In the ever-changing landscape of the forex market, discerning the trend is paramount for successful trading. Amidst a plethora of trend indicators, selecting the most effective one can be a daunting task. This comprehensive guide delves into the nuances of trend indicators, empowering you with the knowledge to identify the ideal tool for your trading endeavors.

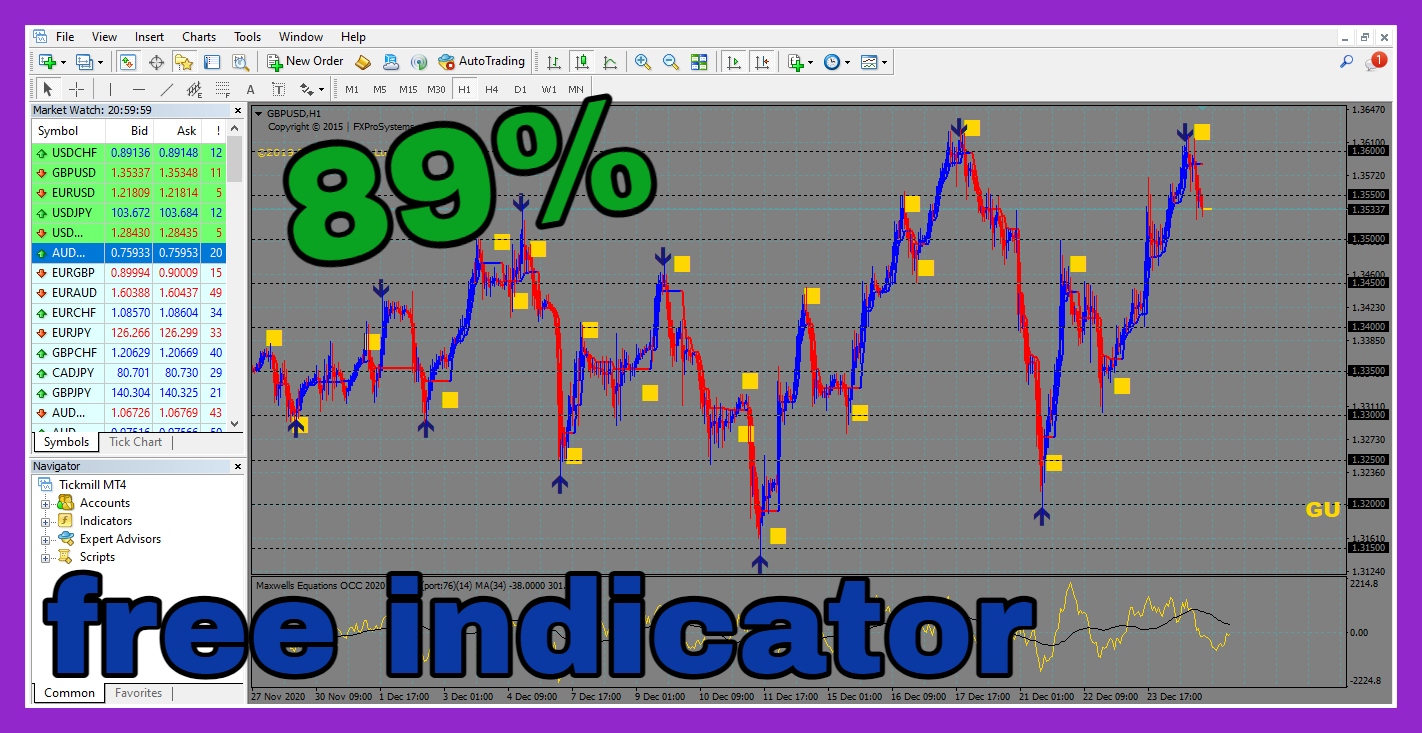

Image: nuala-redfern.blogspot.com

Forex trading, a global marketplace where currencies are exchanged, presents both opportunities and challenges. Understanding market trends is crucial for making informed decisions and maximizing profitability. Trend indicators, technical analysis tools that identify the prevailing price direction, serve as invaluable guides in this dynamic arena.

Types of Trend Indicators: A Comprehensive Overview

Exploring the diverse array of trend indicators unlocks a deeper understanding of their mechanisms and applications. Two broad categories encompass these indicators: leading and lagging.

Leading Indicators: Anticipating Market Shifts

As their name suggests, leading indicators attempt to predict future price movements by analyzing momentum, volume, and market sentiment. By identifying potential trend reversals early on, these indicators offer traders an edge in staying ahead of market shifts.

Lagging Indicators: Confirming Established Trends

Lagging indicators, on the other hand, provide confirmation of existing trends rather than predicting their emergence. Moving averages and trendlines fall under this category, offering a clearer picture of the current market direction.

Criteria for Selecting the Best Trend Indicator

The choice of the most suitable trend indicator hinges on several crucial factors that align with your trading style and risk tolerance. Here are some key criteria to consider:

- Timeframe: The indicator should complement your preferred trading timeframe, be it intraday, swing, or long-term.

- Trading Style: Scalpers, day traders, and position traders have different needs; select an indicator that aligns with your trading approach.

- Volatility: The indicator’s sensitivity to market volatility should match your risk tolerance and trading style.

- Lag: The amount of lag, or delay, in the indicator’s signals can impact your trading decisions;

- Reliability: Opt for an indicator with a proven track record of delivering accurate signals.

Popular Trend Indicators and Their Applications

Navigating the forex market is aided by a wide array of trend indicators, each offering unique insights. Here are some of the most popular indicators and their applications:

- Moving Averages: A staple lagging indicator, moving averages smooth out price data, revealing the underlying trend.

- Bollinger Bands: These bands, formed around a moving average, indicate market volatility and potential trading opportunities.

- Relative Strength Index (RSI): An oscillating indicator measuring market momentum, the RSI identifies potential overbought or oversold conditions.

- Ichimoku Kinko Hyo: A comprehensive indicator combining multiple components, the Ichimoku cloud provides a comprehensive overview of the market.

- Stochastic Oscillator: This oscillator, similar to the RSI, measures price momentum and identifies potential trend reversals.

Image: www.bank2home.com

Best Trend Indicator For Forex Trading

Conclusion: Harnessing Trend Indicators for Forex Trading Success

Understanding and applying the appropriate trend indicator is an indispensable aspect of successful forex trading. By carefully considering your trading style, risk tolerance, and the characteristics of different indicators, you can make informed decisions and navigate the market with greater confidence.

Remember, the best trend indicator for you is the one that aligns with your unique trading approach. By embracing the knowledge presented in this guide, you are well-equipped to identify the ideal tool for your trading endeavors and maximize your chances of achieving consistent profits in the dynamic world of forex.