Introduction

Navigating the intricacies of foreign currency can be a daunting task, especially when traveling or conducting international business transactions. However, Axis Bank, India’s third-largest private sector bank, offers a user-friendly solution: the Axis Bank Forex Card Germany. This prepaid card empowers you to manage your finances abroad with ease and security, ensuring a seamless and stress-free experience. Read on to delve into the comprehensive guide to Axis Bank Forex Card Germany, unlocking its benefits, features, and much more.

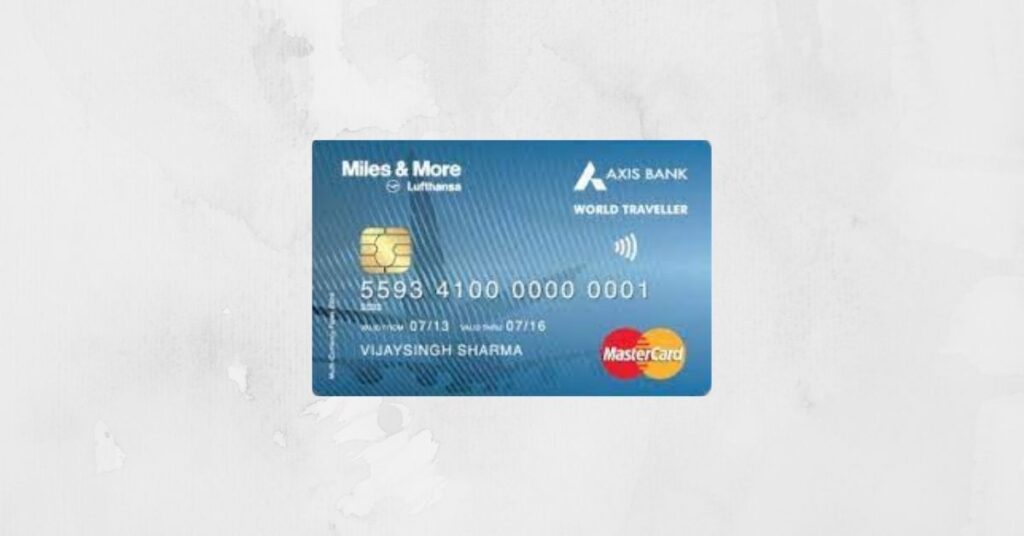

Image: fincards.in

Understanding Forex Card

A forex card, short for foreign exchange card, is a prepaid card loaded with a specific amount of foreign currency. Unlike traditional debit or credit cards, forex cards are linked to the respective currency of the country you’re visiting, allowing for local transactions without incurring hefty currency conversion fees. This eliminates the need to carry large amounts of cash, reducing the risk of loss or theft while maximizing the benefits of local exchange rates.

Benefits of Axis Bank Forex Card Germany

Axis Bank Forex Card Germany offers a range of advantages that make it the preferred choice for travelers and business professionals alike:

-

Competitive Exchange Rates:

Access competitive exchange rates that save you substantial amounts compared to traditional currency exchange services.

-

Image: www.dialabank.comLow Transaction Fees:

Enjoy minimal transaction fees, ensuring that you get the most out of your foreign currency.

-

Global Acceptance:

The card is widely accepted at millions of merchants and ATMs around the world, providing unparalleled convenience.

-

Easy Online Management:

Monitor your transactions, check your balance, and load or reload your card effortlessly through the dedicated online portal.

-

Secure Transactions:

Robust security measures, including EMV chip technology and PIN-based authentication, protect your transactions against unauthorized access.

Features of Axis Bank Forex Card Germany

-

Multi-currency Functionality:

The card can hold multiple currencies simultaneously, allowing you to switch between currencies without paying additional fees.

-

Cash Withdrawals:

Withdraw local currency from ATMs at competitive exchange rates, providing easy access to funds when needed.

-

No Minimum Balance:

Enjoy the flexibility of loading any amount onto your card, without maintaining a minimum balance requirement.

-

24/7 Customer Support:

Dedicated customer support is available around the clock to assist with any queries or emergencies.

How to Apply for Axis Bank Forex Card Germany

Applying for an Axis Bank Forex Card Germany is straightforward and can be completed in a few simple steps:

- Visit the official website of Axis Bank.

- Navigate to the ‘Cards’ section and select ‘Forex Cards’.

- Choose ‘Axis Bank Forex Card Germany’ and click on ‘Apply Now’.

- Fill out the application form with your personal and financial details.

- Submit the form and pay the applicable fees.

- Your card will be delivered to your registered address within a few working days.

Usage Guidelines

- Load your card with the desired amount of Euros before your trip.

- Activate your card upon arrival in Germany by following the instructions provided.

- Use your card at any merchant or ATM that displays the Mastercard or Visa logo.

- Enter your PIN for authentication and select the appropriate currency for the transaction.

- Monitor your transactions regularly through the online portal or mobile app.

- If you lose your card, report it immediately to Axis Bank’s customer support.

Axis Bank Forex Card Germany

Conclusion

The Axis Bank Forex Card Germany is an indispensable tool for hassle-free currency management during your travels or business trips to Germany. Its competitive exchange rates, low transaction fees, and global acceptance make it a smart choice for those seeking convenience, security, and value. Embrace the ease of managing your finances abroad with Axis Bank Forex Card Germany and embark on your journey with peace of mind.