When embarking on international travels, managing foreign currency can be a daunting task. Forex cards, designed specifically for global financial transactions, offer a convenient solution to this challenge. Understanding the balance of USD to convert to SGD in a forex card is crucial for travelers seeking maximum value and efficiency during their stay in Singapore. This comprehensive guide aims to provide a detailed explanation of this process, exploring key considerations and offering practical insights to enhance your foreign exchange experience.

Image: medium.com

What is a Forex Card?

A forex card, also known as a travel card, is a prepaid card linked to a specific foreign currency account. It allows travelers to load multiple currencies and switch between them seamlessly during their travels. This eliminates the need to carry large amounts of physical cash, reducing the risk of theft or loss. Moreover, forex cards often offer more favorable exchange rates and lower transaction fees compared to traditional credit or debit cards, providing potential cost savings for frequent travelers.

Understanding USD to SGD Conversion

Before loading a forex card, it is essential to understand the conversion rate between USD and SGD. This rate is constantly fluctuating based on market dynamics and supply and demand. To determine the current exchange rate, you can refer to reputable sources such as banks, currency exchange websites, or smartphone apps that provide real-time exchange rates.

Once you have established the exchange rate, you can calculate the amount of SGD you will receive for a given amount of USD. For instance, if the exchange rate is 1 USD = 1.37 SGD, loading 100 USD to your forex card would result in an equivalent balance of 137 SGD.

Factors Affecting Forex Card Conversion Rates

Several factors influence forex card conversion rates:

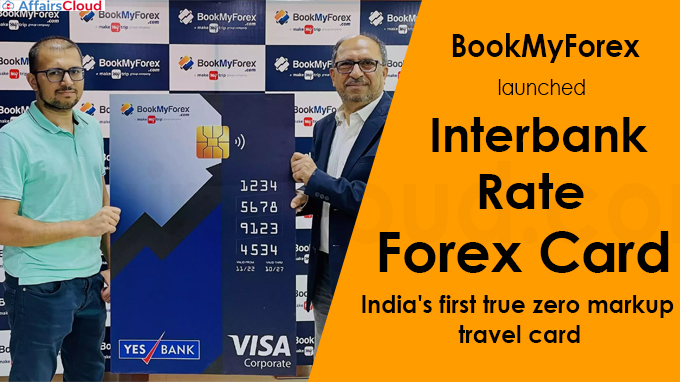

Image: affairscloud.com

1. Market Conditions:

Global economic events, interest rates, and other market conditions can impact exchange rates, affecting the conversion value between USD and SGD.

2. Forex Card Provider:

Different forex card providers may offer varying exchange rates and fees. It is crucial to compare these before selecting a provider to ensure the best possible rates.

3. Transaction Amount:

Larger transaction amounts may qualify for better exchange rates compared to smaller transactions.

Tips for Maximizing USD to SGD Conversion

Here are some tips to optimize your USD to SGD conversion when using a forex card:

1. Monitor Exchange Rates:

Keep an eye on exchange rate fluctuations to identify favorable times to convert your funds.

2. Compare Forex Card Providers:

Research different forex card providers to find the one with the lowest fees and most competitive exchange rates.

3. Load Larger Amounts:

If possible, load a larger amount onto your forex card at once to take advantage of potentially better conversion rates for larger transactions.

4. Avoid Using ATMs:

ATMs often charge additional fees for foreign currency withdrawals, which can reduce the value of your conversion.

5. Utilize Online Conversion Tools:

Use online currency converters to calculate the exact amount of SGD you will receive for a given USD amount, ensuring transparency and accuracy.

Balance Of Usd To Convert Tosgd In Forex Card

Conclusion

Navigating the balance of USD to convert to SGD in a forex card requires a comprehensive understanding of exchange rates and the factors that influence them. By monitoring the market, comparing providers, and utilizing smart strategies, travelers can optimize their currency conversion and make the most of their foreign exchange experience. Forex cards offer a secure and cost-effective way to manage finances while traveling globally, empowering travelers to explore the world confidently and efficiently.