Unveiling the Realm of Automated Trading

In the fast-paced and ever-evolving world of currency trading, the digital age has brought forth a revolutionary tool: the Expert Advisor (EA), an automated trading software that empowers traders to navigate the complex financial markets with ease. EAs, also known as trading bots, have become indispensable for both seasoned traders and beginners alike, offering a plethora of advantages that make trading more efficient, profitable, and less time-consuming.

Image: www.amtradingtips.com

From novice traders seeking a guiding hand in the turbulent waters of forex to experienced professionals seeking to optimize their trading strategies, the advent of free EAs has opened doors to a world of possibilities. These sophisticated programs, equipped with advanced algorithms and pre-defined trading rules, can autonomously analyze market conditions, execute trades, and manage risk on behalf of the trader, freeing up valuable time and reducing emotional biases that can often lead to costly mistakes.

Navigating the Maze of Forex EAs

With a multitude of free Forex EAs available in the marketplace, choosing the right one can be a daunting task. To empower traders with the knowledge they need to make informed decisions, we present this comprehensive guide to the best free Forex EAs of 2018, providing an in-depth analysis of their key features, advantages, and potential drawbacks. Our aim is not only to help traders select the most suitable EA for their individual trading needs but also to equip them with the necessary knowledge to use these automated tools effectively and responsibly.

The Contenders: Best Free Forex EAs of 2018

-

EA Builder: Known for its user-friendly interface and powerful customization options, EA Builder allows traders to create and test their own automated trading strategies without the need for programming knowledge. The EA Builder provides a visual representation of the trading rules, making it easy for traders to understand and modify the strategy’s parameters.

-

Forex Tester: This comprehensive trading platform combines backtesting capabilities with a user-friendly visual editor, allowing traders to test and refine their EAs before deploying them in live trading. Forex Tester provides extensive historical data, enabling traders to optimize their strategies for different market conditions.

-

MetaTrader 4 (MT4): A highly popular and widely used trading platform, MetaTrader 4 offers a robust marketplace where traders can download and install free EAs. MT4’s easy-to-use interface and extensive functionality make it a favorite among traders of all levels of experience.

-

cTrader: Known for its advanced charting capabilities and algorithmic trading features, cTrader provides traders with access to a curated selection of free EAs. cTrader’s intuitive design and support for multiple languages make it a suitable choice for traders from diverse backgrounds.

-

JForex: Designed specifically for the Java programming language, JForex is a powerful trading platform that offers a comprehensive suite of tools for EA development and testing. JForex’s open-source architecture provides traders with the flexibility to customize the platform and EAs to suit their specific needs.

Choosing the Right EA: Tailoring to Individual Needs

Selecting the best free Forex EA depends on a careful consideration of the trader’s individual trading style, risk tolerance, and specific trading objectives. While some EAs may be optimized for scalping strategies, others may excel in trend following or breakout trading. It is essential for traders to thoroughly research the available EAs and choose one that aligns with their unique trading approach.

Furthermore, traders should pay close attention to the EA’s risk management features, such as stop-loss and take-profit orders. These parameters play a critical role in controlling the potential losses and maximizing profits, and should be carefully adjusted to suit the trader’s risk appetite.

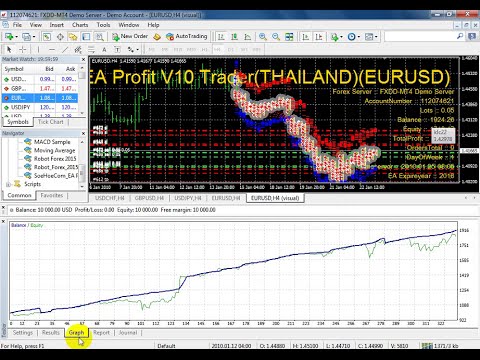

Image: www.youtube.com

Harnessing the Power of EAs: A Step-by-Step Guide

-

Choose a Reliable Broker: The choice of a reputable and trustworthy broker is paramount, as they provide the platform on which the EA will operate. Traders should carefully evaluate the broker’s track record, regulatory compliance, and customer support before making a decision.

-

Select the Right EA: As discussed earlier, traders should diligently research and select the EA that best aligns with their trading style and objectives. It is also crucial to consider the EA’s compatibility with the chosen broker and trading platform.

-

Install and Configure the EA: Once the EA has been selected, traders must follow the installation instructions provided by the developer, ensuring that the EA is properly configured with the desired settings and risk management parameters.

-

Test and Monitor the EA: Before deploying the EA in live trading, traders should thoroughly test its performance using historical data or a demo account. This allows traders to fine-tune the EA’s settings and identify any potential weaknesses or areas for improvement.

-

Live Trading and Risk Management: Once the EA has been adequately tested and optimized, traders can confidently deploy it in live trading. However, it is essential to continuously monitor the EA’s performance and adjust the risk management parameters as needed to ensure that it continues to align with the trader’s risk tolerance.

Best Free Forex Ea 2018

Conclusion: Empowering Traders with Automated Trading

In the ever-evolving landscape of forex trading, the advent of free Forex EAs has revolutionized the way traders approach the market. These sophisticated automated tools empower traders to harness the power of technology, enabling them to make informed trading decisions, manage risk effectively, and achieve consistent profitability.

The best free Forex EAs of 2018, as outlined in this guide, provide traders with a wide range of options to suit their individual trading needs. By carefully researching and selecting the right EA, traders can unlock the potential of automated trading and optimize their chances of success in the dynamic world of currency trading.

It is important to remember that while EAs can be a valuable tool, they are not a substitute for sound trading knowledge and risk management practices. Traders who take the time to understand the markets, develop a solid trading plan, and manage their risk effectively can leverage the power of EAs to enhance their trading performance and achieve their financial goals.