In the ever-evolving world of forex trading, understanding the intricacies of various order types is paramount for success. Among these, the sell stop order stands as a powerful tool, allowing traders to set precise parameters for exiting positions and capturing potential profits. This comprehensive guide will delve into the essence of sell stops, empowering you with the knowledge and strategies to harness their full potential in your forex trading endeavors.

Image: antaraungu.vercel.app

Understanding Sell Stop Orders: A Definition

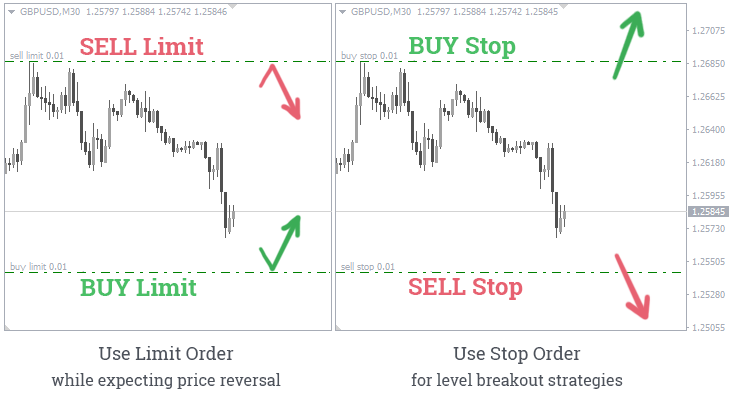

A sell stop order is an order placed below the current market price, triggering a sell trade only if the price falls to or below a predefined level. It serves as an advanced risk management tool, enabling traders to protect their profits or limit losses when market conditions turn unfavorable. Unlike a market order that executes immediately, a sell stop order remains pending until the specified price is reached or surpassed.

Key Concepts and Applications of Sell Stop Orders

-

Profit Protection: Sell stop orders are pivotal in protecting unrealized profits. By setting a sell stop order below your entry price, you can lock in gains if the market reverses direction, preventing further losses.

-

Risk Management: Sell stop orders help limit potential losses by setting a predetermined exit point. If the market moves against your position, the sell stop order triggers an automatic sell, minimizing financial repercussions.

-

Trading Automation: Sell stop orders automate your trading strategy, allowing you to execute trades even when you’re away from the market. It removes the need for constant monitoring, freeing up your time and reducing emotional trading decisions.

-

Stop Loss Optimization: Sell stop orders can complement stop-loss orders by providing greater flexibility. They allow you to set a stop-loss price below the market, ensuring your position is closed even if the price gaps down significantly.

Strategic Implementation of Sell Stop Orders

-

Price Level Selection: Determining the appropriate price level for your sell stop order is crucial. Consider technical analysis, support levels, or previous market movements to identify potential price declines.

-

Risk Tolerance: Tailor your sell stop orders to align with your risk tolerance and trading strategy. A tighter stop loss will limit your losses but may also lead to premature exits, while a wider stop loss will provide more room for price fluctuations but expose you to greater potential losses.

-

Market Volatility: Assess market volatility before placing a sell stop order. In highly volatile markets, wider stop-loss levels are recommended to avoid getting stopped out prematurely.

Image: forexretro.blogspot.com

Expert Insights and Actionable Tips

-

Use Trailing Stop Orders: Consider trailing stop orders to lock in profits as the market moves favorably. A trailing stop order automatically adjusts its price based on the prevailing market trend, allowing you to capture additional gains.

-

Leverage Risk Reward Ratios: Employ sell stop orders to maintain favorable risk-reward ratios. Strive for a ratio where your potential profit exceeds your potential loss, ensuring a positive expected return.

-

Backtest Your Strategy: Test your sell stop order strategies thoroughly using historical data or a demo account. This will help you optimize your parameters and avoid costly mistakes in live trading.

What Is Sell Stop In Forex

Embracing the Power of Sell Stop Orders

Understanding and effectively utilizing sell stop orders can elevate your forex trading skills to new heights. By incorporating these strategies into your trading arsenal, you gain the ability to protect your profits, limit your losses, and automate your trading with greater precision. Remember, knowledge is power, and the mastery of sell stop orders is a key ingredient in unlocking your full potential as a successful forex trader.