In the ever-evolving global financial landscape, currency exchange plays a pivotal role in trade, investment, and personal finance. As one of India’s leading private sector banks, Axis Bank offers a comprehensive suite of foreign exchange services, including transparent and competitive cash rates. This article delves into the intricacies of Axis Bank’s forex cash rates, empowering readers to make informed decisions in their international financial transactions.

Image: cleartax.in

Axis Bank: A Forerunner in Currency Exchange

Axis Bank has established itself as a formidable player in the Indian forex market, catering to individuals, businesses, and institutions seeking currency exchange solutions. The bank’s extensive network of branches across India and robust online platform provide seamless access to a diverse range of currency pairs at advantageous rates.

Decoding Forex Cash Rates: A Simplified Explanation

Forex cash rates refer to the live exchange rates at which currencies are traded for immediate delivery, typically within two business days. Unlike future or forward rates, cash rates reflect the real-time supply and demand dynamics of the currency market, influenced by economic conditions, political events, and market sentiment.

Benefits of Using Axis Bank’s Forex Cash Rates

Selecting Axis Bank as your trusted forex provider offers a host of benefits, including:

- Competitive Rates: Axis Bank consistently offers some of the most competitive cash rates in the market, allowing customers to optimize their currency exchange value.

- Transparency and Clarity: The bank’s forex cash rates are transparent and easily accessible, empowering customers to make informed decisions based on real-time market information.

- Convenience: With branches nationwide and a user-friendly online platform, Axis Bank ensures hassle-free currency exchange transactions anytime, anywhere.

- Expertise and Support: The bank’s experienced currency specialists are always available to provide guidance and support, ensuring customers receive tailored solutions that meet their specific needs.

Image: www.youtube.com

Navigating the Dynamics of Forex Cash Rates

Understanding the factors influencing forex cash rates is crucial for making strategic currency exchange decisions. These factors include:

- Economic Data: Economic indicators such as GDP growth, inflation, and interest rates significantly impact currency demand and supply, leading to fluctuations in cash rates.

- Political Events: Geopolitical events, elections, and policy changes can trigger volatility in currency markets, affecting cash rates.

- Market Sentiment: Speculation and market sentiment can drive short-term fluctuations in currency values, influencing cash rates.

- Global Events: Natural disasters, pandemics, and other global events can disrupt trade patterns and affect currency demand, leading to shifts in cash rates.

Utilising Forex Cash Rates for Your Financial Pursuits

Forex cash rates are essential for various financial activities, including:

- Trade and Commerce: Businesses engaged in international trade require currency exchange to settle cross-border transactions, and forex cash rates provide the basis for these conversions.

- Foreign Investments: Individuals and institutions investing in global markets must consider cash rates to determine the value of their investments and maximize returns.

- Travel and Tourism: Travelers exchanging currency for their overseas adventures can leverage forex cash rates to secure the best possible deals.

- Education and Healthcare: Families paying for international education or healthcare may utilize cash rates to optimize currency conversions and reduce financial burdens.

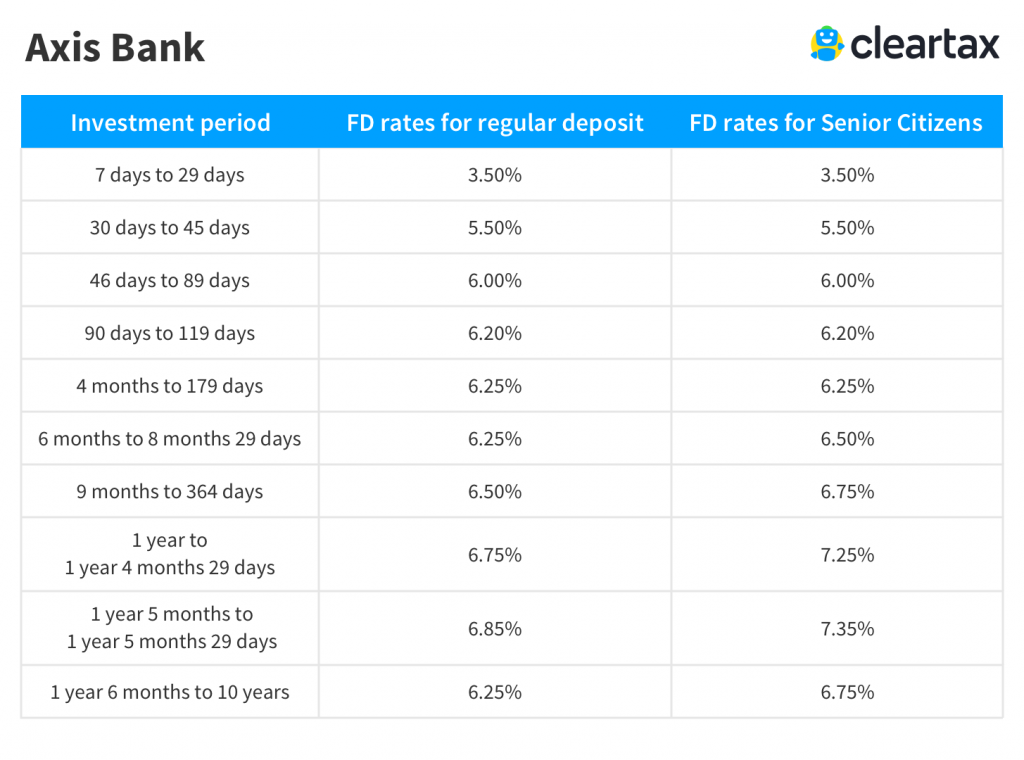

Axis Bank Forex Cash Rates

https://youtube.com/watch?v=B6iDbLHOcV4

Conclusion: Empowering Informed Currency Exchange Decisions

Axis Bank’s forex cash rates provide a transparent and cost-effective solution for managing international financial transactions. By understanding the dynamics of these rates and the factors influencing them, individuals and businesses can make informed decisions that safeguard their financial interests. Whether you are an importer, exporter, investor, or simply a globetrotter, Axis Bank’s forex cash rates offer the stability and competitive advantage you need.