In the ever-evolving realm of forex trading, understanding market volatility is paramount. Enter the average daily range (ADR) forex indicator, a powerful tool that quantifies daily price fluctuations, providing invaluable insights into market behavior and future price movements.

Image: kumarspold1985.blogspot.com

The ADR indicator, measured in pips, represents the average difference between the day’s high and low prices over a specified historical period. Its significance lies in the fact that it distills complex price action into a single, concise value, empowering traders to objectively assess market volatility and make informed trading decisions.

Delving into the Mechanics of the ADR Indicator

Calculating the ADR indicator involves a straightforward mathematical formula. Given a chosen period (e.g., 14 days, representing a typical two-week trading period), the ADR is calculated as the average absolute difference between the highest and lowest prices observed within each of those days.

For instance, consider a 14-day period with daily price highs of 1.2000, 1.2050, 1.2080, 1.2100, 1.2090, 1.2070, 1.2040, 1.2030, 1.2020, 1.2000, 1.2010, 1.2050, 1.2070, and 1.2060, and daily price lows of 1.2080, 1.2040, 1.2000, 1.2060, 1.2040, 1.2000, 1.2010, 1.2020, 1.2030, 1.2020, 1.2000, 1.2020, 1.2030, and 1.2010. The ADR for this period would be calculated as:

ADR = (1.2050 – 1.2080) + (1.2080 – 1.2000) + (1.2100 – 1.2060) + … + (1.2070 – 1.2030) / 14 = 8.2 pips

Practical Applications of the ADR Indicator in Forex Trading

The ADR indicator finds immense utility in various forex trading strategies. It allows traders to:

