Embarking on an international adventure is an exciting experience, but managing currency abroad can be a daunting task. Enter Bank of Baroda’s Forex Card, an indispensable tool for seamless, safe, and convenient currency management during your travels.

Image: recruitmentresult.com

The Ultimate Travel Companion: Bank of Baroda Forex Card

Bank of Baroda’s Forex Card is a prepaid card loaded with the currency of your choice, allowing you to make payments and withdraw cash effortlessly in over 200 countries. With its global acceptance, you can bid farewell to the hassles of cash exchange and fluctuating currency rates.

Benefits of Using a Bank of Baroda Forex Card

- No Hidden Costs: Enjoy transparent and competitive exchange rates without any additional transaction fees.

- Widely Accepted: Use your Forex Card at millions of Visa and Mastercard terminals worldwide.

- Secure Transactions: Safeguard your finances with Chip and PIN technology and real-time transaction notifications.

- Emergency Assistance: Access 24/7 customer support and emergency cash assistance in case of emergencies.

- Convenient Management: Track your expenses, set transaction limits, and manage your account conveniently through online or mobile banking.

Applying for a Bank of Baroda Forex Card: A Step-by-Step Guide

- Eligibility:

– Indian residents above the age of 18

– Holding a valid Indian passport

– Maintaining an active Bank of Baroda account - Documentation:

– Identity proof (PAN Card/Aadhaar Card)

– Address proof (Utility bills/Driving License)

– Passport and visa copies - Submission:

– Online Application: Visit Bank of Baroda’s website and fill out the online application form.

– Branch Visit: Submit your application and documents at your nearest Bank of Baroda branch. - Verification and Issuance:

– The bank will verify your documents and process your application.

– The Forex Card will be issued within 7-10 working days.

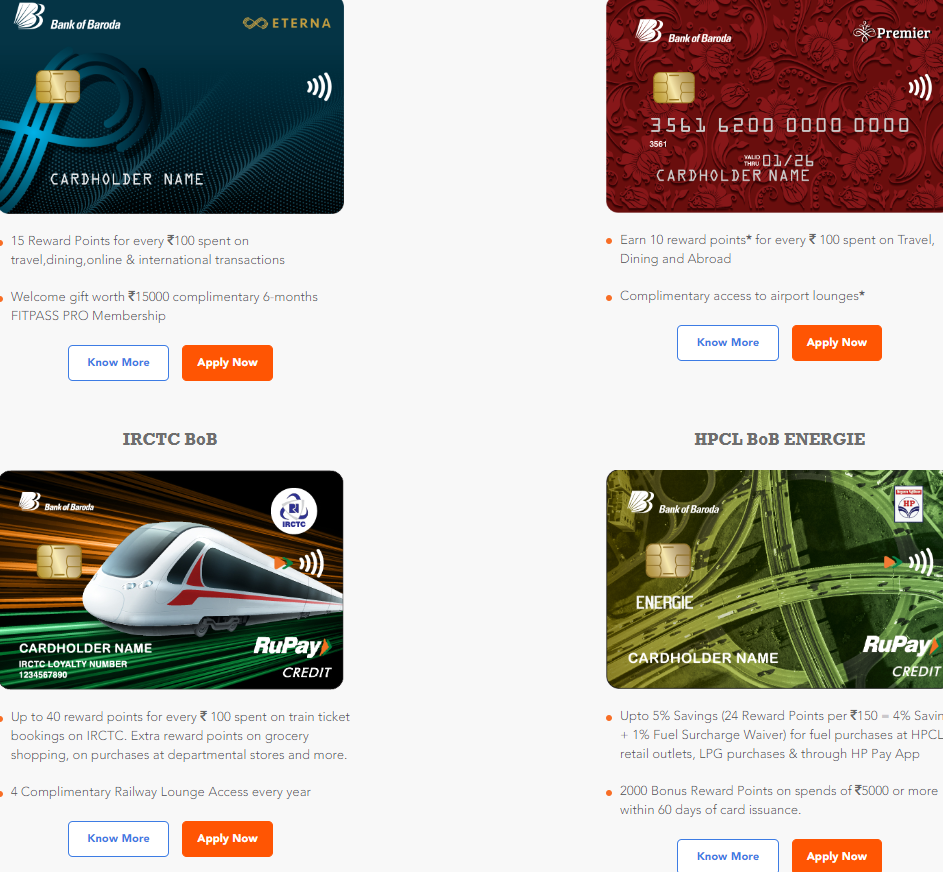

Image: cardinsider.com

Tips and Expert Advice for Using a Forex Card

- Load multiple currencies onto your card for flexibility.

- Inform your bank about your travel dates to prevent card blocking.

- Set transaction limits to monitor and control your expenses.

- Utilize the mobile banking app for real-time updates and easy card management.

- Keep your card secure and report any unauthorized transactions immediately.

Frequently Asked Questions about Bank of Baroda Forex Card

Q: What are the card variants available?

A: Bank of Baroda offers two Forex Card variants: Visa Platinum and Mastercard Platinum.

Q: Is there an annual or maintenance fee?

A: No, Bank of Baroda does not charge any annual or maintenance fees for its Forex Cards.

Q: Can I use the Forex Card for online transactions?

A: Yes, the Forex Card can be used for online purchases and bill payments.

Apply Bank Of Baroda Forex Card

Conclusion

With Bank of Baroda’s Forex Card, you can embrace your international travels with confidence and convenience. Apply today and experience the peace of mind that comes with seamless currency management. Say goodbye to exchange rate woes and embark on your global adventures with ease!

Are you ready to simplify your international finances and make your travels more enjoyable? Apply for a Bank of Baroda Forex Card today and unlock a world of currency convenience!