I recall the day I first discovered the 5 candle strong move forex strategy, I was amazed by its simplicity and effectiveness. This strategy is a powerful tool that can help even novice traders achieve consistent profits in the forex market. In this article, we will delve into the intricacies of the 5 candle strong move strategy, exploring its history, application, and latest trends. Let’s embark on a journey to unlock the secrets of this winning formula.

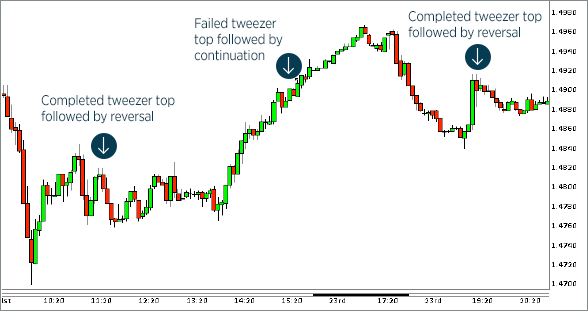

Image: forex-strategies-revealed.com

Defining the 5 Candle Strong Move Strategy

The 5 candle strong move strategy is a technical analysis approach that identifies potential trading opportunities based on the behavior of price action over a 5-candle period. The strategy assumes that a strong trend is likely to continue in the direction of the last 5 candles. Traders using this strategy typically look for candles that exhibit strong momentum, such as long green candles or short red candles, to identify potential trading opportunities.

Identifying Strong Trends with 5 Candles

The key to the 5 candle strong move strategy lies in identifying strong trends. Traders look for candles that have long bodies and small wicks, indicating strong buying or selling pressure. Additionally, they consider the location of the candles within the trend, as well as the overall market context. By combining these factors, traders can determine the strength and direction of the trend and make informed trading decisions.

Historical Origins of the Strategy

The origins of the 5 candle strong move strategy can be traced back to the early days of technical analysis. Traders have long recognized the significance of price patterns, and the 5 candle strong move strategy is a testament to the enduring power of technical analysis in the forex market.

Image: www.forex.com

Applying the 5 Candle Strong Move Strategy in Forex Trading

To apply the 5 candle strong move strategy in forex trading, follow these steps:

- Identify a strong trend in the desired currency pair.

- Look for a series of 5 candles that exhibit strong momentum in the direction of the trend.

- Enter a trade in the direction of the trend, using a stop loss order below the low of the last candle and a take profit order at a predetermined target.

Latest Trends and Developments

The 5 candle strong move strategy remains a popular choice among forex traders due to its simplicity and effectiveness. However, traders should be aware of the latest trends and developments in forex trading. One notable trend is the increasing use of automated trading systems that incorporate the 5 candle strong move strategy. Additionally, traders are exploring new variations of the strategy, such as the 3 candle strong move strategy.

Tips and Expert Advice

Here are some tips and expert advice for using the 5 candle strong move strategy:

- Use the strategy in conjunction with other technical analysis tools, such as support and resistance levels and moving averages.

- Manage your risk carefully by using stop loss orders and position sizing.

- Backtest the strategy on historical data to optimize its parameters.

By following these tips, you can increase your chances of success when using the 5 candle strong move strategy. Remember, the forex market is ever-changing, so it’s crucial to stay updated on the latest trends and developments.

FAQs

Q: What are the key advantages of the 5 candle strong move strategy?

A: The key advantages include simplicity, effectiveness, and adaptability to various market conditions.

Q: Can the strategy be used for all currency pairs?

A: Yes, the strategy can be applied to any currency pair, but it is particularly effective for major currency pairs.

5 Candle Strong Move Forex Strategy

Conclusion

The 5 candle strong move forex strategy is a powerful tool that can help traders of all levels achieve consistent profits in the forex market. By understanding the principles of the strategy, applying it effectively, and staying updated on the latest trends, you can unlock the potential of this winning formula and take your trading to the next level.

Are you ready to embark on a journey of profitability? The 5 candle strong move forex strategy is waiting for you. Embrace its simplicity, harness its effectiveness, and watch as your trading transforms with this time-tested technique.