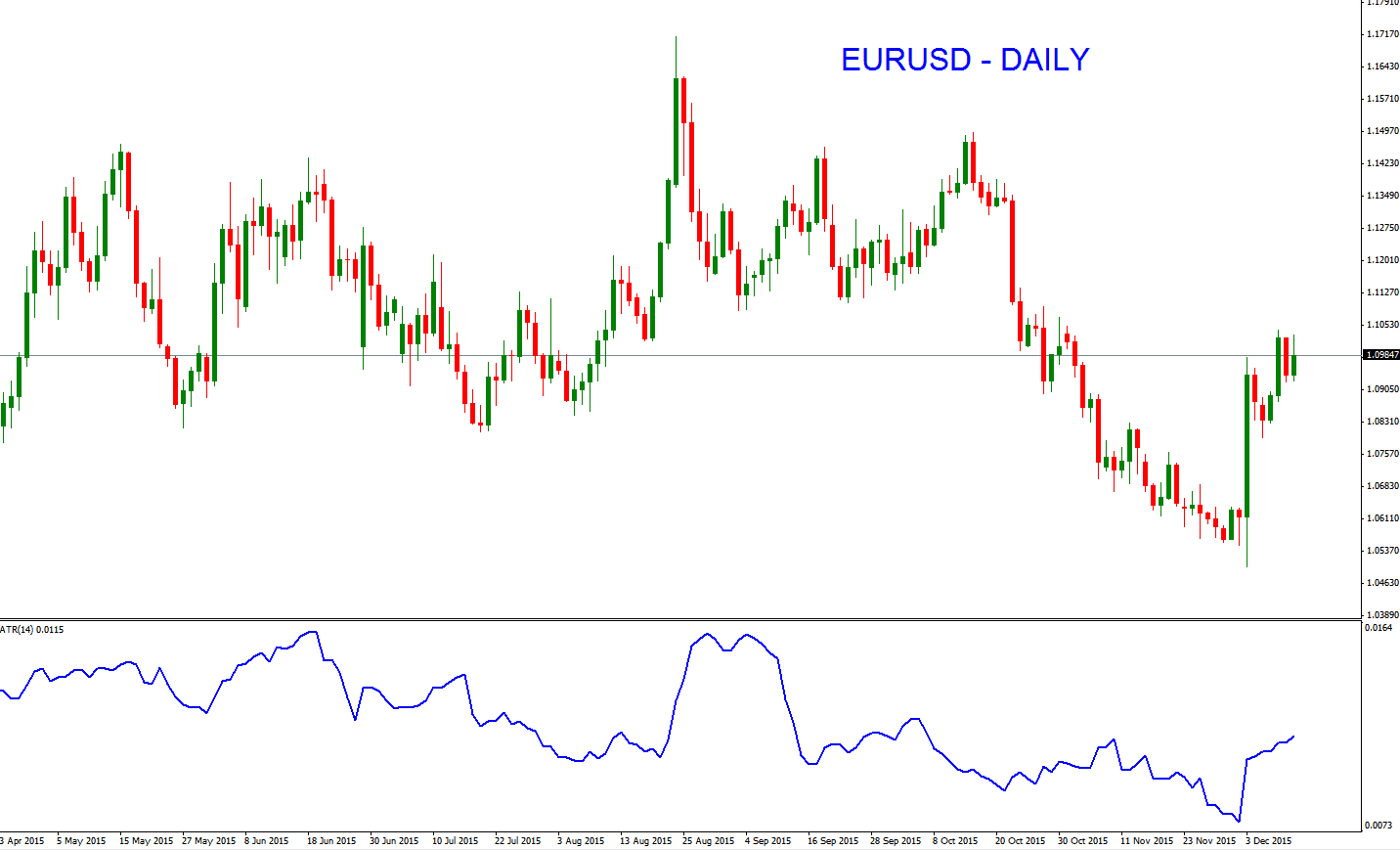

- Assess Market Volatility: The ADR provides an objective measure of market volatility, indicating the average daily price range. Higher ADR values suggest higher volatility, while lower ADR values indicate lower volatility.

- Identify Trading Opportunities: By comparing the current ADR to historical ADR values, traders can identify periods of high or low volatility, which can signify potential trading opportunities. High volatility periods may offer greater profit potential but also increased risk, while low volatility periods may indicate consolidation or a lack of market movement.

- Set Realistic Profit Targets: The ADR can help traders set realistic profit targets based on the average daily price range. For instance, a trader with a bullish breakout trading strategy may set a profit target equivalent to one or two times the ADR for that particular currency pair.

- Manage Risk: The ADR can be used to determine appropriate stop-loss levels. By setting stop-losses at a distance equal to a multiple of the ADR, traders can manage risk and limit potential losses in case of adverse price movements.

- Develop Trading Strategies: The ADR can be combined with other technical indicators to develop tailored trading strategies. For example, a trader could combine the ADR with a moving average to identify potential trend reversals or use it with a Bollinger Band to assess overbought and oversold conditions.

Limitations and Considerations of the ADR Indicator

Like any technical indicator, the ADR has its limitations:

- Backward-Looking: The ADR is a backward-looking indicator, meaning it only reflects historical price behavior. It cannot predict future volatility with certainty.

