Unleashing the Power of Personalized Market Insights

Step into the dynamic world of forex trading, where every decision can shape your financial future. As seasoned traders know, market analysis is the key to making informed trades amidst the ever-fluctuating currency market. While numerous technical indicators exist to guide traders, fundamental indicators offer a unique perspective by tapping into macroeconomic forces that drive currency prices. In this comprehensive guide, we will delve into the world of custom fundamental forex indicators, unlocking their power to enhance your trading strategies and unlock market insights like never before.

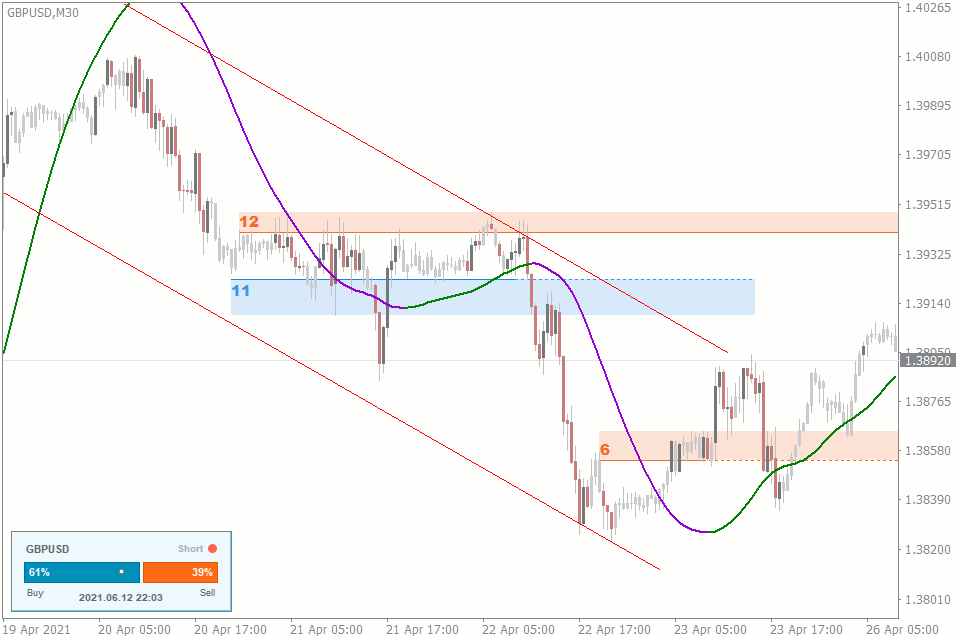

Image: fxssi.dev

Harnessing the Fundamentals: Delving into Custom Indicators

Custom forex indicators are powerful tools that allow traders to create their own unique indicators tailored to their specific trading preferences and market conditions. By leveraging the wealth of macroeconomic data available, traders can develop indicators that isolate specific relationships or trends, providing valuable insights into market behavior. These indicators leverage a wide range of fundamental data, including economic growth, interest rates, inflation, consumer spending, and political events.

The beauty of custom fundamental forex indicators lies in their flexibility. Traders can modify existing indicators or create new ones from scratch, calibrating them to suit their unique trading styles. This enables them to identify trading opportunities that align with their risk tolerance and investment goals. Custom indicators provide a personalized window into the markets, empowering traders to make informed decisions based on their own set of criteria.

Comprehensive Coverage: Navigating the Key Concepts

Before venturing into the world of custom fundamental forex indicators, it is essential to grasp the foundational concepts that underpin their functionality. These key elements ensure a comprehensive understanding of how these indicators work:

- Definition: Custom fundamental forex indicators are mathematical formulas or algorithms that transform raw economic or financial data into actionable trading signals, shedding light on market trends and predicting future price movements.

- Historical and Real-Time Data: These indicators utilize historical data to identify patterns and establish relationships between economic variables and currency prices. Moreover, they can be configured to incorporate real-time data, providing traders with up-to-date insights into market conditions.

- Customizable Parameters: Custom fundamental forex indicators are highly adaptable, allowing traders to modify various parameters to optimize their performance. This personalization empowers traders to refine their strategies, catering to their individual risk profiles and trading styles.

