Volume in forex trading represents the number of currency units traded over a specified period, typically measured in lots. It reflects the level of activity in the market and is a crucial indicator of market sentiment and liquidity.

Image: www.axiory.com

Understanding volume is essential for traders, as it provides insights into market trends and potential trading opportunities. High volume often indicates increased market volatility and potential price movements. Conversely, low volume can signal a period of consolidation or indecision.

Volume and Market Sentiment

Volume plays a significant role in determining market sentiment. When volume is high, it suggests strong interest and conviction among market participants, which can amplify price movements. Conversely, low volume indicates a lack of conviction and can lead to sideways or range-bound markets.

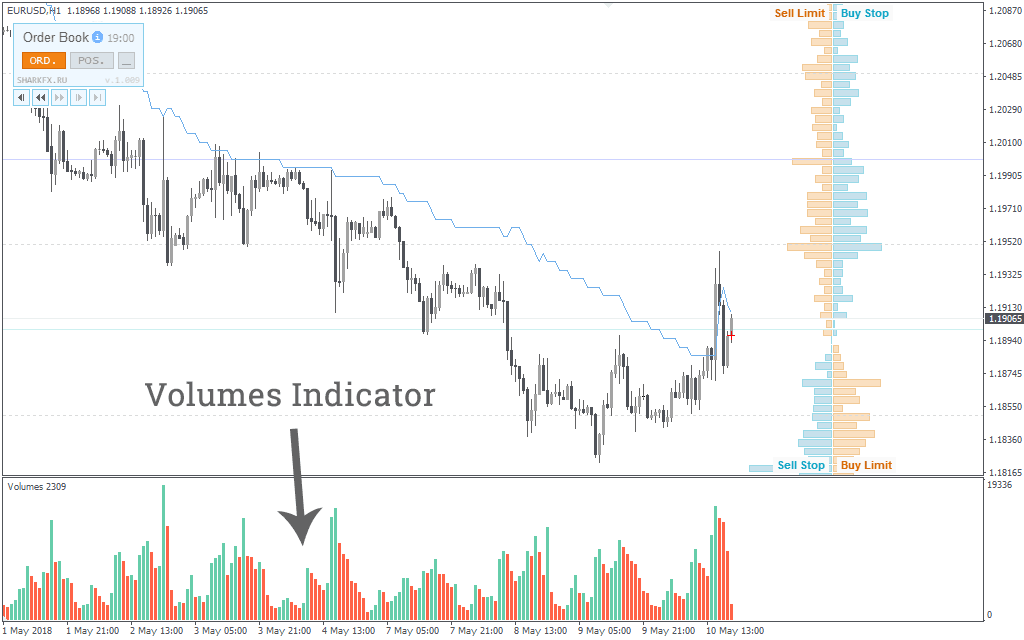

Traders analyze volume in conjunction with price action to identify potential trading opportunities. For instance, a price breakout accompanied by high volume could indicate a strong trend in progress, while a breakout with low volume may be less reliable.

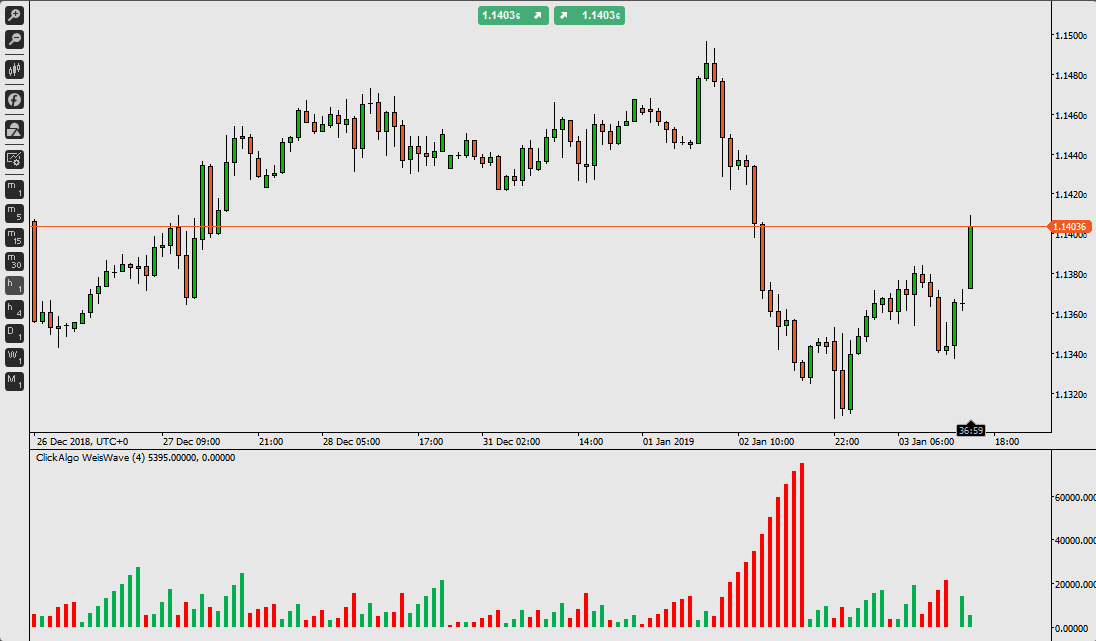

Trading on Volume Indicators

Traders often use technical indicators that measure volume to make informed trading decisions. Common volume indicators include the volume-weighted average price (VWAP), the on-balance volume (OBV), and the Chaikin money flow (CMF).

VWAP is a moving average that takes into account both price and volume, providing a more accurate reflection of market sentiment. OBV measures the cumulative volume over time and can indicate potential trend reversals or continuations. CMF is a momentum indicator that compares volume inflows and outflows, providing insights into market strength or weakness.

Expert Advice on Volume Trading

Experienced traders recommend several strategies for utilizing volume in trading:

- Trade with the trend: High volume often accompanies strong price trends. Traders can identify the trend using technical analysis and then buy or sell in the direction of the trend.

- Identify support and resistance levels: Volume can help traders identify areas where the market is likely to bounce or reverse. High volume at a support level indicates strong buying interest, while high volume at a resistance level suggests strong selling pressure.

- Confirm breakouts: Breakouts from trading ranges or support/resistance levels are more likely to be successful when accompanied by high volume.

Image: howtotradeonforex.github.io

FAQs on Volume in Forex Trading

- Q: What is the relationship between volume and volatility?

A: High volume typically indicates increased volatility, as it suggests a high level of activity and uncertainty in the market.

- Q: Can volume be used to predict future price movements?

A: While volume can provide insights into market sentiment, it cannot accurately predict future price movements on its own. Traders should consider volume in conjunction with other technical and economic indicators.

What Is Volume In Forex Trading

Conclusion

Volume is a critical aspect of forex trading that provides valuable insights into market sentiment, liquidity, and trading opportunities. By understanding and analyzing volume, traders can make more informed decisions and improve their trading performance. The strategies and tips discussed in this article can help traders effectively utilize volume in their trading strategies.

Are you interested in learning more about the role of volume in forex trading? Share your thoughts and questions in the comments below.