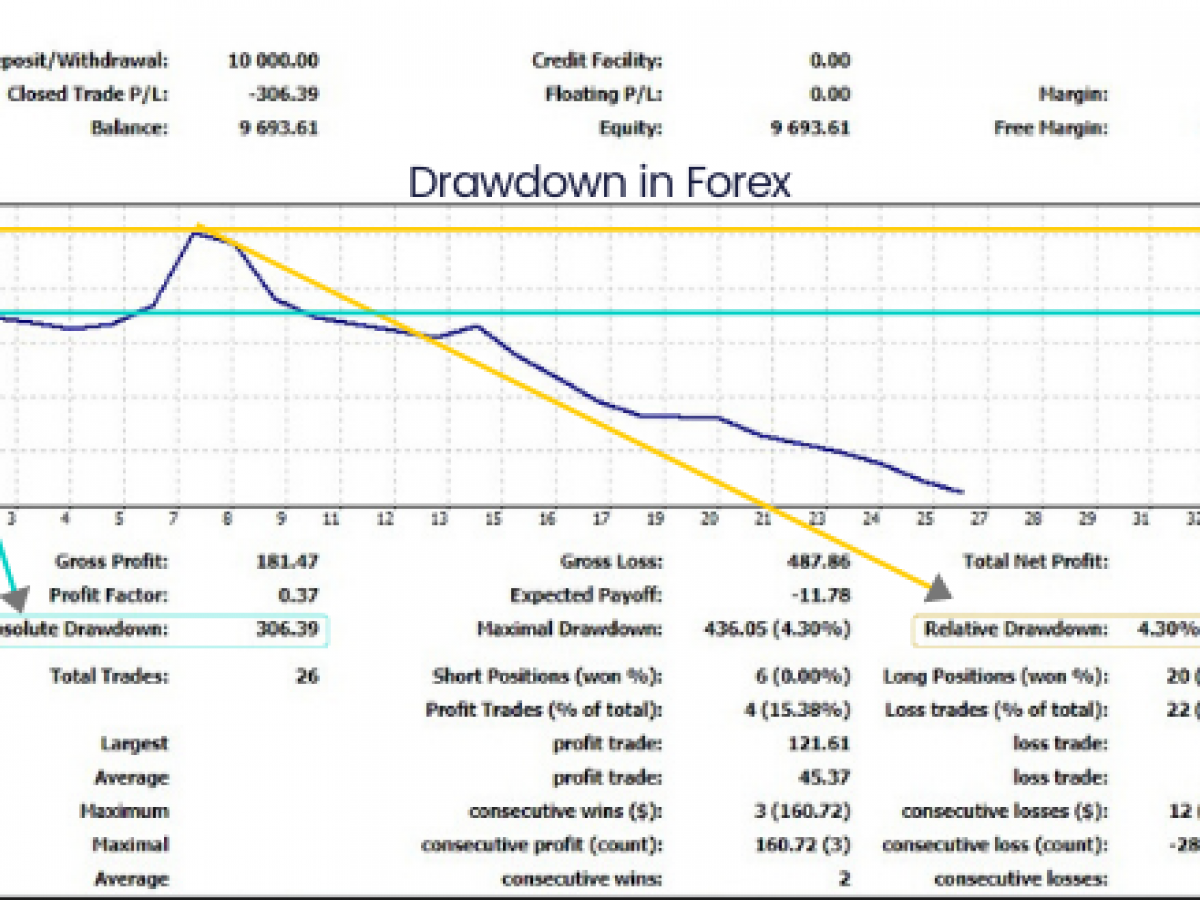

In the realm of forex trading, understanding and managing drawdown is crucial for long-term success. Drawdown refers to the temporary loss of value in your trading account, compared to its highest point. Every trader, regardless of their experience, encounters drawdowns as an inherent part of the trading journey. By recognizing the nature of drawdown and implementing effective management strategies, you can mitigate its impact and secure sustainable profitability.

Image: thisisforextrading.blogspot.com

Defining Drawdown: A Closer Look

Drawdown is essentially a decline in account equity from its peak level. It can occur due to unfavorable market conditions, poor trading decisions, or a combination of factors. Drawdown is expressed as a percentage, representing the loss of value from the highest point to the lowest point. For instance, a drawdown of 10% indicates that your account has dropped by 10% from its peak.

While drawdowns can be unsettling, it’s important to remember that they are an inevitable part of trading. The key is to manage them effectively to preserve capital and ensure long-term profitability. Drawdown management involves a combination of risk mitigation strategies, disciplined trading practices, and emotional control.

Strategies for Effective Drawdown Management

1. Define Your Risk Tolerance: Determine how much drawdown you are comfortable with and set clear risk parameters. This will help you establish appropriate position sizes and avoid taking on excessive risk.

2. Use Stop-Loss Orders: Stop-loss orders are essential for limiting potential losses. Place stop-loss orders at a predetermined level below your entry point to automatically close losing trades and prevent excessive drawdowns.

3. Diversify Your Portfolio: Diversification involves trading multiple currency pairs or assets. By spreading your risk across different markets, you reduce the impact of losses in any single pair or asset, mitigating overall drawdown.

4. Maintain Discipline: Follow your trading plan diligently and avoid emotional trading. Stick to your risk parameters and don’t let fear or greed influence your decisions.

5. Learn from Your Mistakes: Every drawdown is an opportunity to learn and improve. Analyze your trades, identify the reasons behind the losses, and adjust your trading strategy accordingly.

Emotional Impact of Drawdowns

Drawdowns can take an emotional toll on traders. It’s important to be aware of the psychological effects and develop coping mechanisms. Here are some tips:

- Accept Drawdowns: Recognize that drawdowns are an inherent part of trading. Don’t let them shatter your confidence or lead to impulsive decisions.

- Stay Positive: Maintain a positive outlook and focus on the long-term goals. Remember that even the most successful traders experience drawdowns.

- Take Breaks: Step away from the markets during periods of high stress or drawdown to clear your mind and regain perspective.

By managing drawdowns effectively and controlling your emotions, you can navigate the ups and downs of forex trading with greater confidence and resilience. Remember, the goal is not to avoid drawdowns altogether but to minimize their impact and emerge stronger from each experience.

Image: forexleaderboard.com

What Is Drawdown In Forex Trading

https://youtube.com/watch?v=pa3gkwT8lEQ

Conclusion

Drawdown is a fundamental aspect of forex trading, and understanding its nature and implementing effective management strategies is paramount for success. By defining your risk tolerance, using stop-loss orders, diversifying your portfolio, maintaining discipline, learning from mistakes, and managing emotions, you can mitigate the impact of drawdowns and achieve sustainable profitability. Remember, every trader experiences drawdowns; it’s how you respond to them that truly matters. Embrace the challenges, learn from your setbacks, and let them fuel your journey towards trading mastery.