Introduction: The Quest for Forex Success

Embarking on the captivating journey of forex trading requires a compass to navigate the turbulent financial seas. Amidst the plethora of trading strategies that dot the landscape, discerning the most effective ones becomes paramount. In this comprehensive guide, we will delve into the world of forex trading strategies, exploring their intricacies and unveiling the exclusive techniques that astute traders employ.

Image: www.youtube.com

Chapter 1: Laying the Foundation: Essential Concepts and Market Dynamics

1.1 Forex Basics:

- Understanding Forex Market Mechanics

- Types of Orders and Market Participation

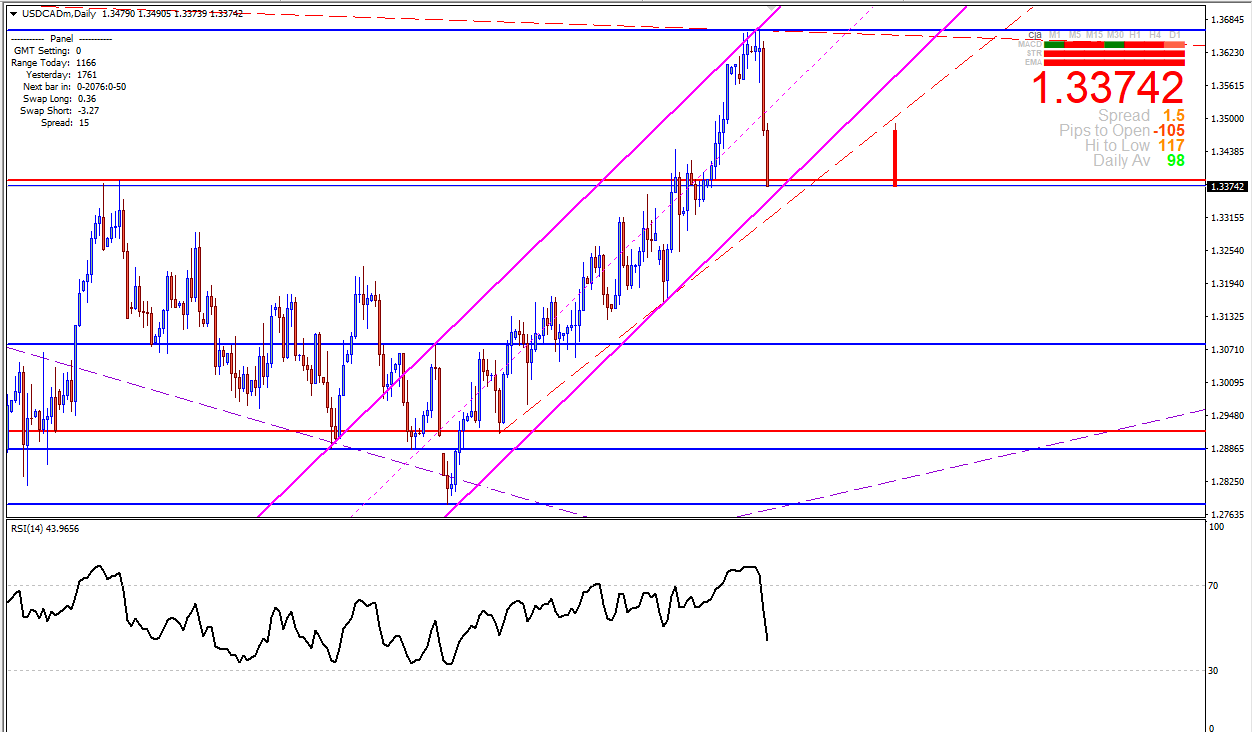

1.2 Technical Analysis:

- Charting Techniques and Price Patterns

- Moving Averages and Oscillators

- Support and Resistance Levels

1.3 Fundamental Analysis:

- Global Economic Indicators

- News and Event Risk

- Central Bank Decisions

Chapter 2: The Power of Trends: Navigating the Market Momentum

2.1 Trend-Following Strategies:

- Riding the Waves of Market Sentiments

- Bollinger Bands and Moving Averages

- Momentum Indicators

2.2 Counter-Trend Strategies:

- Fading the Herd Mentality

- Fibonacci Retracements and Pivots

- Stochastic and RSI Divergences

Chapter 3: Swing Trading Mastery: Trading the Periodic Market Fluctuations

3.1 Swing Trading Overview:

- Identifying Market Swings

- Position Management Techniques

3.2 Indicators for Swing Trading:

- Relative Strength Index (RSI)

- Ichimoku Cloud

- Parabolic Stop and Reverse (SAR)

Image: forexexpertknowledge.blogspot.com

Chapter 4: Piecing the Puzzle: Integrating Diverse Strategies

4.1 Scalping Techniques:

- Capturing Minute Market Movements

- Using High Leverage and Tight Spreads

4.2 Day Trading Strategies:

- Entering and Exiting Trades Within a Day

- Utilizing Market Volatility and News Events

4.3 Position Trading:

- Holding Positions for Extended Periods

- Combining Fundamental and Technical Analysis

Chapter 5: Risk Management: The Art of Survival

5.1 Understanding Leverage:

- Amplifying Gains and Losses

- Managing Risk Exposure

5.2 Stop Loss Orders:

- Protecting Capital from Adverse Market Shifts

- Determining Optimal Placement

5.3 Position Sizing:

- Allocating Trade Capital Wisely

- Maintaining a Balanced Portfolio

Chapter 6: The Trader’s Mindset: Cultivating Psychological Resilience

6.1 Overcoming Cognitive Biases:

- Identifying and Mitigating Trading Traps

- Emotional Control and Discipline

6.2 Developing a Trading Plan:

- Structuring Trading Strategies Systematically

- Defining Entry, Exit, and Risk Parameters

6.3 Continuous Learning and Adaptation:

- Staying Abreast of Market Trends

- Embracing New Trading Techniques

Best Trading Strategy In Forex

Conclusion: The Path to Forex Mastery

The pursuit of the best trading strategy in forex is an ongoing journey that requires both technical proficiency and an unwavering mindset. By mastering the fundamental concepts, embracing a diverse array of strategies, and cultivating risk management skills, traders can navigate the forex markets with increased confidence and the potential for long-term success. Remember, the path to trading mastery is paved with continuous learning, perseverance, and the ability to adapt to the ever-changing landscape of the financial world.