Introduction

The world of financial trading offers a myriad of opportunities for those seeking to multiply their wealth. Among the most popular methods are binary options and forex trading. Both options provide the potential for substantial gains, but they also carry varying levels of risk. This article delves into the complexities of binary options and forex trading, comparing their advantages, disadvantages, and suitability for different types of traders. By the end, you will have a clear understanding of each method and be equipped to make an informed decision on which one suits your trading style and goals.

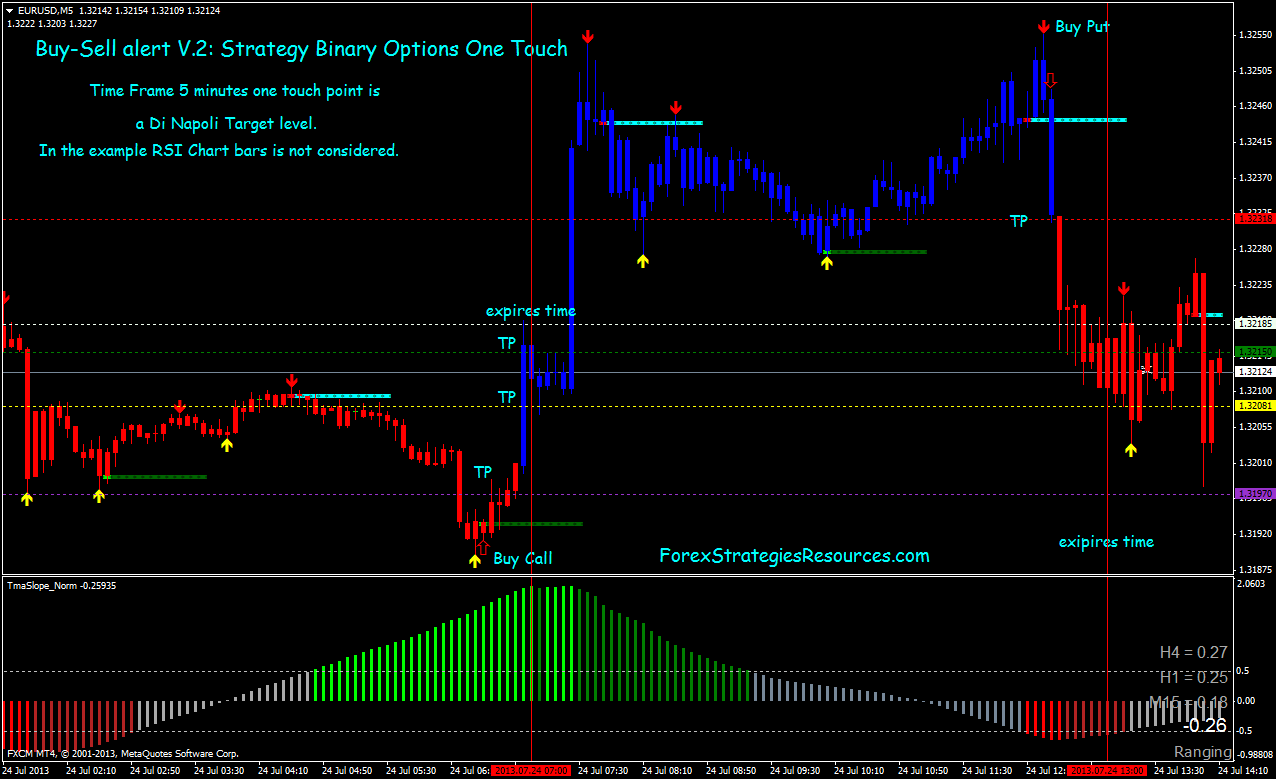

Image: forexstrategiesresources.com

Binary Options Explained

Binary options are a form of financial trading where the trader speculates on the future price of an underlying asset, such as a stock, commodity, or currency pair. The trader has the option of predicting whether the asset’s price will rise or fall over a specified period. If the prediction is correct, the trader receives a fixed payout; otherwise, the entire investment is lost. Binary options are enticing due to their simplicity and the potential for high returns in a short time frame.

Advantages of Binary Options:

- Simplicity: Binary options are straightforward to understand, even for novice traders. The trader only needs to choose a trading asset, predict its price direction, and set the duration of the trade.

- High Returns: Binary options offer the potential for substantial returns, ranging from 70% to 90% or even higher, depending on the broker and the asset being traded.

Disadvantages of Binary Options:

- High Risk: Binary options are known for their high-risk nature. The trader either profits from the trade or loses the entire investment, leaving no room for partial returns.

- Limited Flexibility: Binary options offer limited flexibility compared to forex trading. Traders cannot change their position or close a trade once it has been executed.

- Lack of Leverage: Binary options platforms usually do not provide leverage, which limits the potential for higher profits.

Image: nggolekiimpresi.blogspot.com

Forex Trading Explained

Forex trading, also known as foreign exchange trading, involves the buying and selling of currency pairs. It is the largest financial market in the world, with a daily trading volume exceeding trillions of dollars. Unlike binary options, forex trading offers more depth and flexibility, allowing traders to employ various strategies and techniques to manage risk and maximize profits.

Advantages of Forex Trading:

- Flexibility: Forex trading offers superior flexibility compared to binary options. Traders have the freedom to enter and exit trades at any time during the market’s trading hours.

- Leverage: Forex brokers typically provide leverage, which allows traders to magnify their initial investment and increase their profit potential.

- Wide Range of Trading Strategies: Forex trading offers a wide range of trading strategies, including scalping, swing trading, and news trading. Traders can choose the approach that best suits their risk tolerance and investment goals.

- Long-Term Wealth Creation: Forex trading can be a viable path for long-term wealth creation through consistent profitability.

Disadvantages of Forex Trading:

- Complexity: Forex trading is a complex discipline that requires extensive knowledge of the financial markets, technical analysis, and risk management techniques.

- Risk Management: Forex trading carries significant risk due to fluctuations in currency values. Traders need to implement sound risk management strategies to mitigate potential losses.

- Learning Curve: The learning curve for forex trading is steep. It takes time and effort to develop the necessary skills and knowledge to become a successful forex trader.

Suitability for Different Types of Traders

Binary options may be suitable for traders who are attracted to simplicity, seek quick returns, or have limited trading experience. However, risk-averse traders should approach binary options with caution due to their all-or-nothing nature. Forex trading, on the other hand, is more appropriate for traders with a long-term investment horizon, who value flexibility, and are willing to invest time and effort to acquire the necessary knowledge and skills.

Am Binary And Forex Trading

Conclusion

Choosing between binary options and forex trading depends on your individual risk tolerance, investment goals, and experience level. Binary options offer simplicity and the potential for high returns but come with significant risk and limited flexibility. Forex trading provides superior flexibility, a wider range of trading strategies, and the possibility of long-term wealth creation but requires a substantial learning curve and carries inherent risk. Ultimately, the best choice for you will depend on your unique circumstances and preferences.