The Ultimate Guide to Navigating the Forex Market with the Best Indicators

Image: tradingforexguide.com

In the turbulent waters of the foreign exchange market, where fortunes are made and lost in the blink of an eye, every trader needs a reliable compass to guide their decisions. Technical indicators, like beacons of clarity amidst the choppy seas, play a pivotal role in providing traders with insights into market trends, helping them make informed trades and maximize their returns.

This comprehensive guide will delve into the depths of technical analysis, introducing you to the crème de la crème of forex indicators that have proven their worth over time. From trend-following juggernauts to volatility-gauging marvels, we’ll explore the arsenal of tools that can transform you into a forex trading virtuoso. Whether you’re a seasoned veteran or just setting sail on your forex adventure, this guide will equip you with the knowledge and confidence to conquer the market with unwavering precision.

Forecasting the Flow with Trend-Following Indicators:

-

Moving Average (MA): The granddaddy of trend indicators, the MA smoothens out price fluctuations, revealing the underlying trend.

-

Exponential Moving Average (EMA): This dynamic indicator places greater weight on recent prices, making it more responsive to trend changes.

-

Ichimoku Cloud: A multifaceted indicator that provides a comprehensive view of market conditions, combining multiple technical tools into a harmonious whole.

Measuring Market Momentum with Oscillators:

-

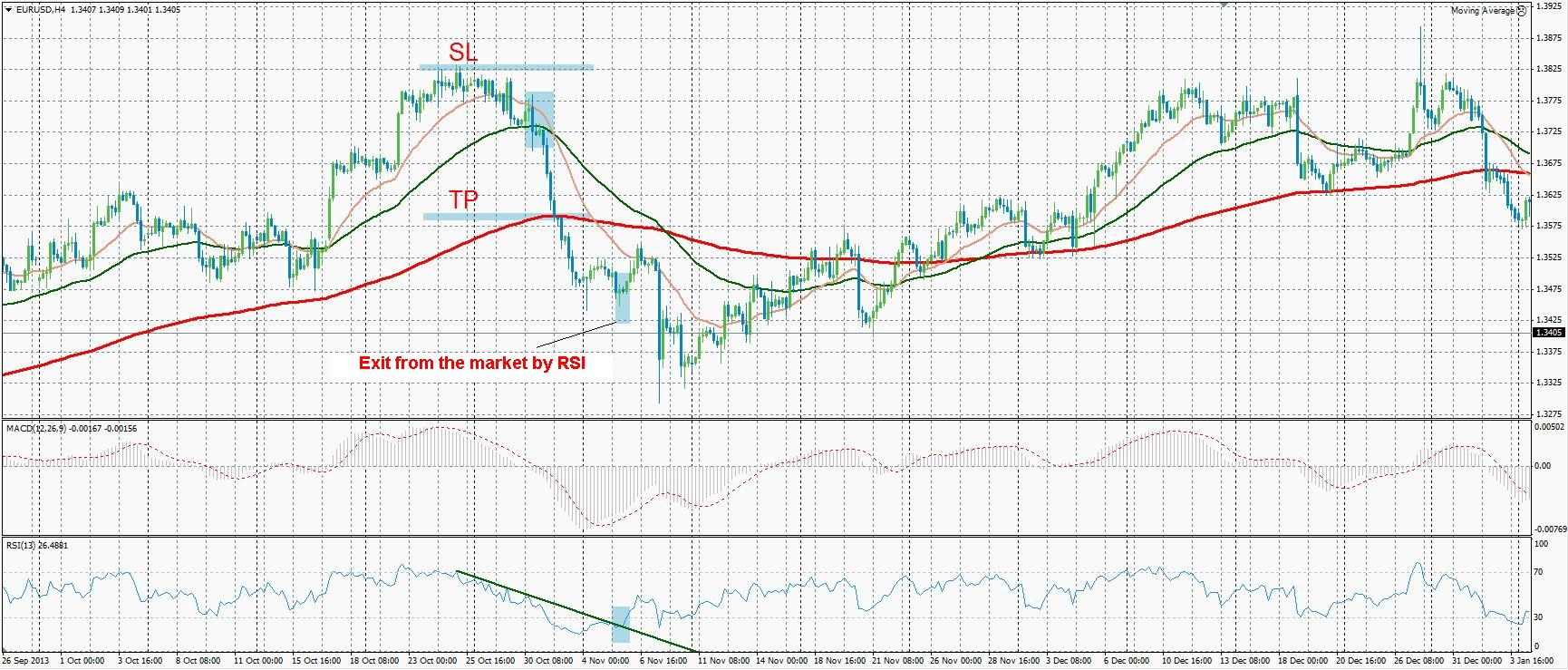

Relative Strength Index (RSI): A powerful tool for gauging the strength or weakness of a trend, helping traders identify overbought or oversold conditions.

-

Stochastic Oscillator: Similar to RSI, the Stochastic Oscillator signals when a market is reaching extreme levels, indicating potential trend reversals.

-

MACD (Moving Average Convergence Divergence): A versatile indicator that measures the relationship between two exponential moving averages. It can detect trend reversals and provide insights into momentum.

Monitoring Volatility with Range Indicators:

-

Bollinger Bands: These bands define a range of likely price movement, helping traders identify support and resistance levels.

-

Average True Range (ATR): A measure of market volatility, ATR assists traders in determining the size of stop-loss orders and profit targets.

-

Donchian Channels: Another range indicator, Donchian Channels mark the highest high and lowest low within a specified period, providing boundaries for price movement.

Identifying Trading Opportunities with Volume Indicators:

-

Volume: The amount of currency traded over a specific period, volume analysis can reveal supply and demand imbalances, indicating potential market moves.

-

On Balance Volume (OBV): This cumulative indicator combines volume with price, helping traders identify potential trend changes and market sentiment.

-

Chaikin Oscillator: A momentum-based indicator that incorporates volume, providing a comprehensive view of market dynamics.

Conclusion:

Navigating the forex market is akin to venturing into a treacherous ocean. Without a reliable compass, traders risk getting lost in a storm of conflicting signals and emotional turmoil. The best forex indicators, like guiding stars, illuminate the path to success by revealing market trends, momentum, volatility, and trading opportunities. By mastering these technical tools and interpreting their signals with unwavering discipline, traders can harness the power of the forex market and achieve their financial goals with unwavering precision. Remember, the journey to trading mastery is fraught with challenges, but with the right tools in hand, you can conquer the turbulent seas and emerge victorious.

Image: abizaly.web.fc2.com

Best Forex Indicators To Use