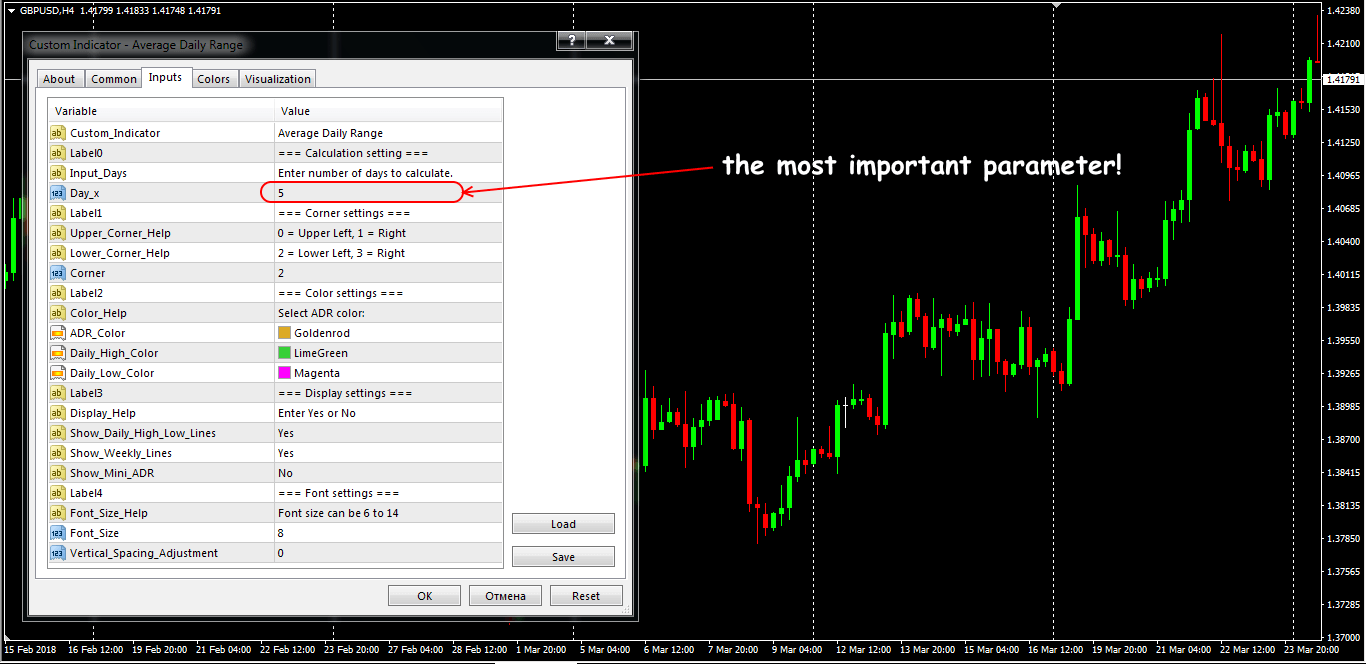

- Period Sensitivity: The accuracy of the ADR indicator can be dependent on the chosen period. Different periods can produce different ADR values, so traders should experiment with different periods to find the most suitable one for their trading style.

- Not Suitable for All Markets: The ADR indicator may not be effective for all forex currency pairs or market conditions. It is generally more applicable to trending markets where volatility is more pronounced.

Image: yzyjifoh.web.fc2.com

Incorporating the ADR Indicator into Your Forex Trading

To effectively incorporate the ADR indicator into your forex trading, consider the following steps:

- Choose an Appropriate Period: Start by experimenting with different periods to find the one that best suits your trading style and the currency pair you are trading.

- Monitor the Trend: Use the ADR in conjunction with other technical indicators to assess the underlying trend of the market. This will help you make more informed decisions about the direction of your trades.

- Set Realistic Targets and Stop-Losses: Utilize the ADR to determine appropriate profit targets and stop-loss levels. This will help you manage risk and secure profits.

- Be Cautious in Low Volatility Periods: Exercise caution when trading in markets with low ADR values. Low volatility periods often indicate a lack of market momentum, which can make it difficult to generate significant profits.

- Continuously Evaluate and Adjust: The forex market is dynamic, so it’s essential to continuously monitor the ADR and adjust your trading strategy accordingly.

Average Daily Range Forex Indicator

Conclusion: Unlocking Forex Market Volatility with the ADR Indicator

The average daily range (ADR) forex indicator is a valuable tool that empowers traders to understand market volatility and make objective trading decisions. By incorporating the ADR into your trading strategy, you can assess market conditions, identify trading opportunities, set realistic targets, manage risk, and develop tailored trading strategies. Remember, technical indicators are not foolproof, and it’s always prudent to use them in conjunction with other analysis techniques and sound risk management practices.

Harness the power of the ADR indicator to elevate your forex trading to the next level!