In the realm of business and finance, knowledge is power. And when it comes to maximizing profits, the calculadora de margen de ganancia – or profit margin calculator – is your indispensable ally. Embark on a journey to unravel the secrets of this essential tool and unlock the door to financial success.

Image: telencuestas.com

Defining the Profit Margin: A Cornerstone of Business

Profit margin is the bedrock of any thriving enterprise, representing the percentage of revenue that remains after subtracting expenses. It’s the metric that gauges the effectiveness of a business’s cost management, pricing strategies, and overall financial health.

Types of Profit Margins: Choosing the Right Gauge

Just as there are different types of businesses, there are also several types of profit margins. The three most common are:

- Gross Profit Margin: Reveals the proportion of revenue left after deducting the costs directly tied to producing the goods or services.

- Operating Profit Margin: Indicates the amount of revenue remaining after accounting for operating expenses, such as employee salaries and rent.

- Net Profit Margin: The holy grail of profitability, this margin unveils the percentage of revenue that remains after all expenses have been netted out.

The Calculadora de Margen de Ganancia: Your Path to Precision

The calculadora de margen de ganancia is an invaluable instrument that takes the guesswork out of profit calculation. By simply plugging in your revenue and expense figures, this tool will instantly generate accurate profit margin results in a matter of seconds.

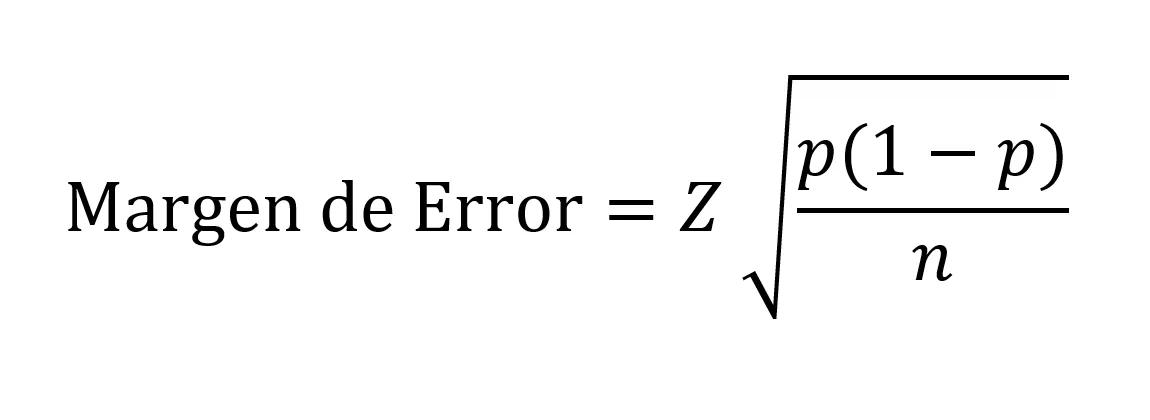

Unveiling the Formula: Demystifying Profit Margins

To calculate your profit margin manually, simply follow this formula:

Profit Margin = Profit ÷ Revenue x 100%

For instance, if a business generates $100,000 in revenue and has $20,000 in expenses, its profit margin would be calculated as:

Profit Margin = $20,000 ÷ $100,000 x 100% = 20%

Interpreting Profit Margins: A Guide to Success

Different industries have different profit margin benchmarks, so it’s crucial to research the norms for your particular sector. However, as a general rule of thumb, a profit margin of 10% or higher is considered healthy.

Maximizing Profit Margins: Strategies for Success

Harnessing the power of profit margin calculation is not merely about understanding your current financial situation but also about identifying areas for improvement. Here are some proven strategies to enhance your profit margins:

- Optimize Pricing: Conduct thorough market research to ensure your prices are competitive while still delivering ample profit.

- Reduce Costs: Analyze expenses with a critical eye and seek opportunities to streamline operations and reduce waste.

- Enhance Sales: Implement sales strategies to increase revenue, such as promotional campaigns or cross-selling complementary products.

Conclusion: Empowering Entrepreneurs, Driving Success

In the hands of the astute entrepreneur, the calculadora de margen de ganancia becomes a transformative tool that empowers informed decision-making, unlocks profit potential, and paves the way to financial triumph. Embrace the power of profit margin calculation and elevate your business to new heights.

Image: www.caminofinancial.com

Calculadora De Margen De Ganancia