Latest Trends and Developments: Unraveling the Evolving Market

The world of custom fundamental forex indicators is constantly evolving, driven by advancements in data science and trading technology. Staying abreast of the latest trends and developments is crucial for traders seeking an edge in the ever-changing markets:

- Machine Learning and AI: Artificial Intelligence (AI) and Machine Learning (ML) are transforming the development and use of custom indicators. By automating data analysis and identifying complex patterns, AI-powered indicators can enhance accuracy and efficiency.

- Alternative Data Sources: The proliferation of alternative data sources, such as social media sentiment and satellite imagery, is creating new opportunities for custom indicator development. These non-traditional data sets can provide unique insights into market trends.

- Cloud-Based Platforms: Cloud-based platforms are revolutionizing the way traders access and utilize custom indicators. These platforms offer a centralized repository of indicators, streamline data processing, and enable seamless collaboration among traders.

- Regulatory Scrutiny: As the use of custom indicators grows, regulators are paying closer attention to their development and deployment. Traders should stay informed about regulatory changes to ensure compliance and avoid potential penalties.

Image: www.forex.academy

Expert Advice: Unlocking the Power of Custom Indicators

To maximize the potential of custom fundamental forex indicators, consider the following tips and expert advice:

- Test and Validate: Before implementing any custom indicator in your trading strategy, rigorous testing and validation are essential. This ensures that the indicator performs as expected and aligns with market conditions.

- Combine Multiple Indicators: Relying on a single custom indicator can be limiting. By combining multiple indicators, traders can triangulate their analysis and gain a more comprehensive understanding of market movements.

- Understand the Underlying Data: A deep understanding of the economic data underlying custom indicators is crucial. This knowledge enables traders to interpret the signals generated by the indicators more effectively.

- Consider the Time Horizon: Custom fundamental forex indicators can be designed for short-term or long-term trading. Traders should align the time horizon of their indicators with their trading style and investment goals.

- Monitor and Adjust: Market conditions and economic factors are constantly changing. Traders should regularly monitor the performance of their custom indicators and make adjustments as needed to ensure optimal performance.

FAQs: Addressing Common Queries

To address some of the most frequently asked questions regarding custom fundamental forex indicators, we present the following Q&A section:

- Q: Are custom indicators more accurate than traditional technical indicators?

A: The accuracy of custom indicators depends on the quality of the data used and the robustness of the underlying methodology. While they can provide unique insights, custom indicators should not be considered a substitute for sound trading practices. - Q: How can I create my own custom fundamental indicator?

A: Creating custom indicators requires knowledge of programming languages and a solid understanding of economic principles. Traders can also utilize online platforms that offer pre-built indicators or provide tools for creating their own. - Q: Are custom indicators suitable for all traders?

A: Custom indicators can be valuable tools for both experienced and novice traders. However, traders should possess a foundational understanding of forex markets and be comfortable with the level of customization and analysis involved. - Q: How often should I update my custom indicator?

A: The frequency of updates depends on the underlying data used and the market conditions. Economic data is typically updated on a regular schedule, but traders may need to adjust their indicators more frequently based on market volatility.

Conclusion: Empowering Traders with Precision and Insight

Custom fundamental forex indicators empower traders with the tools to navigate the complex and dynamic currency markets. By harnessing the power of macroeconomic data, these indicators provide personalized insights into market trends and enable traders to develop tailored trading strategies that align with their unique goals. Remember, ongoing research, testing, and adaptation are key to unlocking the full potential of custom indicators. We encourage you to explore the world of custom fundamental forex indicators, refine your trading strategies, and elevate your forex trading journey to new heights.

Best Fundamental Custom Forex Indicator

Are You Ready to Embark on the Journey of Custom Forex Indicators?

We would love to hear your thoughts and experiences with custom fundamental forex indicators. Share your insights, success stories, or questions in the comments section below. Together, we can foster a community of knowledge and support, empowering each other to navigate the ever-evolving landscape of forex trading.