In the fast-paced world of forex trading, understanding the intricacies of bid and offer prices is paramount for both novice and experienced traders. These prices play a crucial role in determining the profitability of your trades and can significantly impact your overall trading strategy. In this comprehensive guide, we will delve into the concept of bid and offer prices, their significance, and how they influence the forex market.

Image: learnpriceaction.com

Decoding Bid and Offer Prices: The Basics

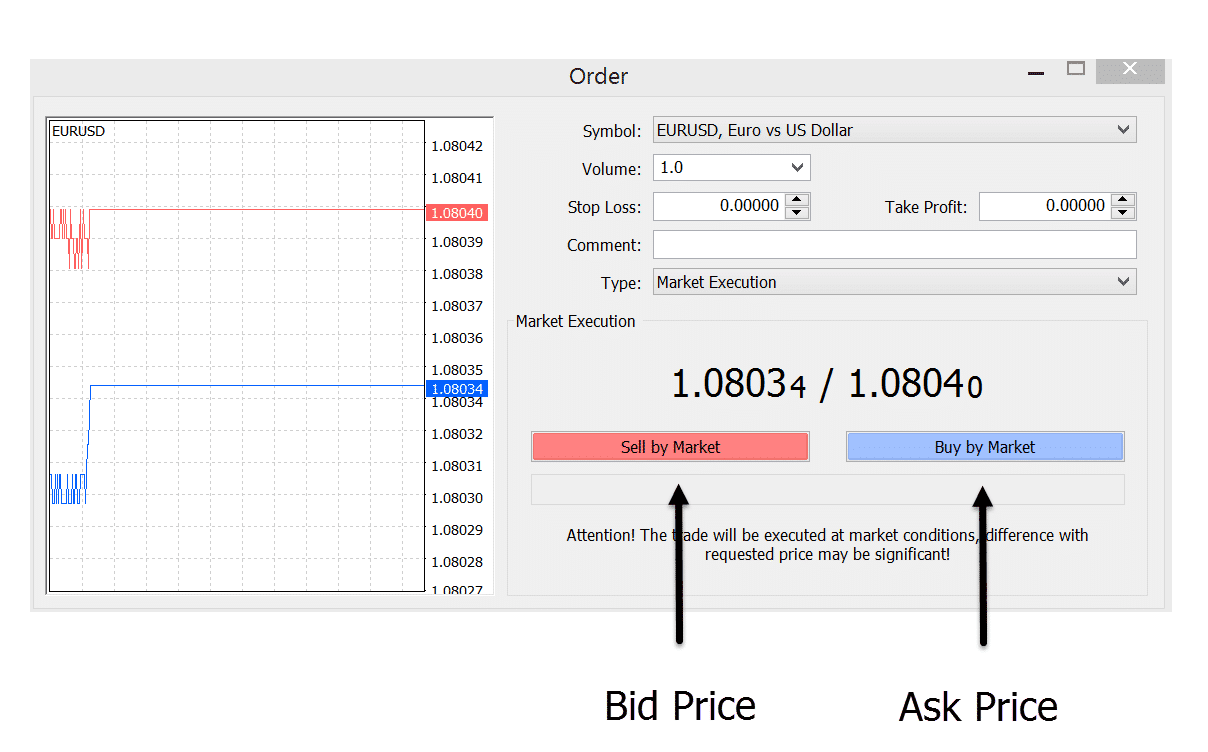

Every currency pair in the forex market has two prices: the bid price and the offer price. The bid price represents the rate at which a market maker is willing to buy the base currency in the pair, while the offer price is the rate at which they are willing to sell the base currency. The difference between these two prices, known as the spread, is the market maker’s profit margin.

The Relevance of Bid and Offer Prices

Bid and offer prices are of utmost importance in forex trading as they determine the execution price of your trades. When you buy a currency pair, you are buying it at the offer price. Conversely, when you sell a currency pair, you are selling it at the bid price. Understanding the bid-offer spread is crucial because it impacts the profitability of your trades. A wider spread means higher transaction costs, reducing your potential profits.

Historical Evolution of Bid and Offer Prices

The concept of bid and offer prices has evolved over time. In the early days of forex trading, prices were quoted over the phone, and there was no central exchange. Consequently, spreads were often wide, and traders had to haggle with market makers to secure the best prices. With the advent of electronic trading platforms, price dissemination became more transparent, and spreads have generally narrowed.

Image: www.dailyfx.com

Market Dynamics and Bid-Offer Spread

The bid-offer spread is primarily influenced by market liquidity. In highly liquid markets, where there is a large volume of buyers and sellers, spreads tend to be tighter. This is because market makers have more competition and, as a result, offer more favorable prices. In contrast, in less liquid markets, spreads are typically wider due to the lower volume of participants.

Expert Tips for Navigating Bid and Offer Prices

To navigate the forex market effectively, it is essential to understand how bid and offer prices work. Here are a few expert tips to help you stay ahead:

- Choose liquid currency pairs: Favor trading currency pairs with higher liquidity, as they typically have tighter spreads.

- Compare spreads from multiple brokers: Different brokers offer varying spreads. Comparing spreads before selecting a broker can save you money in the long run.

- Use limit orders: Limit orders allow you to specify the exact price at which you want to execute your trade. This can help you avoid unfavorable execution prices during market volatility.

FAQs on Bid and Offer Prices

- Q: What is the difference between the bid price and the offer price?

- A: The bid price is the price at which a market maker is willing to buy a currency pair, while the offer price is the price at which they are willing to sell.

- Q: Why is the bid-offer spread important?

- A: The bid-offer spread effectively determines the transaction costs of your trades and can impact your profitability.

- Q: How can I minimize the impact of bid-offer spreads?

- A: Trade liquid currency pairs, compare spreads from multiple brokers, and use limit orders to specify your execution price.

Bid And Offer Price In Forex

Conclusion: Master the Art of Forex Trading

Understanding the nuances of bid and offer prices is essential for successful forex trading. By incorporating the tips and insights outlined above, you can navigate the market more effectively, reduce transaction costs, and increase your chances of profitability. Whether you are a seasoned trader or just starting your forex journey, mastering the bid-offer concept will empower you to make informed decisions and achieve your trading aspirations. So, are you ready to delve deeper into the world of forex and conquer its complexities?